The AI frenzy made Nvidia the world's largest company by market cap this Monday, while at the same time, the market discovered that the technology select sector index ETF (code XLK) with a management scale of up to $80 billion, has already attracted huge amounts of money. On June 19th, according to EPFR Global data, about 8.7 billion US dollars flowed into XLK, accounting for one third of the total capital inflows into US stocks during the same period.

According to EPFR Global data, as of the week ending on June 19th, about 8.7 billion US dollars flowed into XLK, which accounted for one third of the total capital inflows into US stocks during the same period.

Why did so much money flow into a single ETF? Some analysts believe that it may be related to XLK's 'heartbeat transactions' during the 'triple witching hour'.

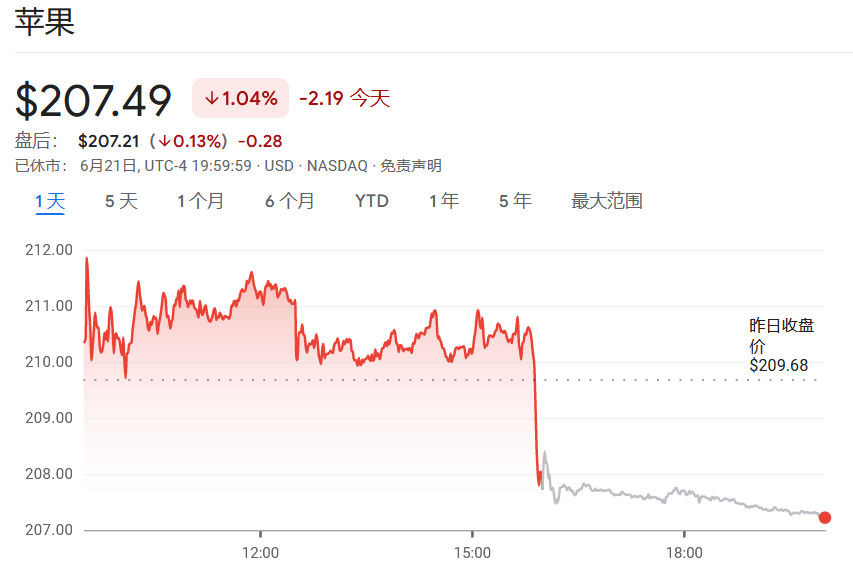

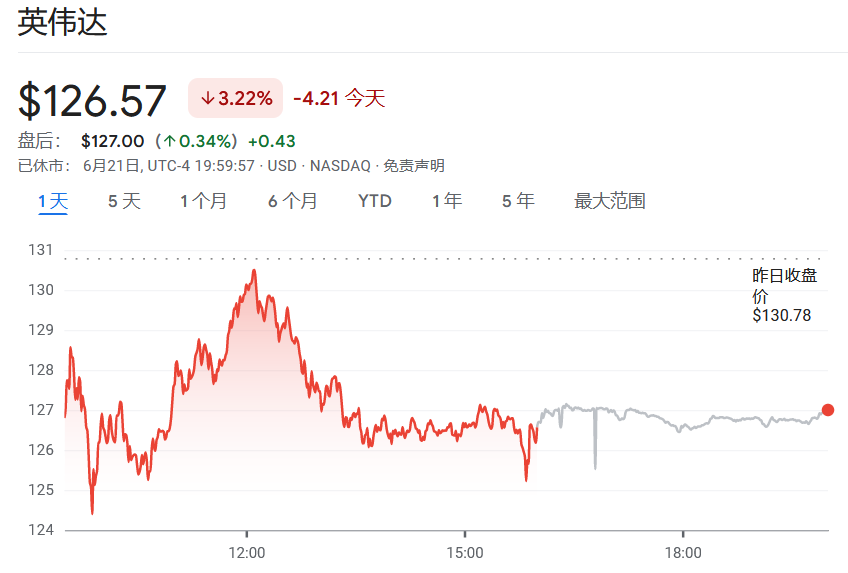

However, the decline was not significant. Apple's stock price fell by 1% on Friday, while Nvidia fell by about 3%.

Why did XLK sell Apple and buy Nvidia?

XLK mainly tracks the technology select sector index and, like many index funds, rebalances its portfolio once a quarter to bring it back to its original rule-compliant state.

XLK is not a simple market value-weighted index, but a 'corrected' market value-weighted index. In order to avoid excessive concentration of the index in a few companies, XLK also sets upper limits on individual stock holdings in addition to market value weighting. For example:

1. The weight of a single company cannot exceed 22.5%.

2. The total weight of stocks with a weight of 5% or more cannot exceed 50%.

3. Once the holding ceiling of 50% is exceeded, the weight of the remaining individual components of the stock cannot exceed 4.5%.

