Weekly Overview

Price Changes This Week

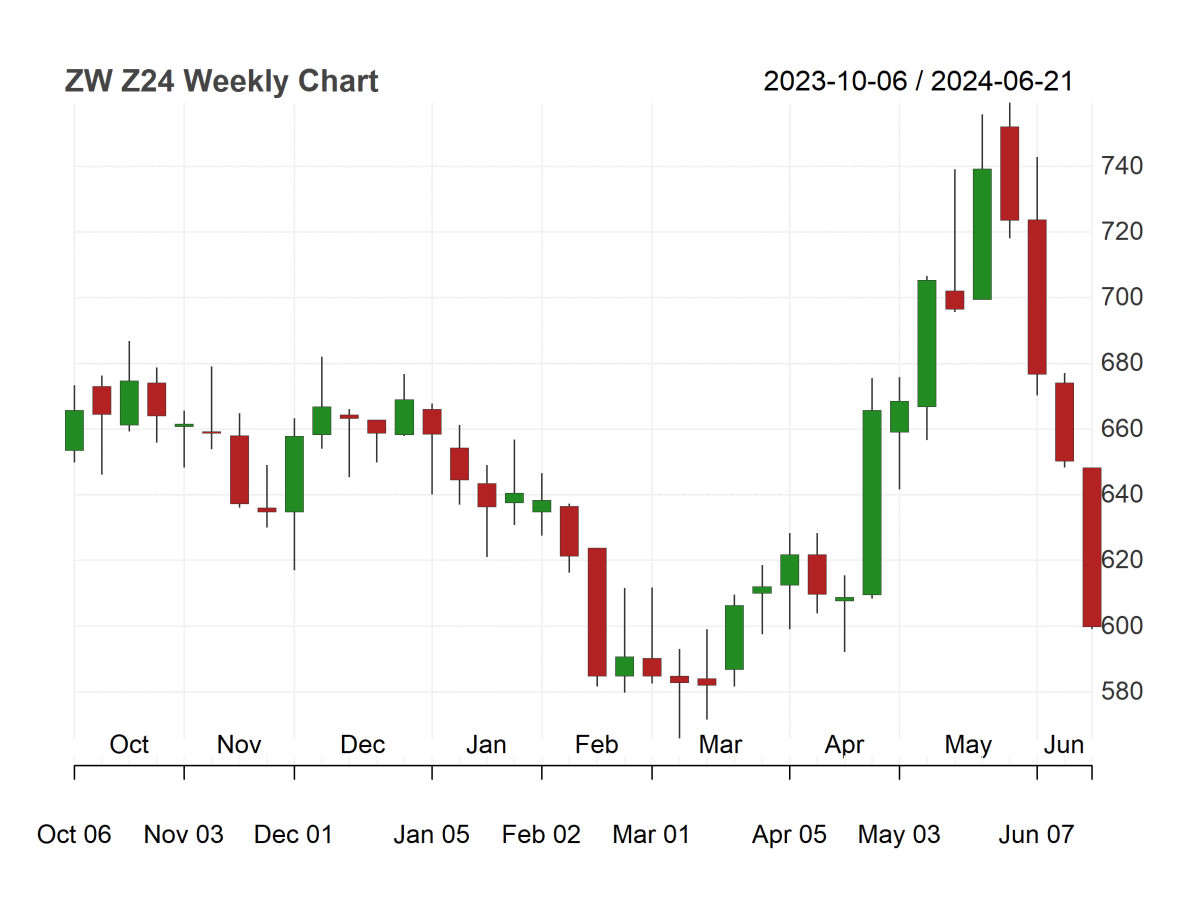

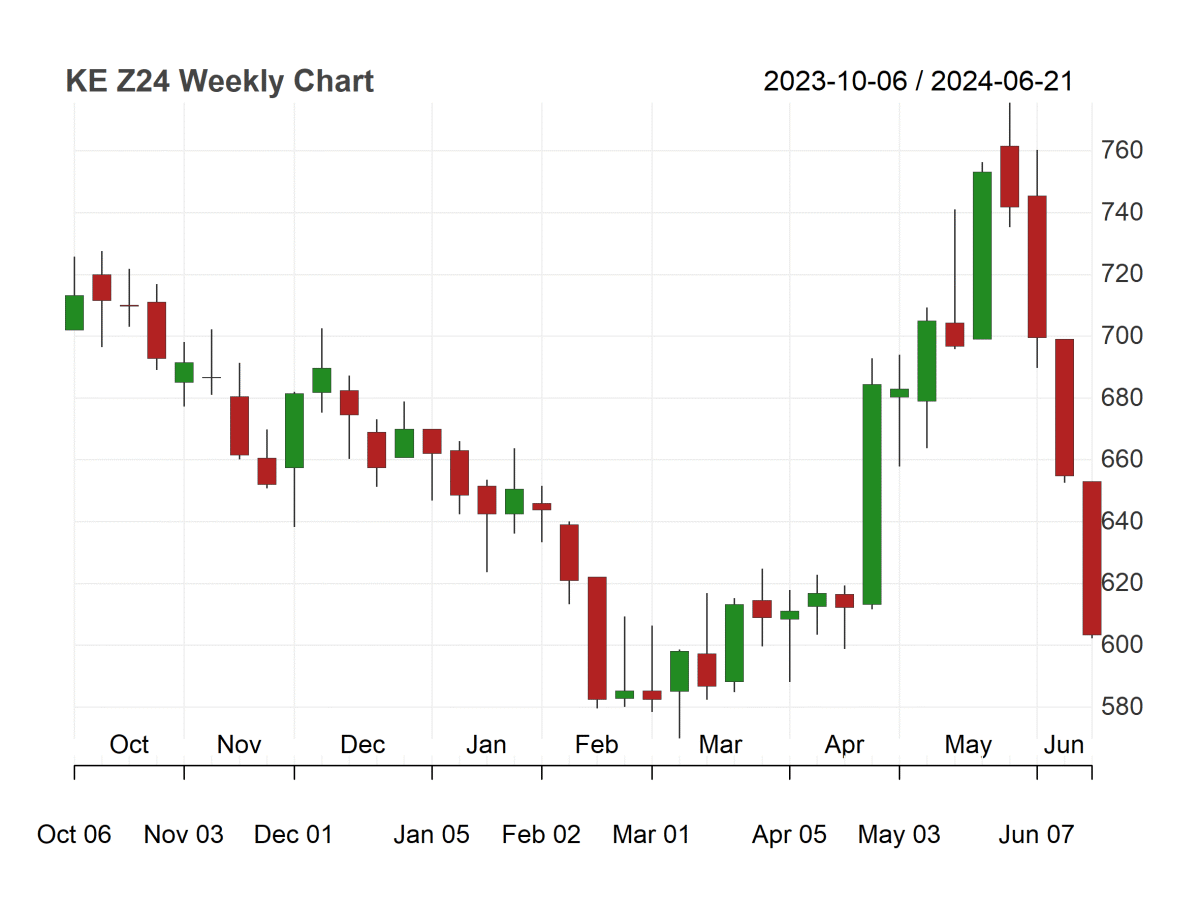

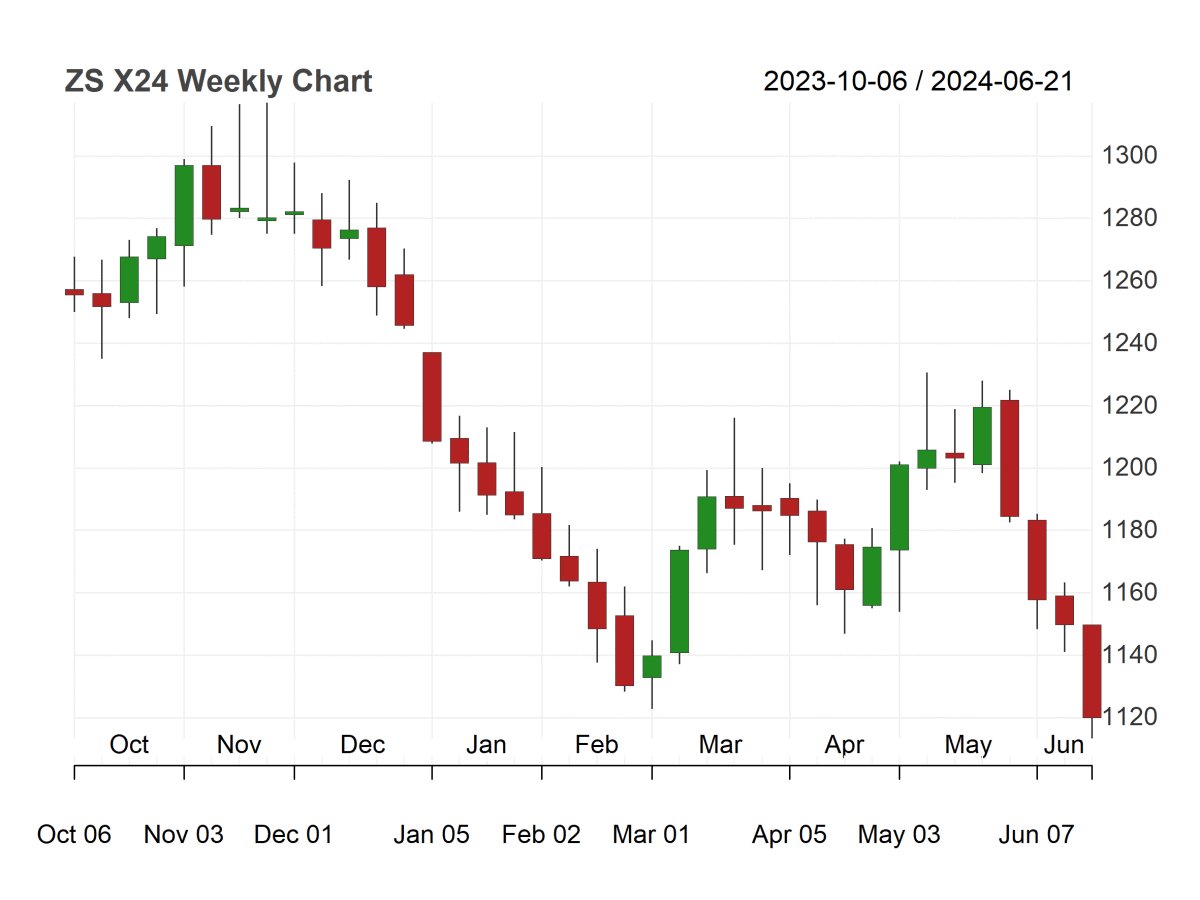

Prospects for hard red winter wheat (HRW) crops have improved, and wheat prices continue to fall. Corn and soybean prices are also under pressure due to favorable weather forecasts. Over the next few months, price volatility is expected to remain high, largely influenced by the severity of adverse weather and tightening supply and demand balances for these commodities. The latest Commodity Futures Trading Commission (CFTC) Commitments of Traders (CoT) report shows that funds have increased bearish corn and soybean positions, exacerbating market bearish sentiment.

