Whales with a lot of money to spend have taken a noticeably bullish stance on Block.

Looking at options history for Block (NYSE:SQ) we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 61% of the investors opened trades with bullish expectations and 30% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $569,064 and 4, calls, for a total amount of $138,661.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $42.5 and $82.5 for Block, spanning the last three months.

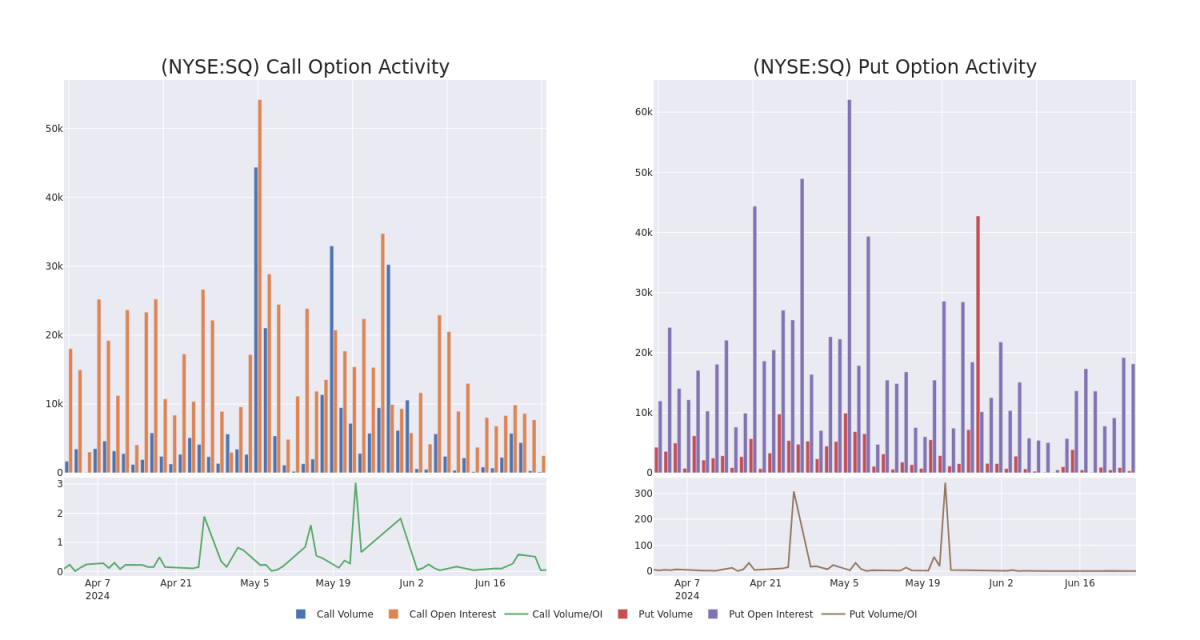

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Block's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Block's whale trades within a strike price range from $42.5 to $82.5 in the last 30 days.

Block Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | PUT | TRADE | BULLISH | 01/17/25 | $1.45 | $1.39 | $1.39 | $42.50 | $125.1K | 1.7K | 0 |

| SQ | PUT | SWEEP | BEARISH | 08/16/24 | $5.5 | $5.4 | $5.5 | $65.00 | $110.0K | 2.4K | 16 |

| SQ | PUT | SWEEP | BULLISH | 06/20/25 | $6.9 | $6.8 | $6.8 | $55.00 | $90.4K | 2.8K | 173 |

| SQ | PUT | SWEEP | BULLISH | 08/16/24 | $3.1 | $3.0 | $3.03 | $60.00 | $60.1K | 1.2K | 85 |

| SQ | PUT | SWEEP | BULLISH | 07/19/24 | $1.33 | $1.29 | $1.29 | $60.00 | $52.5K | 4.2K | 30 |

About Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

Present Market Standing of Block

- With a trading volume of 2,464,918, the price of SQ is down by -0.86%, reaching $63.47.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 36 days from now.

What The Experts Say On Block

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $90.0.

- Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for Block, targeting a price of $100.

- An analyst from Goldman Sachs has revised its rating downward to Buy, adjusting the price target to $80.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Block options trades with real-time alerts from Benzinga Pro.