复宏汉霖的停牌终于揭开了谜底,与市场此前传言一致:复星医药将私有化复宏汉霖退市, 私有化估值约为124亿人民币。

此次复星医药对复宏汉霖每股报价为24.60港元,较其停牌前收盘价溢价30.6%。以去年复宏汉霖5.46亿净利计算,本次私有化PE约23x。

整体交易54亿港币,将使用不超过37亿并购贷款

复宏汉霖总股本为5.435亿股,其中H股1.634亿股,非上市股份3.801亿股。

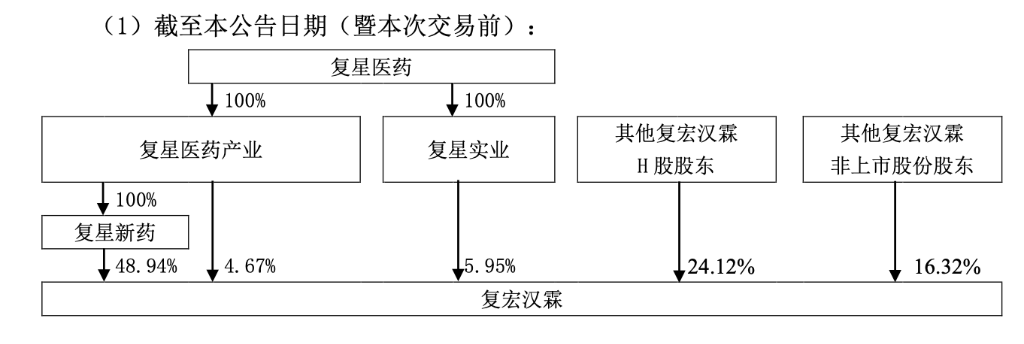

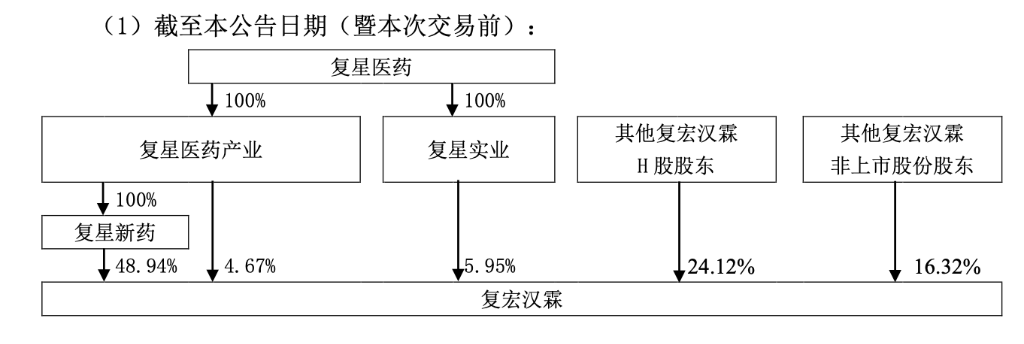

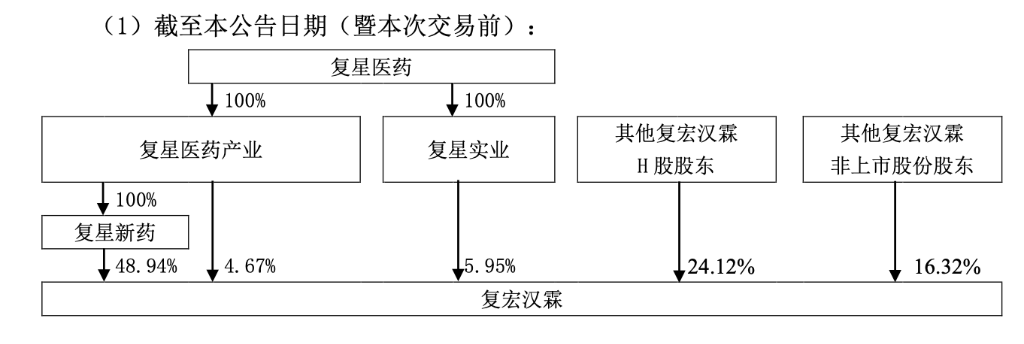

此次要约人复星新药目前持有复宏汉霖48.94%非上市股份。同时,复星医药通过复星医药产业持有4.67%非上市股份;通过复星实业持有5.95%的H股。

复星医药合计持股323,696,487股,占复宏汉霖总股份59.56%。

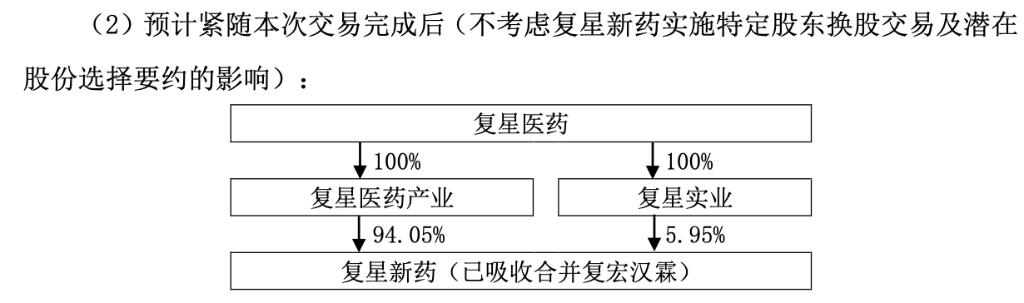

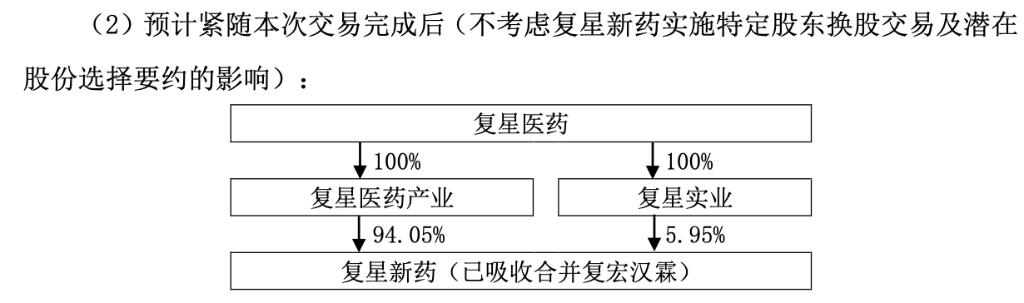

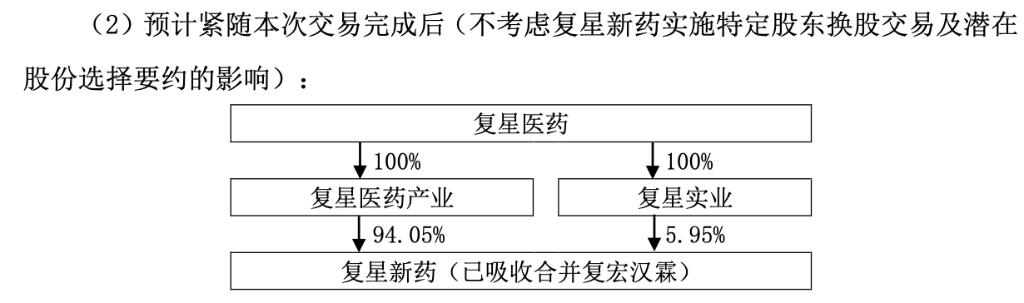

