The MicroPort CardioFlow Medtech Corporation (HKG:2160) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

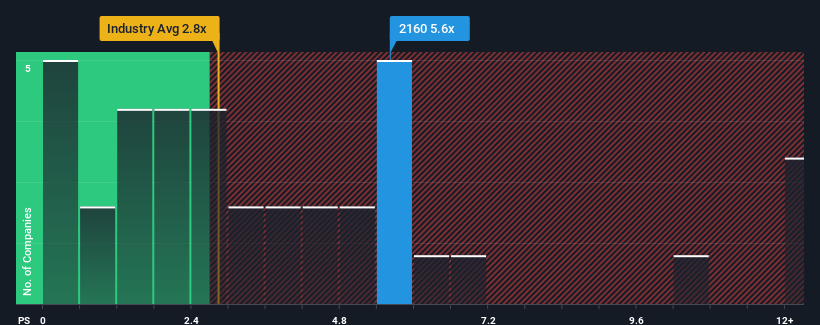

Even after such a large drop in price, given around half the companies in Hong Kong's Medical Equipment industry have price-to-sales ratios (or "P/S") below 2.8x, you may still consider MicroPort CardioFlow Medtech as a stock to avoid entirely with its 5.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does MicroPort CardioFlow Medtech's Recent Performance Look Like?

Recent times haven't been great for MicroPort CardioFlow Medtech as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on MicroPort CardioFlow Medtech will help you uncover what's on the horizon.How Is MicroPort CardioFlow Medtech's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like MicroPort CardioFlow Medtech's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 34% last year. Pleasingly, revenue has also lifted 223% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 32% per year over the next three years. With the industry predicted to deliver 48% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that MicroPort CardioFlow Medtech's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

MicroPort CardioFlow Medtech's shares may have suffered, but its P/S remains high. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see MicroPort CardioFlow Medtech trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for MicroPort CardioFlow Medtech with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com