The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in Henan Dayou Energy Co., Ltd (SHSE:600403) have tasted that bitter downside in the last year, as the share price dropped 36%. That contrasts poorly with the market decline of 16%. At least the damage isn't so bad if you look at the last three years, since the stock is down 27% in that time. Furthermore, it's down 22% in about a quarter. That's not much fun for holders.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Henan Dayou Energy wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Henan Dayou Energy's revenue didn't grow at all in the last year. In fact, it fell 37%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 36% in that time. What would you expect when revenue is falling, and it doesn't make a profit? We think most holders must believe revenue growth will improve, or else costs will decline.

Henan Dayou Energy's revenue didn't grow at all in the last year. In fact, it fell 37%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 36% in that time. What would you expect when revenue is falling, and it doesn't make a profit? We think most holders must believe revenue growth will improve, or else costs will decline.

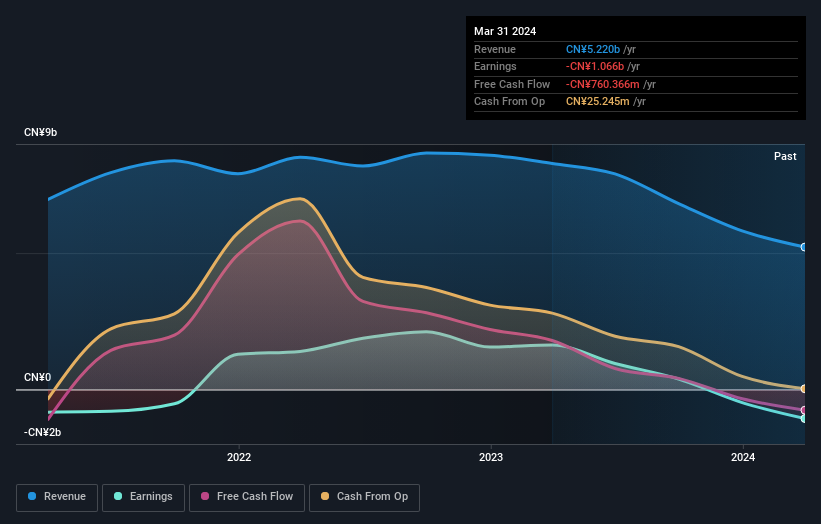

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We regret to report that Henan Dayou Energy shareholders are down 36% for the year. Unfortunately, that's worse than the broader market decline of 16%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com