本次交易完成后,复星医药将通过复星医药产业和复星实业持有吸收合并后的复星医药100%股份,实现100%控制复宏汉霖。截至目前,复星新药只持有复宏汉霖,无其他资产。

本次交易对价部分分为现金和股权两部分:

现金对价部分:包括H股和非流通股合计2.198亿股,占复宏汉霖总股份的40.44%,交易总金额为54.07亿港元。

股份对价部分:通过复星新药增发注册资本收购及注销复星医药产业和复星实业共计57,724,918 股复宏汉霖股份。

同时,复星新药为复宏汉霖的股东提供了一项特别选择权,允许除上述两股东外的其他股东在一定条件达成后,放弃现金对价,而以他们持有的复宏汉霖股份按照指定比例兑换为持股平台的股份。然而,根据公告,这一选择权涉及的复宏汉霖股份总量不得超过总股份的8%,即43,479,588股复宏汉霖股份。![big]()

值得注意的是,此次私有化现金对价部分,复星医药将为子公司复星新药担保,向银行申请不超过37亿港币的并购贷款,由复星新药质押其持有的复宏汉霖48.49%股份,复星医药提供连带责任担保。

截至24Q1,复星医药现金及现金等价物93.51亿元,当期利息费用为22.14亿元。

![big]()

![big]()

为什么私有化复宏汉霖?

