宏觀大勢

降息預期下原油價格反彈

週五,WTI 原油期貨維持在每桶 81 美元上方,本週上漲超過 3%,並有望連續第二週上漲。這一上升趨勢受到美國原油庫存減少和中東衝突加劇的支撐。週四的數據顯示,美國原油供應降幅超預期,上週減少254.7萬桶,超過預期的200萬桶。此外,包括歐洲央行、瑞士央行在內的多家央行今年實施多次降息的前景正在改變經濟前景,並可能影響能源市場。

美國住房許可和新屋開工繼續回落

美國商務部一份報告顯示,5月新屋開工量下降5.5%,經季節性調整後的年率爲127.7萬套,爲2020年6月以來的最低水平。經濟學家此前預測新屋開工量將反彈至 137 萬套。

美國商務部一份報告顯示,5月新屋開工量下降5.5%,經季節性調整後的年率爲127.7萬套,爲2020年6月以來的最低水平。經濟學家此前預測新屋開工量將反彈至 137 萬套。

5 月份開工率同比下降19.3%。新屋開工增長的勢頭被今年抵押貸款利率的飆升所扼殺。Freddie Mac的數據顯示,5 月初,30 年期固定抵押貸款的平均利率飆升至 7.22% 的六個月高位,然後在月底回落至略低於7.0%。

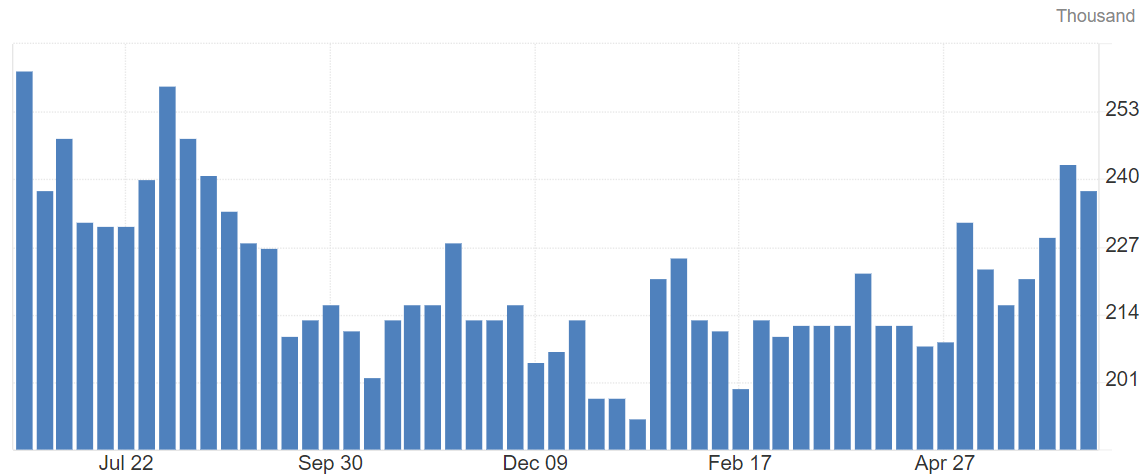

美國初請失業金人數較上週高位略有下降

6月第二週,美國初請失業金人數爲238,000人,高於市場預期的235,000人,創2023年8月以來第二高水平,僅落後於上調的243,000人。持續申請失業救濟人數持續增加15,000人至1,828,000人,爲1月份以來的最高水平,反映出失業者尋找合適工作的難度加大。

