Quantum computing technology has recently been frequently discussed by investors and has become a cutting-edge technology field that has received attention following artificial intelligence. Morgan Stanley analysts Edward Stanley and Matias Ovrum analyzed in-depth the current state of development of quantum computing and its potential impact on the financial market in the latest research report, providing valuable insights for investors. Regarding product structure, the operating income of 10-30 billion yuan products was respectively 401/1288/60 million yuan, and the overall sales volume of the company in 2023 was 18,000 kiloliters, with a year-on-year growth of +28.10%, showing significant growth.

They believe that quantum computing is still in its very early stages and is not mature enough in terms of technology and policy. The interest of enterprises, investors, and the public in quantum computing is far lower than that in artificial intelligence, and the stock performance of pure quantum computing listed companies is also not ideal.

Why is quantum computing attracting attention? Analysts stated at the beginning of the report that they were asked questions related to quantum computing at more than half of the industry conferences they recently participated in. They believe that quantum computing attracts the strong interest of investors for the following reasons:

First, from a technological perspective, the industry has made significant breakthroughs in quantum bit stability and scalability lately, and governments of various countries have also increased their funding support for quantum computing startups.

Second, after the investment boom in the field of artificial intelligence, investors are looking for the next cutting-edge technology that may bring rich returns.

This point is particularly important because for the currently hot artificial intelligence industry, quantum computing poses a potential threat:

(1) The current encryption technology risk threatens traditional cybersecurity systems;

(2) Enterprise research and development resources are redistributed and no longer used for artificial intelligence;

(3) The competition in the breakthrough of hardware and software may challenge the leader of the artificial intelligence market and squeeze the profits of existing enterprises;

(4) If there is a magnitude breakthrough before significant investment returns are obtained for artificial intelligence infrastructure construction, people will worry about the risk of outdated investments in huge artificial intelligence expenditures.

The above risk factors have raised concerns in the market about the possibility of disruptive changes the AI industry may face.

The actual development of quantum computing is still in a relatively early stage.

Although quantum computing has caused extensive discussion, its actual development is still in a relatively early stage.

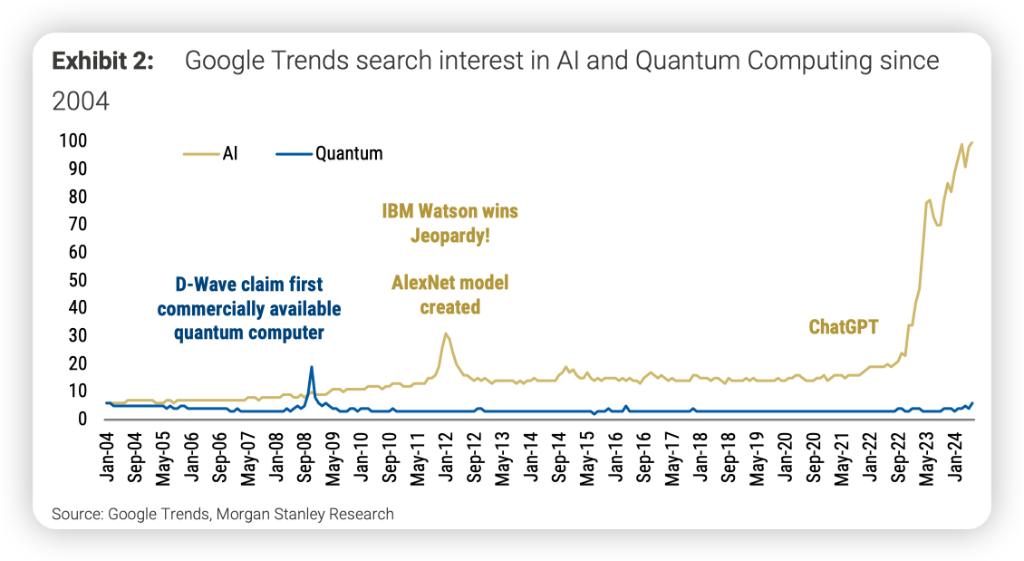

The analysts point out that although investors' attention to quantum computing has risen, it is still far lower than that in the field of artificial intelligence. Public interest in quantum computing has also increased, but it is still at a lower level than that of artificial intelligence, accounting for only about 6%. The frequency of mentioning quantum computing in corporate financial reports and documents has also increased, but the base is still relatively low.