自2019年9月复宏汉霖在港交所上市以来,尽管公司业务发展持续向好,并在2023年取得利润5.46亿元,但在全球经济不确定性增加、港股市场持续低迷的大环境下,复宏汉霖的股价表现并不尽如人意。

彼时复宏汉霖IPO募集资金30.96亿港元,以当时收盘价计算,复宏汉霖的市值为267亿港元。截至此次私有化提案收盘价格,市值缩水已超过50%,尽管公司股价已在今年反弹超过35%。

在这样的背景下,复星医药选择溢价30.6%私有化复宏汉霖,可以视为一种双赢的策略。

复宏汉霖小股东受益

对复宏汉霖而言,私有化意味着摆脱二级市场波动的压力,公司可以更加专注于长期发展战略,而不必过分关注短期股价表现。

同时,作为非上市公司,复宏汉霖在业务发展和资源配置上将获得更大的灵活性,能够更加专注于新管线研发和当下业务。不用因为顾及股价波动,从而影响业务重心。

此外,公司在公告中还解释到,退市后公司可以减少维持上市地位所需的各项费用,如合规成本、信息披露成本等,从而降低运营成本。

对于国内医药行业,母公司私有化子公司退市并非没有先例。

2019年药明康德曾经将子公司合全药业从新三板私有化退市,彼时药明康德私有化理由同样是:专注于长期发展策略并提高运营效率,并节省不必要的行政及其他挂牌相关成本与开支。从后续效果来看,合全药业的私有化确实对药明康德内部资源整合起到了重要作用。

此次私有化,对从去年开始买入复宏汉霖的小股东来说是利好,对于今年年初买入的小股东来说,整体回报也将超过60%。

![big]()

虽然更长期股东来讲仍然存在亏损可能,但这已经是H股市场共同的问题。

复星医药将进一步提升创新药研发效率

对于复星医药来说,私有化复宏汉霖的意义更大:

首先,私有化复宏汉霖为复星医药带来的最直接影响,就是直接提升复星医药的利润水平和市场价值,从而提升股东回报。

从财务角度看,此次复星医药23x PE收购复宏汉霖,估值低于目前复星医药25x PE,私有化将直接提升复星医药的利润水平和市场价值。

根据复星医药2023年报,不含新冠相关产品,其制药业务营收同比增长13.50%。其中,抗肿瘤及免疫调节核心产品销售76.38亿元,同比增长38%,主要得益于复宏汉霖的汉斯状、汉曲优、苏可欣等产品的快速增长。

通过私有化复宏汉霖,复星医药将直接受益于这些优质资产的高速增长。

![big]()

值得一提的是,复宏汉霖在创新药研发和国际化方面已取得显著成果。其核心产品汉曲优(曲妥珠单抗)已在40多个国家和地区获批上市,包括欧盟、英国、中国、澳大利亚等,并于2024年4月成功获得美国FDA批准,成为首个在中国、欧盟和美国三大市场同时获批的中国单抗生物类似药。

2023年全年,汉斯状实现收入超11亿元,同比增长230.20%;汉曲优收入超27亿元,同比增长58.19%;苏可欣收入超9亿元,同比增长19.67%。

第二,复星医药私有化其创新药板块中最具优势的复宏汉霖,在当下国内医药市场整体景气度受限,融资艰难的背景下,可以增加其与子公司间的协同,增强研发效率,减少资源浪费。

近10年来,复星医药的研发投入增长迅速,从2013年的5.03亿元增加到2023年的59.37亿元,营收占比从5.1%逐年提升至14.34%。

虽然研发持续增长,但是长期以来,市场一直诟病复星医药旗下各子公司研发资源存在重复投入、效率低下的问题。例如,不同子公司可能同时在研发相同适应症的产品,造成资源浪费。

在今年5月华安证券举行的复星医药电话会上,公司曾表示:

公司已经在通过各种动作降低内部研发资源的浪费。

去年,公司成立了转化研究中心,旨在加强与科研院所和早期研发机构的合作,促进源头创新转化,推动更多高效创新成果进入临床阶段。

同时,复星医药设立了六个关键决策点,在每个节点都会重新评估项目优先级,考虑商业化价值和市场变化。这种更加市场化、更注重效率的研发体系,在私有化后将更容易在整个集团范围内推广和实施。尤其是在项目早研阶段,公司表示已经产生变化。