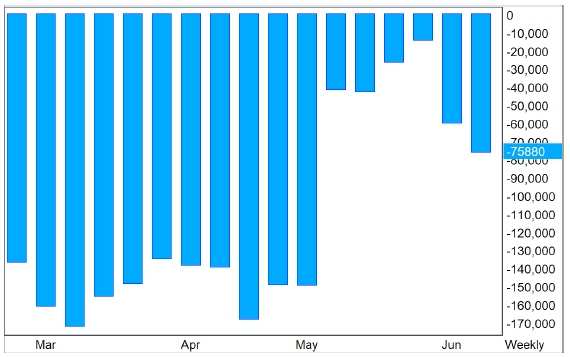

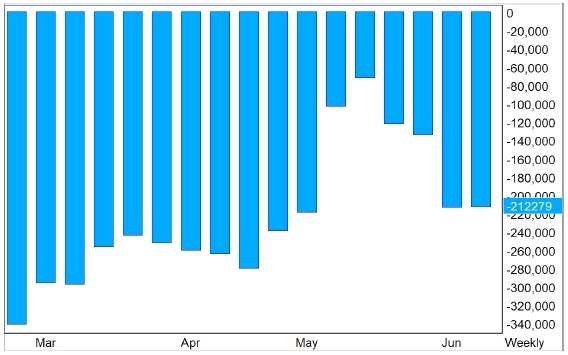

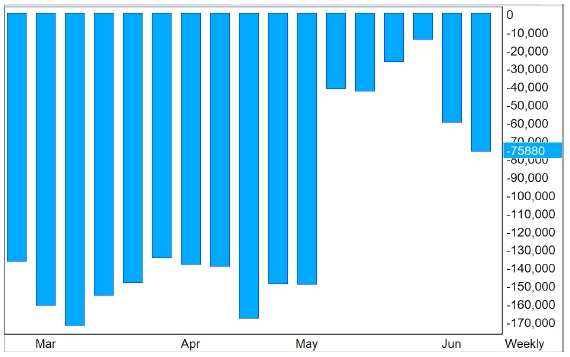

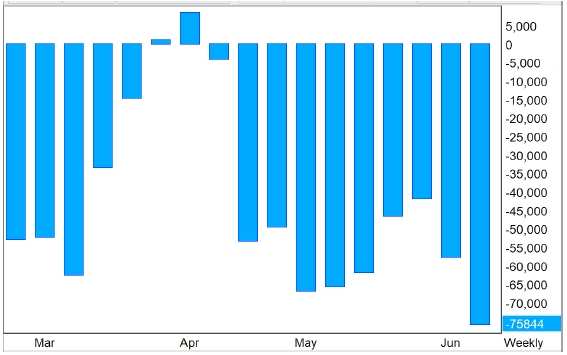

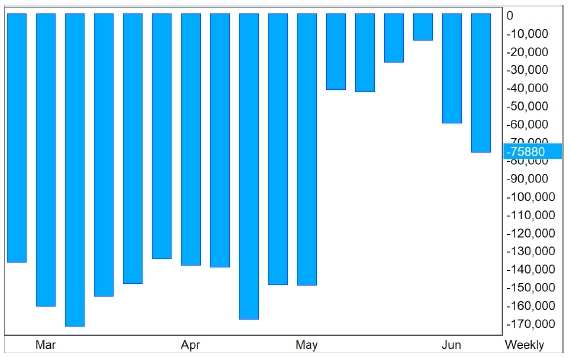

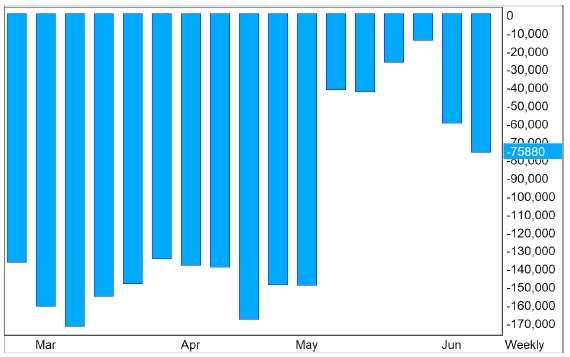

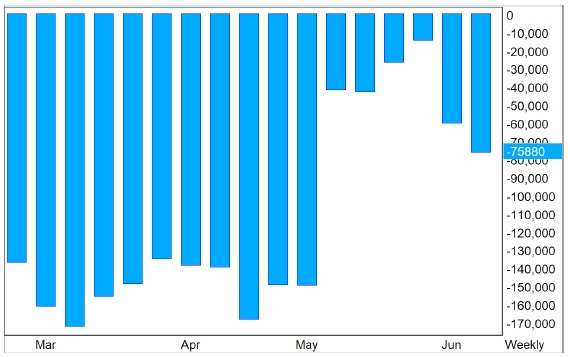

Over the next few months, price volatility is expected to remain high, largely influenced by the severity of adverse weather and tightening supply and demand balances for these commodities. The latest Commodity Futures Trading Commission (CFTC) Commitments of Traders (CoT) report shows that funds have increased bearish corn and soybean positions, exacerbating market bearish sentiment. Soybean Managed Money Fund Net Positions (in contracts). Corn Managed Money Fund Net Positions (in contracts).

Soybean Managed Money Fund Net Positions (in contracts)

Corn Managed Money Fund Net Positions (in contracts)

Weather remains a major factor driving price fluctuations. Wheat prices are particularly sensitive to weather conditions in the Black Sea region, while corn and soybean prices are also expected to be heavily influenced by weather conditions over the next few months.

As we approach the critical production determination stage in July and August, market participants will closely monitor weather changes.

As we approach the critical production determination stage in July and August, market participants will closely monitor weather changes.

Next, the market will focus on the June 30 report, which could change expectations for corn and soybean acreage.

This report, along with current weather trends, will play a crucial role in recent market dynamics.

Grains

Last week, harvest pressure overshadowed earlier weather concerns, driving wheat futures to their lowest level in eight weeks.

As the US wheat harvest has completed nearly 50%, and the harvest in Ukraine and Russia is progressing rapidly, the premiums previously affected by Black Sea frost and drought risk have been eliminated. In addition, Turkey has imposed a four-month ban on imports from Russia, causing offshore quotes from Russia to fall.