圖:初請失業金人數

資金動向

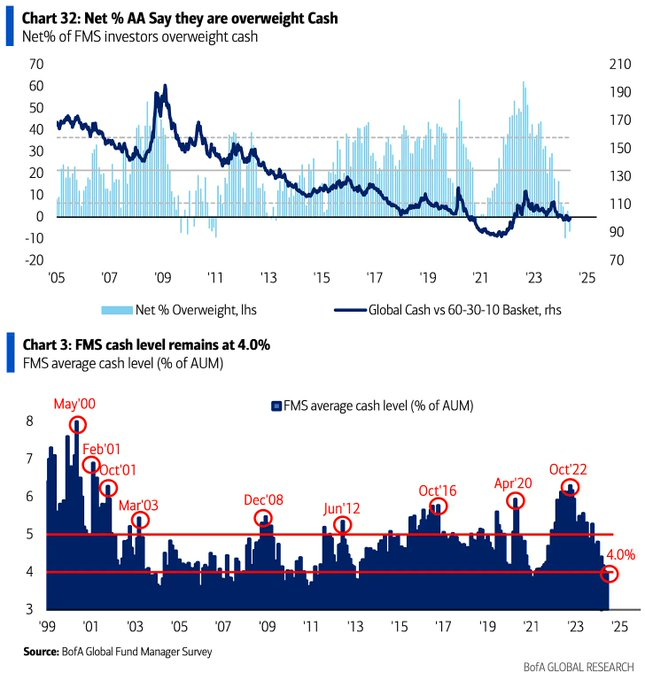

美銀調查:全球基金經理股票配置大,現金配置低

美國銀行的一項調查顯示,全球基金經理調查(FMS)的情緒是自2021年11月以來最樂觀的,將現金水平推至三年來的低點,而股票配置則處於高位。

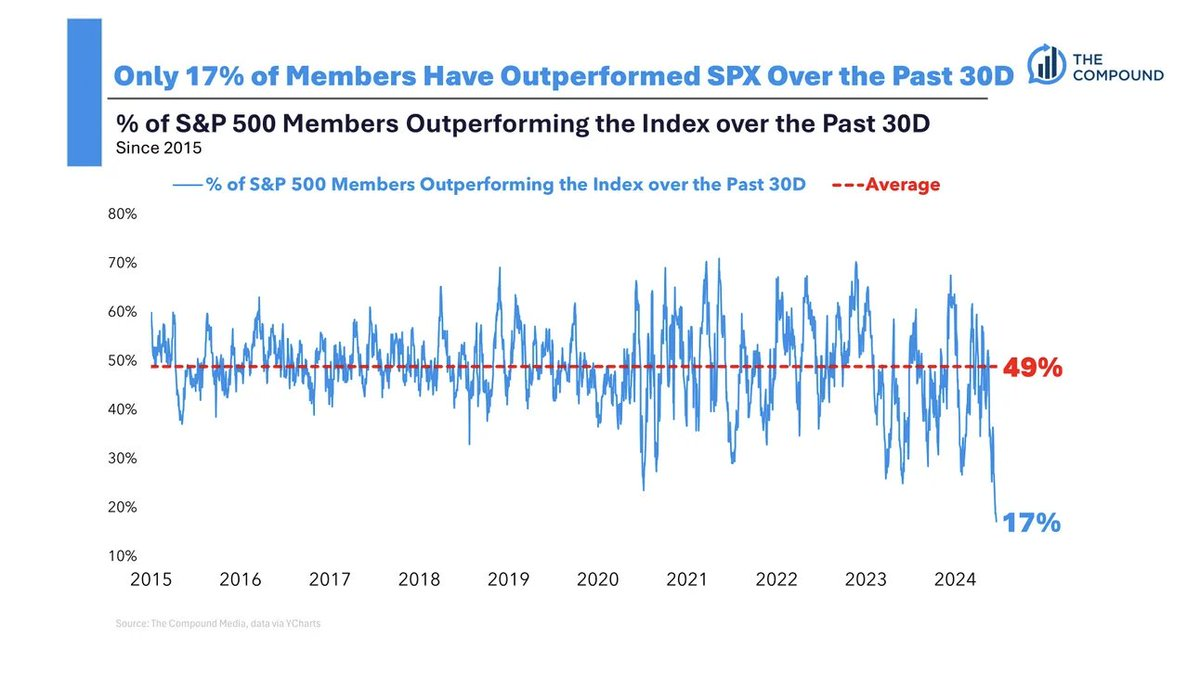

美股分化仍在繼續

在過去30天裏,標準普爾500指數成分股中只有17%的成分股表現優於該指數,這是過去10年來的最低水平。

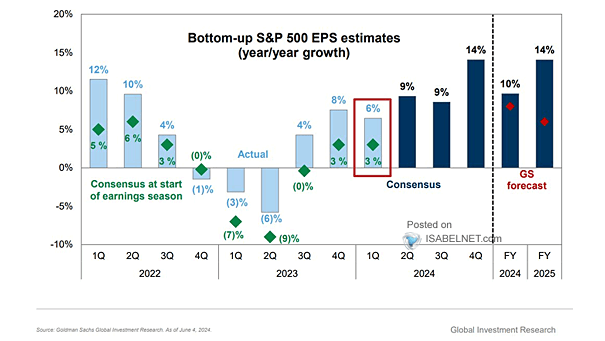

高盛(Goldman Sachs)預計,在有彈性的經濟狀況和銷售增長的推動下,標準普爾500指數(S&P 500)將在2024年下半年實現更強勁的盈利增長

公司新聞

據報道,英偉達的競爭對手、人工智能芯片製造商Cerebras Systems正在申請IPO

與英偉達(Nvidia)在人工智能領域展開競爭的高性能計算機芯片初創公司Cerebras Systems已提交機密文件,準備今年晚些時候在納斯達克(Nasdaq)上市。該公司生產專門處理人工智能和高性能計算工作負載的強大芯片,聲稱它們比英偉達的圖形處理單元更強大、更經濟。