除了自研外,复星医药还通过基金形式布局行业前沿领域,进一步整合研发。例如,2024年复星医药与深圳市两级引导基金共同设立了50亿元的深圳生物医药产业基金,复星医药认缴15亿元,持有30%份额。私有化复宏汉霖之后,复星医药的研发资金无论是自研还是BD将更加灵活。

如果后续公司能够以复宏汉霖为优势整合研发资源,无疑将进一步提高复星医药集团创新药板块的整体研发效率。

当然,考虑到复星资本运作的传统,市场也不应排除复星医药未来再次让复宏汉霖上市的可能性。考虑到A股市场的估值优势,未来在A股上市可能是一个潜在选项。

结语:

国内医药市场正在经历着第三个年头的寒冬,无论对于biotech还是pharma,大家的选择都殊途同归,保证现金流,提升研发效率,更快将产品推向市场。

作为国内pharma的代表,复星医药私有化创新药子公司也给国内市场带来了新的方向——并购整合研发资源,提升整体效率。

復宏漢霖的停牌終於揭開了謎底,與市場此前傳言一致:復星醫藥將私有化復宏漢霖退市, 私有化估值約爲124億人民幣。

此次復星醫藥對復宏漢霖每股報價爲24.60港元,較其停牌前收盤價溢價30.6%。以去年復宏漢霖5.46億淨利計算,本次私有化PE約23x。

整體交易54億港幣,將使用不超過37億併購貸款

復宏漢霖總股本爲5.435億股,其中H股1.634億股,非上市股份3.801億股。

此次要約人復星新藥目前持有復宏漢霖48.94%非上市股份。同時,復星醫藥通過復星醫藥產業持有4.67%非上市股份;通過復星實業持有5.95%的H股。

復星醫藥合計持股323,696,487股,佔復宏漢霖總股份59.56%。

本次交易完成後,復星醫藥將通過復星醫藥產業和復星實業持有吸收合併後的復星醫藥100%股份,實現100%控制復宏漢霖。截至目前,復星新藥只持有復宏漢霖,無其他資產。

本次交易對價部分分爲現金和股權兩部分:

現金對價部分:包括H股和非流通股合計2.198億股,佔復宏漢霖總股份的40.44%,交易總金額爲54.07億港元。

股份對價部分:通過復星新藥增發註冊資本收購及註銷復星醫藥產業和復星實業共計57,724,918 股復宏漢霖股份。

同時,復星新藥爲復宏漢霖的股東提供了一項特別選擇權,允許除上述兩股東外的其他股東在一定條件達成後,放棄現金對價,而以他們持有的復宏漢霖股份按照指定比例兌換爲持股平台的股份。然而,根據公告,這一選擇權涉及的復宏漢霖股份總量不得超過總股份的8%,即43,479,588股復宏漢霖股份。![big]()

值得注意的是,此次私有化現金對價部分,復星醫藥將爲子公司復星新藥擔保,向銀行申請不超過37億港幣的併購貸款,由復星新藥質押其持有的復宏漢霖48.49%股份,復星醫藥提供連帶責任擔保。

截至24Q1,復星醫藥現金及現金等價物93.51億元,當期利息費用爲22.14億元。

![big]()

![big]()

爲什麼私有化復宏漢霖?

自2019年9月復宏漢霖在港交所上市以來,儘管公司業務發展持續向好,並在2023年取得利潤5.46億元,但在全球經濟不確定性增加、港股市場持續低迷的大環境下,復宏漢霖的股價表現並不盡如人意。

彼時復宏漢霖IPO募集資金30.96億港元,以當時收盤價計算,復宏漢霖的市值爲267億港元。截至此次私有化提案收盤價格,市值縮水已超過50%,儘管公司股價已在今年反彈超過35%。

在這樣的背景下,復星醫藥選擇溢價30.6%私有化復宏漢霖,可以視爲一種雙贏的策略。

復宏漢霖小股東受益

對復宏漢霖而言,私有化意味着擺脫二級市場波動的壓力,公司可以更加專注於長期發展戰略,而不必過分關注短期股價表現。

同時,作爲非上市公司,復宏漢霖在業務發展和資源配置上將獲得更大的靈活性,能夠更加專注於新管線研發和當下業務。不用因爲顧及股價波動,從而影響業務重心。

此外,公司在公告中還解釋到,退市後公司可以減少維持上市地位所需的各項費用,如合規成本、信息披露成本等,從而降低運營成本。

對於國內醫藥行業,母公司私有化子公司退市並非沒有先例。

2019年藥明康德曾經將子公司合全藥業從新三板私有化退市,彼時藥明康德私有化理由同樣是:專注於長期發展策略並提高運營效率,並節省不必要的行政及其他掛牌相關成本與開支。從後續效果來看,合全藥業的私有化確實對藥明康德內部資源整合起到了重要作用。

