Author of this article: Li Dan.

The weather is good today The weather is good today.

As the AI concept that has been hot in the stock market this year shows signs of fatigue, the highly anticipated annual shareholder meeting failed to stop the downward trend of Nvidia's stock price.

On Wednesday, June 26, Eastern Time, Nvidia's shareholder meeting lasted only about 30 minutes. According to the established schedule, shareholders voted to approve all 12 nominated Nvidia directors, including CEO Huang Renxun and executives' compensation plans of CNY 0.401bn / CNY 1.288bn / CNY 0.06bn for 10-30 billion yuan products' operating income respectively, and agreed that PwC would continue to be the independent registered accounting firm for Nvidia in fiscal year 2025, responsible for auditing Nvidia's financial statements.

According to the compensation plan, Huang Renxun will receive a compensation of about $34m in fiscal year 2024, an increase of 60% compared to fiscal year 2023. The compensation of Nvidia executives is largely linked to performance. Previously, the media estimated that Huang Renxun received about 78% of his compensation through stock rewards, so the rise in Nvidia's stock price is equivalent to an increase in Huang Renxun's compensation.

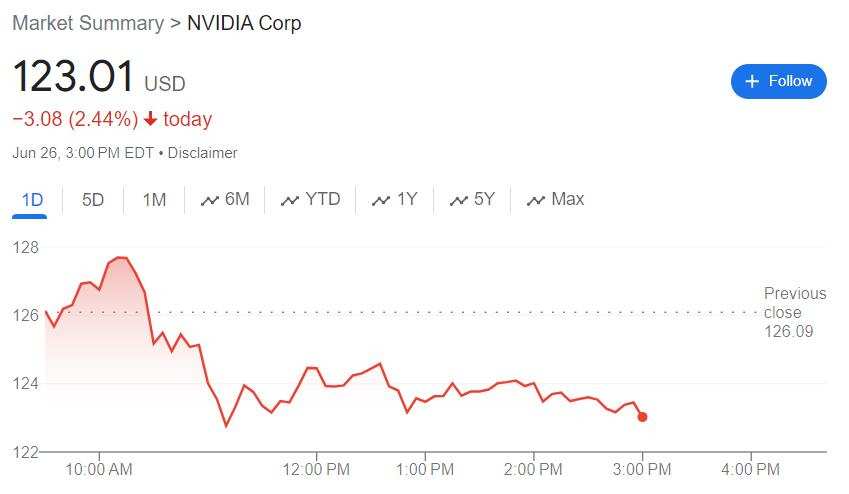

Nvidia did not announce any new products at this meeting, and no executives made any remarks related to new products. Judging from the stock price performance, investors have had a mediocre reaction to this meeting. During the meeting, Nvidia's stock price maintained a decline of more than 2%, after rising by 6.8% on Tuesday, it fell back, and once fell 2.8% after falling in early trading, which is expected to be the fourth consecutive day of decline in the past five trading days.

Wall Street news noticed that before the meeting, some comments said that Nvidia might not release any breakthroughs this time, but Huang Renxun and other Nvidia executives may take this opportunity to emphasize the achievements Nvidia has made in the AI boom and show the company's long-term growth prospects. Some comments also believe that any comments made by Huang Renxun may become a driving force for the stock price. Huang Renxun's recent remarks about AI chips during his trip to Asia have caused the stock price to rebound, and his relevant comments may boost the market sentiment and make investors feel that Nvidia has not yet reached its revenue peak.

During this meeting, although Huang Renxun attended and answered several shareholder questions, although it seems to investors in the stock market that it did not arouse any splashes, it does not mean that there are no highlights.

Huang Renxun is optimistic about the prospects of the Blackwell platform launched in March this year. He said:

"The Blackwell architecture platform is likely to be the most successful product in the history of Nvidia and the entire computer industry."

Some netizens commented that this is a major statement because Nvidia is competing with Microsoft.

Some netizens said that this is the reason why Huang Renxun sold his shares when Nvidia's stock price was at its highest point. But then some netizens explained that Huang Renxun's sale of Nvidia's shares was a plan that had already been discussed, and the proportion was less than 1% of all the shares he held.

Huang Renxun said that Nvidia's advantage in the field of AI chips stems from the bet made more than ten years ago, investing tens of billions of dollars around AI, and deploying a team of thousands of engineers.

When asked about the competition Nvidia is facing, Huang Renxun did not specifically name which competitors, but elaborated on the overall strategy to maintain Nvidia's leading position. First, he mentioned that Nvidia has transformed from a company that used to focus on games to one that focuses on data centers, and hopes to open up new markets for its AI technology, such as industrial robots, and plans to work with all computer manufacturers and cloud service providers.

Huang Renxun said that Nvidia's AI chip provides "the lowest total ownership cost (TOC)." This means that although other chips may be cheaper, considering performance and operational costs, Nvidia's chips are more cost-effective for users.

Finally, Huang Renxun said that Nvidia has achieved a "virtuous cycle." This statement refers to the fact that when a platform has the most users, it can make necessary improvements to attract more users. Huang Renxun said that Nvidia's platform can be widely provided to everyone through all large cloud service providers and computer manufacturers, creating a huge and attractive installation base for developers and customers, making Nvidia's platform more valuable to customers.

One shareholder asked Huang Renxun about Nvidia's plans for quantum computing. Huang Renxun said that he believes "practical quantum computing still needs several decades", and when it comes, "computational algorithms will be a combination of acceleration and quantum methods."

Another shareholder asked how Nvidia would deal with the market environment of tight semiconductor manufacturing capacity. Huang Renxun replied that Nvidia "has professional knowledge and scale to develop a resilient supply chain," and then said that Nvidia can sign long-term supply agreements or prepay manufacturing capacity costs to ensure that customer needs are met.

Nvidia's shareholder meeting coincided with the recent downturn in AI concept stocks led by the company. On Monday, Nvidia fell nearly 6.7%, hitting its biggest daily drop in two months. By the end of Monday's three trading days, it had fallen nearly 13%, just one short day away from its brief global stock king status last week, and fell into the adjustment range. The total market value evaporated 430 billion dollars in three days, the largest three-day market value drop in all stocks in history. On Tuesday, Nvidia's stock price and market cap surpassed the $3 trillion mark, but returned to a downward trend on Wednesday.

Investors are looking forward to new catalysts for the rise of the AI and chip industries. Wednesday's relatively calm Nvidia shareholder meeting failed to play this role, and now the market's attention has shifted to Micron Technology's earnings report after Wednesday's closing bell.