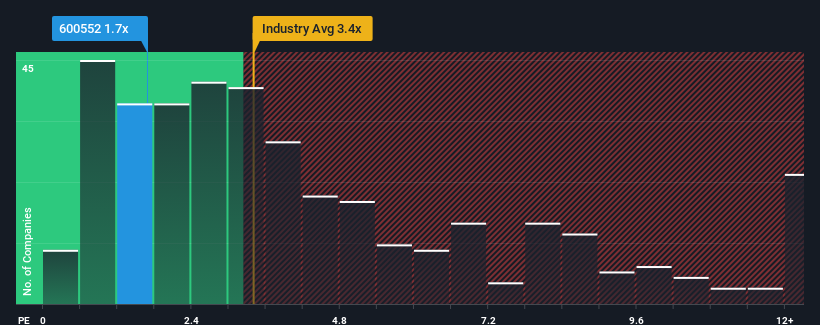

Triumph Science & Technology Co.,Ltd's (SHSE:600552) price-to-sales (or "P/S") ratio of 1.7x might make it look like a buy right now compared to the Electronic industry in China, where around half of the companies have P/S ratios above 3.4x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Triumph Science & TechnologyLtd's Recent Performance Look Like?

Recent revenue growth for Triumph Science & TechnologyLtd has been in line with the industry. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. Those who are bullish on Triumph Science & TechnologyLtd will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Triumph Science & TechnologyLtd.Is There Any Revenue Growth Forecasted For Triumph Science & TechnologyLtd?

The only time you'd be truly comfortable seeing a P/S as low as Triumph Science & TechnologyLtd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 8.5% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 15% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 29% as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 25%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Triumph Science & TechnologyLtd's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems Triumph Science & TechnologyLtd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Triumph Science & TechnologyLtd (1 makes us a bit uncomfortable!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com