Below, we will use XLK's specific holdings to explain why XLK had to rebalance on Friday's 'witching hour'.

According to ETF Action data as of May 30th, XLK's top three holdings were Microsoft (22.5%), Apple (21.5%) and Nvidia (5.4%).

Obviously, the weights of Microsoft, Apple and Nvidia exceed the 5% threshold. The weight of the largest holding Microsoft is 22.5%, and the total weight of the three is 49.4%, which complies with the rules.

However, an unexpected thing happened. Last week, Nvidia's market cap once surpassed Apple's. If there were no rebalancing, Nvidia's weight would also rise to around 21.5%. In this way, the total weight of Microsoft, Nvidia and Apple would reach 65%, which is obviously higher than the 50% limit set by XLK, so Apple's weight can only go down.

This is what happened on Friday's 'witching hour', XLK had to rebalance, selling about $11 billion worth of Apple stock, reducing its weight from 21.5% to around 4.5%, and then buying about $10 billion worth of Nvidia stock, increasing Nvidia's weight to more than 20%, in order to comply with the rules.

This is also why investors closely watched the market value battle between Apple and Nvidia last week, because whoever has the larger market value will get a higher weight, while the loser's weight will drop by about 75%.

Some analysts believe that the $8.7 billion that flowed into XLK last week may be part of XLK's selling of Apple to rebalance its portfolio.

Todd Sohn, head of ETF strategy at Strategas Securities, said that the huge inflow of funds last week was probably part of XLK's 'heartbeat transactions' aimed at selling Apple stocks with floating profits without paying taxes.

What are 'heartbeat transactions'?

In the US ETF industry, it is common for funds like XLK to rebalance their portfolios to comply with the rules. During the rebalancing process, if the stocks sold have floating profits, Uncle Sam will come knocking for capital gains taxes. To avoid unreasonable taxation, funds will adopt the common practice of 'heartbeat transactions'.

Factset analyst Elisabeth Kashner pointed out that the purpose of heartbeat trading is not to meet the public's demand for ETFs, but to achieve reasonable deferred taxation of relevant ETFs in the portfolio rebalancing process. The main participants are ETFs and large investment banks, and the process does not involve cash transactions, but replaces assets with stocks. The specific steps are as follows:

Step 1: In heartbeat trading, the first cooperating investment bank will receive a large amount of funds in advance and flow into a specific ETF, such as XLK, which absorbed more than 8 billion US dollars last week. This part of the funds is usually not in cash, but exchanges ETF shares for physical assets (such as NVIDIA stock) through investment banks.

Step 2: Subsequently, the ETF will rebalance its portfolio, during which the ETF may buy or sell a large number of stocks to comply with relevant regulations. (This time, XLK is going to sell tens of billions of Apple shares and then buy NVIDIA shares.)

Step 3: In the last step of heartbeat trading, the previously entered funds will quickly flow out of the relevant ETF. This is usually achieved by investment banks exchanging ETF shares for physical assets (such as stocks).

This process looks like the pulsation of a heartbeat in a chart due to the large inflows and outflows of funds, hence the name 'heartbeat trading'.

Mohit Bajaj, ETF director at WallachBeth Capital, said that next week XLK may experience a large-scale outflow of funds as the last step of heartbeat trading.

The main function of heartbeat trading

The main function of heartbeat trading is to help fund managers achieve tax optimization. When ETFs carry out physical exchange, they can avoid capital gains tax generated when selling appreciated assets.

It is worth noting that Kashner pointed out that heartbeat trading is essentially a deferred taxation strategy, not a permanent tax avoidance measure. It only postpones the tax obligation through reasonable rules, and once the ETF finally clears a certain stock, the related capital gains tax still needs to be paid. However, for Wall Street, today's one dollar and tomorrow's one dollar are different. The later the payment of capital gains tax, the higher the potential income.

Although heartbeat trading is highly respected on Wall Street for its efficient tax reduction efficiency, it has also caused some controversies.

JeffreyColon, a law professor at the University of Chicago, pointed out that compared with direct investments by mutual funds, publicly traded partnerships, and investors, heartbeat trading will give ETFs unfair tax advantages. The US Congress should abolish tax exemptions for asset physical exchanges or reduce relevant exemptions. Either choice will make the taxable income and economic benefits of ETF shareholders more consistent.