We Think Shareholders May Want To Consider A Review Of SANVO Fine Chemicals Group Limited's (HKG:301) CEO Compensation Package

We Think Shareholders May Want To Consider A Review Of SANVO Fine Chemicals Group Limited's (HKG:301) CEO Compensation Package

Key Insights

主要见解

- SANVO Fine Chemicals Group will host its Annual General Meeting on 28th of June

- Salary of CN¥214.0k is part of CEO Ernest Chen's total remuneration

- Total compensation is similar to the industry average

- SANVO Fine Chemicals Group's three-year loss to shareholders was 2.3% while its EPS was down 55% over the past three years

- 三和精化集团将于6月28日举行年度股东大会。

- 三和精化集团首席执行官陈峥的总薪酬中包括CN¥214k的薪资。

- 总补偿与行业平均水平相似

- 三和精化集团的三年股东亏损达2.3%,而过去三年EPS下降了55%。

Shareholders will probably not be too impressed with the underwhelming results at SANVO Fine Chemicals Group Limited (HKG:301) recently. At the upcoming AGM on 28th of June, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

SANVO Fine Chemicals Group Limited(HKG:301)最近的业绩欠佳可能不会让股东们太满意。 在即将到来的6月28日股东大会上,除了听取董事会的计划来挽回业绩之外,股东们还有机会质疑公司的方向并投票表决提案,例如执行薪酬。 我们提出原因,认为CEO的薪酬与公司业绩不相符。

Comparing SANVO Fine Chemicals Group Limited's CEO Compensation With The Industry

将三和精化集团有限公司的CEO薪酬与该行业进行比较。

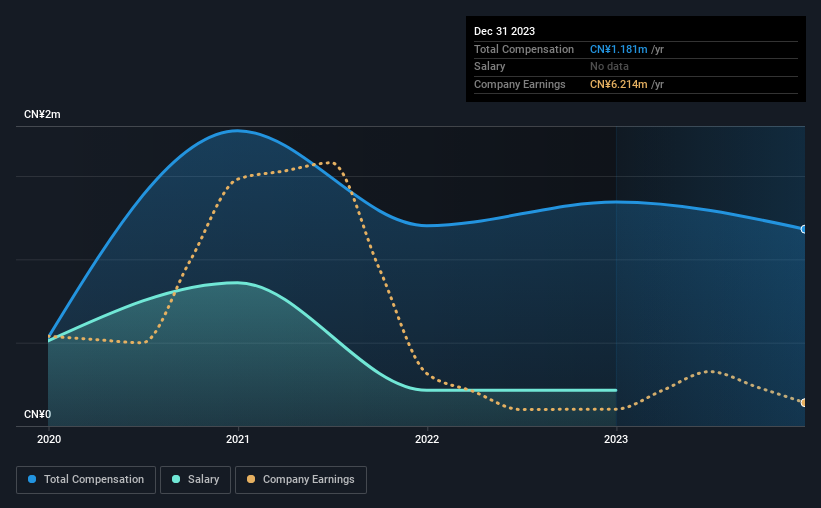

At the time of writing, our data shows that SANVO Fine Chemicals Group Limited has a market capitalization of HK$564m, and reported total annual CEO compensation of CN¥1.2m for the year to December 2023. Notably, that's a decrease of 12% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CN¥214k.

截至撰写本文时,我们的数据显示,SANVO Fine Chemicals Group Limited的市值为港币56400万,并于2023年12月年度报告中报告总CEO薪酬为CN¥120万。 值得注意的是,相对前一年减少了12%。尽管这项分析侧重于总薪酬,但值得承认的是,薪资部分更加低,为CN¥21.4万。

In comparison with other companies in the Hong Kong Chemicals industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was CN¥1.6m. So it looks like SANVO Fine Chemicals Group compensates Ernest Chen in line with the median for the industry. What's more, Ernest Chen holds HK$414m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

与市值在16亿元以下的香港化学品行业中的其他公司相比,报告的中位数总CEO薪酬为CN¥160万。 所以看起来三和精化集团给予陈峥的薪酬符合该行业的中位数。而另一方面,陈峥以自己的名义持有香港41400万港元的公司股份,这表明他们在游戏中拥有大量股份。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥214k | CN¥214k | 18% |

| Other | CN¥967k | CN¥1.1m | 82% |

| Total Compensation | CN¥1.2m | CN¥1.3m | 100% |

| 组成部分 | 2023 | 2022 | 比例(2023) |

| 薪资 | CN¥214k | CN¥214k | 18% |

| 其他 | CN¥967k | 人民币1.1百万 | 82% |

| 总补偿 | 120万人民币 | 130万元人民币 | 100% |

On an industry level, around 74% of total compensation represents salary and 26% is other remuneration. In SANVO Fine Chemicals Group's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

在行业层面上,约74%的总薪酬代表薪资,26%则是其他薪酬。 在SANVO Fine Chemicals Group的情况下,非薪资薪酬占据了总薪酬的更大比例,相比其他行业而言。 如果总薪酬偏向非薪资福利,这表明CEO的薪酬与公司业绩息息相关。

A Look at SANVO Fine Chemicals Group Limited's Growth Numbers

三和精化集团的成长数字。

Over the last three years, SANVO Fine Chemicals Group Limited has shrunk its earnings per share by 55% per year. It achieved revenue growth of 14% over the last year.

在过去的三年中,SANVO Fine Chemicals Group Limited每年的每股收益下降了55%。 它在过去一年实现了14%的收入增长。

The decline in EPS is a bit concerning. And while it's good to see some good revenue growth recently, the growth isn't really fast enough for us to put aside my concerns around EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

EPS下降有点令人担忧。 虽然最近有一些不错的收入增长,但增长并不够快,以至于我们无法放弃对EPS的担忧。 很难说公司正处于全速运转状态,因此股东可能会抵制高CEO薪酬。 尽管我们没有分析师预测,您可能想评估这个数据丰富的盈利,收入和现金流可视化。

Has SANVO Fine Chemicals Group Limited Been A Good Investment?

SANVO Fine Chemicals Group Limited是否是一个好的投资?

Since shareholders would have lost about 2.3% over three years, some SANVO Fine Chemicals Group Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

由于股东在三年内损失了约2.3%,因此一些SANVO Fine Chemicals Group的投资者肯定会感到消极情绪。 这表明为公司支付过高的CEO薪酬是不明智的。

In Summary...

总之……

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

股东不仅没有看到投资的良好回报,而且公司的业绩也不佳。很少有股东愿意继续提高CEO的薪酬待遇。在即将到来的股东大会上,他们可以对管理层的计划和策略提出质疑,以扭转公司的业绩,并重新评估他们的公司投资结论。

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 3 warning signs for SANVO Fine Chemicals Group you should be aware of, and 2 of them can't be ignored.

在检查业务表现时,CEO薪酬仅是众多因素之一。 在我们的研究中,我们发现3个可以警惕三和精化集团的投资要素,其中2个不能忽略。

Important note: SANVO Fine Chemicals Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

重要提示:三和精化集团是一支令人兴奋的股票,但我们了解投资者可能正在寻找资产负债表干净和回报率高的股票。 在这个拥有高roe和低负债的有趣公司名单中,您可能会找到更好的选择。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者,发送电子邮件至editorial-team (at) simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者发送电子邮件至editorial-team@simplywallst.com。