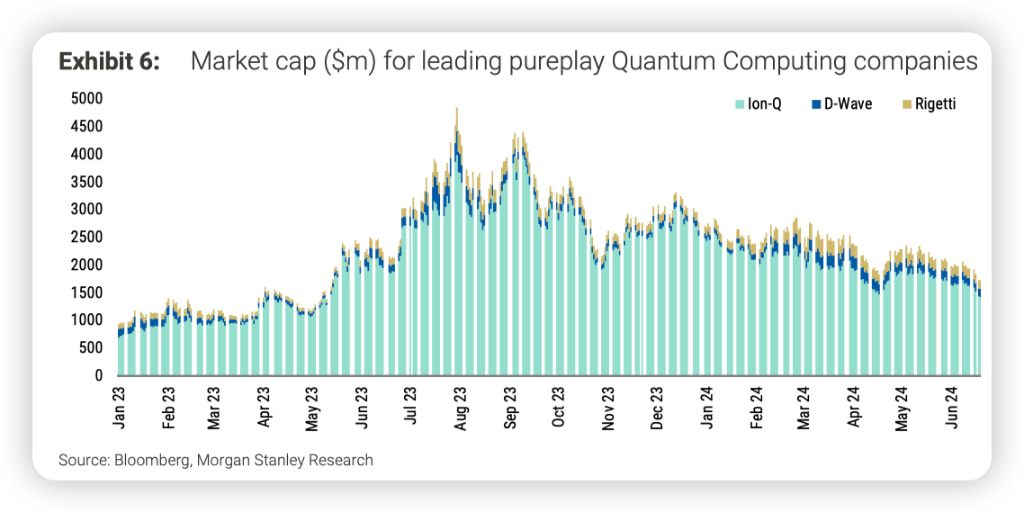

Regarding market performance, the market value of pure quantum computing listed companies reached its peak in the third quarter of 2023 and then fell sharply, falling by more than 50%. This indicates that investors' enthusiasm for quantum computing may have cooled down or reflects a downward revision of short-term commercialization expectations.

However, the interest of the venture capital market in the quantum computing field is still strong. Against the backdrop of a decline in the overall venture capital market by more than 60%, the financing of the quantum computing field has only decreased by about 25%. It is noteworthy that the proportion of European startups in the global quantum computing financing has risen to more than 50%, indicating that the region's competitiveness in this field is increasing.

It is even more noteworthy that the interest of strategic investors in quantum computing has increased significantly, with cumulative investments exceed 2 billion US dollars, of which Microsoft and Google are the most active strategic investors in the past three years:

According to Pitchbook's data, Microsoft and Google are the only leading companies that have made venture capital investments in quantum technology in the past three years. However, with accumulated capital from strategic investors exceeding 2 billion US dollars, public market investors have also begun to pay attention to the necessity of this emerging vertical field.

For quantum computing to become a mainstream investment theme, major policy changes or the introduction of breakthrough products may still be needed.

However, Morgan Stanley's report pointed out that quantum computing has not yet become a mainstream investment theme. Compared with popular themes such as AI, quantum computing has relatively flat performance in the public market. The report believes that for quantum computing to become a mainstream investment theme, significant policy changes or breakthrough products may still be needed.

For the financial market, the development of quantum computing brings both opportunities and risks. On the one hand, quantum computing may bring revolutionary changes to certain industries and create new investment opportunities. On the other hand, it may pose disruptive threats to existing technologies and companies, especially in the field of cryptocurrencies and cybersecurity. In addition, if quantum computing makes significant breakthroughs, it may affect the large-scale investment returns for AI infrastructure currently at play.

Overall, quantum computing technology is developing rapidly, but it still has a long way to go before it can be widely used in commercial applications. Investors need to carefully evaluate the relevant risks and opportunities and closely monitor long-term trends. Although quantum computing may become the next disruptive technology, it may be difficult to replicate the investment frenzy in the AI field in the short term. For visionary investors, now may be a good time to start paying attention to and understanding this field, and prepare for potential investment opportunities that may arise in the future.