Field inspections in Kansas suggest that final yields may exceed the May report data from the USDA. However, the risk still exists if hard red winter wheat is affected by high temperatures and dryness at the end of the growth season.

Russia's output is expected to remain stable at around 79-80 million metric ton (MMT), with some estimated data from certain sources even higher.

CBOT Wheat Managed Money Fund Net Positions (in contracts)

Although harvesting is ongoing, demand is expected to shift away from Russia and Ukraine towards other export countries, leading to an unprecedented tightening of supply and demand balances for the European Union, Australia and Canada. The ratio of global export stock usage has reached a historical low, and a rebound in wheat prices seems to be approaching.

This suggests that the seasonal harvest low may be near, and may trigger a short covering rebound before next Friday's key USDA stocks/planting report is released.

Although wheat prices may experience harvest weakness in July, the expectation is that they will continue to rise during November-January.

CBOT corn futures also closed lower last week. Although there was export demand competition from South America in July, the market was not willing to increase US weather premiums. Traders noted that the correlation between precipitation/high temperatures in June and the final US corn yield is relatively low.

Corn crops are highly sensitive to weather conditions in July. As this critical period approaches, the market will become increasingly sensitive to high temperatures and droughts in the Midwest.

Long-term weather forecasts have improved but are still not moist enough. The first crop evaluation ratings in the Midwest are at the upper limit of the five-year historical range, and the area of drought is the smallest since 2022.

Due to reduced production in South America and Ukraine, the long-term outlook for corn remains supportive. It is expected that the total output of Argentina, Brazil and Ukraine in 2024 will decrease by more than 10 million metric tons year-on-year.

However, the competition for import demand in summer and early autumn will not appear until July, and the offshore premium of Argentina has fallen due to the harvest progress.

Due to the decrease in production and the weak growth in key areas, there is limited space in the Midwest for unfavorable weather.

The position of managing the mmf remains basically unchanged, holding 212,000 short contracts.

The focus of corn prices will be on the duration of high temperature and drought in July. If extreme weather conditions prevail, there may be upward risks in corn prices.

Oilseed Complex

Last week, affected by the new round of fund selling, soybean futures fell 19 cents. The fund increased its net short position in soybeans, making the total net short position reach 75,000 contracts. Last week, 70% of the US soybean crop rating dropped 2%, compared with 54% in the same period last year.

Market news is limited, but weather remains the main focus. The planting areas in the eastern and southern regions are facing limited rainfall and rising temperatures, which are expected to have a negative impact on crop ratings next week. The crop in the western and northern regions is expected to benefit greatly from heavy rain.

Net position (in contracts) of managing the soybean oil mmf

0

Net position (in contracts) of managing the soybean meal mmf

1

2

Exports of aged soybeans have exceeded expectations, with unfinished sales up 21% from the same period last year. The export volume and unfinished sales volume of soybean meal have also reached record levels.

The theme of the oilseed market remains the same: as the growing season progresses, volatility is expected to increase in the coming weeks.

The main determinant of soybean production is the weather conditions in August.

As the critical period of the growing season approaches, the market will continue to focus on weather changes, especially in August, which is the key month to determine soybean production.

Disclaimer and Important Disclosures

The information in this report is for reference only and should not be construed as a recommendation to buy, sell, or trade any particular investment. The purpose of this document is only to assist you in discussing PRETB. Please note that there may be multiple authors of this report, and the views reflected in this report may have varied over the past 12 months or even been opposite. A large number of views are being generated and changed immediately. Any valuation or fundamental assumptions are based on the author's market knowledge and experience. In addition, the information in this report has not been prepared in accordance with legal requirements aimed at promoting the independence of investment research. While we believe the information relied upon is reliable, we do not guarantee its accuracy or completeness. PRETB believes that the information in this report has been disclosed to the public on the Internet. This material is not intended to be used as a general guide to investing or as a source of any specific investment advice. Investors should consult their financial and tax advisors concerning the suitability of this brief for their individual circumstances.

This material does not constitute an invitation or solicitation to anyone in any jurisdiction in which such invitation or solicitation is not authorized. Persons in possession of this document must inform themselves of any such restrictions and comply with them.

This document is confidential. It may not be copied, distributed or transmitted by any person without the express written consent of PRETB. All rights reserved.

随着7、8月关键的产量决定阶段的逐渐临近,市场参与者将密切监控天气变化。

随着7、8月关键的产量决定阶段的逐渐临近,市场参与者将密切监控天气变化。