該公司已累計融資7.2億美元,估值約爲42億至50億美元。OpenAI聯合創始人兼首席執行官薩姆·奧特曼參與了Cerebras 8000萬美元的D輪融資。

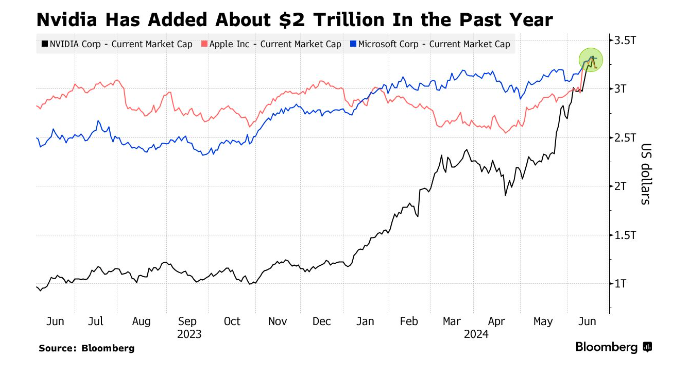

蘋果在人工智能領域的崛起使其估值提升

蘋果公司最近在人工智能驅動下的反彈,使該公司的市值飆升至歷史新高,並一度超過微軟公司(Microsoft),這引發了一些懷疑論者對其估值可持續性的質疑。蘋果公司目前的預期市盈率徘徊在30倍左右。儘管投資者對可能引發重大用戶升級週期的新人工智能功能充滿熱情,但預期收入增長和投資回報的時間仍然存在不確定性。

資深科技投資者因商業風險削減英偉達股份

來自塞利格曼投資公司(Seligman Investments)的資深科技投資者保羅•威克(Paul Wick)最近一直在減持英偉達的股份,理由是擔心這家芯片製造商的盈利增長潛力。在瑞士聯合銀行(UBS)於新加坡舉行的一次活動上,他指出人們對英偉達的熱情有所下降,並將其與互聯網時代思科(Cisco)不穩定的鼎盛時期相提並論。他的基金Columbia Seligman Technology & Information fund管理着135億美元的資產。

台積電估值接近1萬億美元,目標升級提振漲勢

華爾街對臺積電的信心正在飆升,多家券商調高了其目標價,該公司股價一路上揚,接近令人垂涎的1萬億美元估值。高盛(Goldman Sachs)引領看漲情緒,將目標價大幅上調19%,預計三納米和五納米芯片生產的價格將溫和上漲。與此同時,摩根大通暗示台積電的收入預測和資本支出可能會上升,預計到2028年,人工智能將佔其銷售額的35%,花旗集團和摩根士丹利也同樣看好台積電,因爲盈利前景更爲強勁。

孫正義將在新一輪投資中打造“超級”人工智能

軟銀集團(SoftBank Group Corp.)創始人孫正義對未來提出了大膽的願景,旨在開創人工超級智能時代。孫正義以全新的活力講述了他的雄心壯志,即利用Arm Holdings Plc的芯片,實現超越人類智能數千倍的人工智能。他設想了一個先進的人工智能驅動機器人和數據中心的世界,這些機器人和數據中心能夠完成巨大的壯舉,從治療癌症到做家務和與孩子互動,這是軟銀在經歷了一些引人注目的創業失誤後進行財務調整以來最雄心勃勃的聲明。

一周重要經濟數據

內容僅用作提供信息及教育之目的,不構成對任何特定證券或投資策略的推薦或認可。本內容中的信息僅用於說明目的,可能不適用於所有投資者。本內容未考慮任何特定人士的投資目標、財務狀況或需求,並不應被視作個人投資建議。建議您在做出任何投資於任何資本市場產品的決定之前,應考慮您的個人情況判斷信息的適當性。過去的投資表現不能保證未來的結果。投資涉及風險和損失本金的可能性。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

美国商务部一份报告显示,5月新屋开工量下降5.5%,经季节性调整后的年率为127.7万套,为2020年6月以来的最低水平。经济学家此前预测新屋开工量将反弹至 137 万套。

美国商务部一份报告显示,5月新屋开工量下降5.5%,经季节性调整后的年率为127.7万套,为2020年6月以来的最低水平。经济学家此前预测新屋开工量将反弹至 137 万套。