Deep-pocketed investors have adopted a bearish approach towards Vertiv Hldgs (NYSE:VRT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in VRT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 19 extraordinary options activities for Vertiv Hldgs. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 42% leaning bullish and 52% bearish. Among these notable options, 4 are puts, totaling $706,285, and 15 are calls, amounting to $1,272,140.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $60.0 to $145.0 for Vertiv Hldgs over the last 3 months.

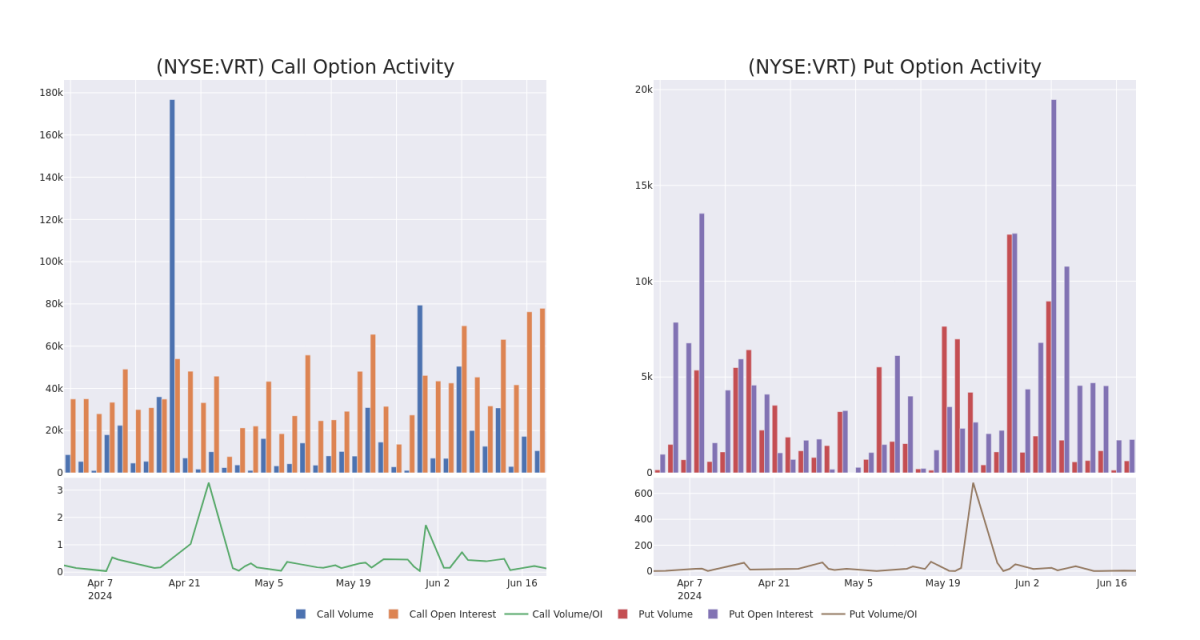

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Vertiv Hldgs's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Vertiv Hldgs's whale activity within a strike price range from $60.0 to $145.0 in the last 30 days.

Vertiv Hldgs Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | PUT | SWEEP | BEARISH | 11/15/24 | $13.3 | $13.1 | $13.3 | $90.00 | $332.5K | 824 | 0 |

| VRT | PUT | SWEEP | BEARISH | 06/20/25 | $18.5 | $18.2 | $18.4 | $87.50 | $239.2K | 148 | 43 |

| VRT | CALL | SWEEP | BEARISH | 07/12/24 | $3.6 | $3.5 | $3.5 | $90.00 | $177.1K | 4.1K | 1.2K |

| VRT | CALL | TRADE | BEARISH | 07/12/24 | $3.1 | $2.95 | $3.0 | $90.00 | $132.0K | 4.1K | 2.7K |

| VRT | CALL | TRADE | BEARISH | 07/12/24 | $4.1 | $3.9 | $3.9 | $90.00 | $117.0K | 4.1K | 312 |

About Vertiv Hldgs

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

Current Position of Vertiv Hldgs

- With a volume of 2,404,983, the price of VRT is down -5.15% at $87.0.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 35 days.

What The Experts Say On Vertiv Hldgs

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $105.0.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Vertiv Hldgs, targeting a price of $105.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vertiv Hldgs with Benzinga Pro for real-time alerts.