此次私有化,對從去年開始買入復宏漢霖的小股東來說是利好,對於今年年初買入的小股東來說,整體回報也將超過60%。

![big]()

雖然更長期股東來講仍然存在虧損可能,但這已經是H股市場共同的問題。

復星醫藥將進一步提升創新藥研發效率

對於復星醫藥來說,私有化復宏漢霖的意義更大:

首先,私有化復宏漢霖爲復星醫藥帶來的最直接影響,就是直接提升復星醫藥的利潤水平和市場價值,從而提升股東回報。

從財務角度看,此次復星醫藥23x PE收購復宏漢霖,估值低於目前復星醫藥25x PE,私有化將直接提升復星醫藥的利潤水平和市場價值。

根據復星醫藥2023年報,不含新冠相關產品,其製藥業務營收同比增長13.50%。其中,抗腫瘤及免疫調節核心產品銷售76.38億元,同比增長38%,主要得益於復宏漢霖的漢斯狀、漢曲優、蘇可欣等產品的快速增長。

通過私有化復宏漢霖,復星醫藥將直接受益於這些優質資產的高速增長。

![big]()

值得一提的是,復宏漢霖在創新藥研發和國際化方面已取得顯著成果。其核心產品漢曲優(曲妥珠單抗)已在40多個國家和地區獲批上市,包括歐盟、英國、中國、澳大利亞等,並於2024年4月成功獲得美國FDA批准,成爲首個在中國、歐盟和美國三大市場同時獲批的中國單抗生物類似藥。

2023年全年,漢斯狀實現收入超11億元,同比增長230.20%;漢曲優收入超27億元,同比增長58.19%;蘇可欣收入超9億元,同比增長19.67%。

第二,復星醫藥私有化其創新藥板塊中最具優勢的復宏漢霖,在當下國內醫藥市場整體景氣度受限,融資艱難的背景下,可以增加其與子公司間的協同,增強研發效率,減少資源浪費。

近10年來,復星醫藥的研發投入增長迅速,從2013年的5.03億元增加到2023年的59.37億元,營收佔比從5.1%逐年提升至14.34%。

雖然研發持續增長,但是長期以來,市場一直詬病復星醫藥旗下各子公司研發資源存在重複投入、效率低下的問題。例如,不同子公司可能同時在研發相同適應症的產品,造成資源浪費。

在今年5月華安證券舉行的復星醫藥電話會上,公司曾表示:

公司已經在通過各種動作降低內部研發資源的浪費。

去年,公司成立了轉化研究中心,旨在加強與科研院所和早期研發機構的合作,促進源頭創新轉化,推動更多高效創新成果進入臨床階段。

同時,復星醫藥設立了六個關鍵決策點,在每個節點都會重新評估項目優先級,考慮商業化價值和市場變化。這種更加市場化、更注重效率的研發體系,在私有化後將更容易在整個集團範圍內推廣和實施。尤其是在項目早研階段,公司表示已經產生變化。

除了自研外,復星醫藥還通過基金形式佈局行業前沿領域,進一步整合研發。例如,2024年復星醫藥與深圳市兩級引導基金共同設立了50億元的深圳生物醫藥產業基金,復星醫藥認繳15億元,持有30%份額。私有化復宏漢霖之後,復星醫藥的研發資金無論是自研還是BD將更加靈活。

如果後續公司能夠以復宏漢霖爲優勢整合研發資源,無疑將進一步提高復星醫藥集團創新藥板塊的整體研發效率。

當然,考慮到復星資本運作的傳統,市場也不應排除復星醫藥未來再次讓復宏漢霖上市的可能性。考慮到A股市場的估值優勢,未來在A股上市可能是一個潛在選項。

結語:

國內醫藥市場正在經歷着第三個年頭的寒冬,無論對於biotech還是pharma,大家的選擇都殊途同歸,保證現金流,提升研發效率,更快將產品推向市場。

作爲國內pharma的代表,復星醫藥私有化創新藥子公司也給國內市場帶來了新的方向——併購整合研發資源,提升整體效率。