Investors with a lot of money to spend have taken a bearish stance on Occidental Petroleum (NYSE:OXY).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with OXY, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 8 uncommon options trades for Occidental Petroleum.

This isn't normal.

The overall sentiment of these big-money traders is split between 25% bullish and 62%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $188,690, and 5 are calls, for a total amount of $245,330.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $57.5 to $66.0 for Occidental Petroleum during the past quarter.

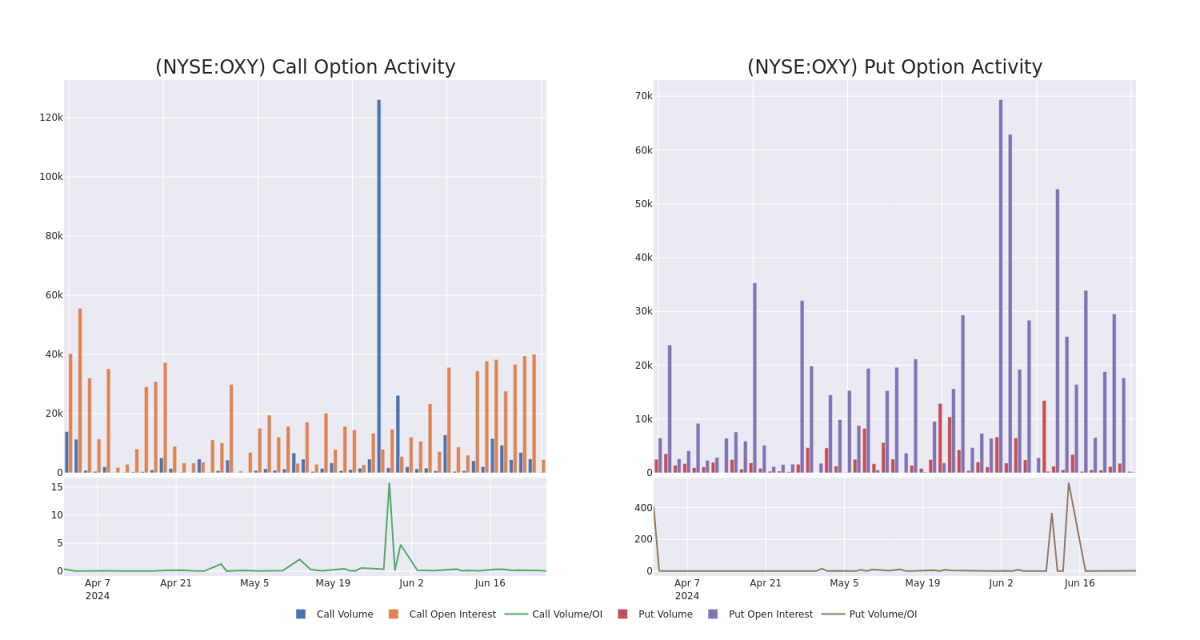

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Occidental Petroleum's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Occidental Petroleum's significant trades, within a strike price range of $57.5 to $66.0, over the past month.

Occidental Petroleum Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | CALL | SWEEP | BEARISH | 12/18/26 | $13.95 | $13.5 | $13.5 | $60.00 | $67.5K | 114 | 1 |

| OXY | PUT | TRADE | BULLISH | 12/18/26 | $9.0 | $7.55 | $7.55 | $62.50 | $66.4K | 142 | 0 |

| OXY | PUT | TRADE | BULLISH | 12/18/26 | $8.95 | $7.5 | $7.5 | $62.50 | $66.0K | 142 | 88 |

| OXY | CALL | SWEEP | BEARISH | 12/20/24 | $8.1 | $8.05 | $8.05 | $57.50 | $64.4K | 638 | 0 |

| OXY | CALL | SWEEP | NEUTRAL | 07/26/24 | $0.5 | $0.46 | $0.46 | $66.00 | $58.0K | 2.3K | 50 |

About Occidental Petroleum

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

In light of the recent options history for Occidental Petroleum, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Occidental Petroleum

- With a trading volume of 2,930,164, the price of OXY is down by -0.16%, reaching $63.0.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 35 days from now.

Professional Analyst Ratings for Occidental Petroleum

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $69.0.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Occidental Petroleum, targeting a price of $69.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.