Capitalizing on Investment Opportunities as US Dollar Hits 2024 Peak

Capitalizing on Investment Opportunities as US Dollar Hits 2024 Peak

moomoo News

moomoo資訊

The U.S. dollar has surged to its highest level since November, driven by speculation that the Federal Reserve will maintain elevated interest rates, attracting global investors seeking higher bond yields. This rise marks the dollar's longest weekly winning streak since February, with a Bloomberg gauge recently hitting a one-month high following a stronger-than-expected jobs report that dampened hopes for rate cuts. The dollar market trend will continue to be influenced by various economic and political factors. As investors, what opportunities and risks lie ahead? Let's explore Wall Street's perspective and discover how investors can benefit from these developments.

由於聯儲局將維持高利率,吸引了全球尋求更高債券收益率的投資者,美元已經上漲至11月以來的最高水平。這一上漲標誌着美元自2月以來的最長周連漲,彭博指數最近因強勁的就業報告打壓降息預期而創下了一個月的新高。美元市場趨勢將繼續受到各種經濟和政治因素的影響。作爲投資者,未來有哪些機遇和風險?讓我們探討華爾街的看法,併發掘投資者如何從這些發展中受益。

What causes the strength of the US dollar?

什麼導致了美元的強勢?

The U.S. dollar's strength is underpinned by the resilient U.S. economy, as evidenced by robust inflation and labor market data, which have reduced expectations for Federal Reserve rate cuts this year and propelled the dollar to new highs. Meera Chandan, Global FX Strategist at J.P. Morgan, highlights that the narrative has changed from "when" to "whether" the Fed will ease, supporting the dollar's rise. While global economic improvement could temper the dollar's performance, the U.S.'s strong economic activity and high-for-longer interest rates provide a solid foundation. The dollar's positive correlation with rising oil prices, particularly in the context of Russia's production cuts, also further bolsters its outlook.

美元的強勢基於美國經濟的抗調整性,如強勁的通脹和勞動力市場數據,這降低了今年聯邦儲備委員會降息的預期並推動了美元走高。根摩根大通的全球外匯策略師Meera Chandan強調,從“何時”變爲了“是否”以降息,支持了美元的上升。儘管全球經濟改善可能會抑制美元的表現,美國強勁的經濟活動和持續較高的利率爲其提供了堅實的基礎。美元與油價上漲呈正相關,特別是在俄羅斯減產的背景下,這在進一步支持其前景方面也起到了推動作用。

Earlier this year, there was speculation of such divergence as the U.S. outlook for growth and inflation appeared stronger compared to Europe and China. However, recent months have shown a more convergent global landscape. U.S. economic activity has softened, Europe has seen an uptick, and China has demonstrated improved data and policy efforts to address its issues. This convergence has kept the dollar and other major currencies in a relatively tight range, suggesting that, barring new significant divergences, sharp movements in the dollar are unlikely in the near term.

今年早些時候,由於美國增長和通脹的前景相對歐洲和中國更強,人們猜測會出現這種分歧。然而,最近幾個月顯示出一個更加一體化的全球格局。美國經濟活動有所放緩,歐洲有所上漲,中國展示了改進的數據和應對問題的政策努力。這種趨同使得美元和其他主要貨幣保持相對穩定,除非出現顯著的分歧,否則美元在短期內不太可能出現大幅波動。

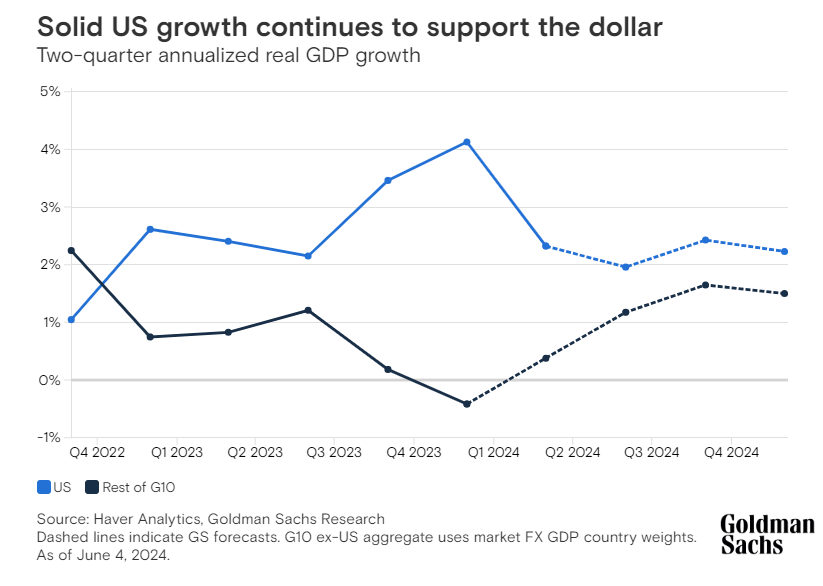

Goldman Sachs Research expects the dollar to retain its gains over the next 12 months, remaining steady against the euro, British pound, and Australian dollar. Kamakshya Trivedi, head of global FX and interest rates strategy at Goldman Sachs, attributes the dollar's stability to limited global macroeconomic divergence and robust U.S. economic growth. "We will continue to live in a strong U.S. dollar world," Trivedi notes. The dollar's strength in 2024, fueled by higher interest rates, sticky inflation, and a resilient economy, has led it to appreciate against nearly every major currency.

高盛研究預計美元在未來12個月內仍將保持漲勢,對歐元、英鎊和澳元保持穩定。高盛全球外匯和利率策略負責人Kamakshya Trivedi將美元的穩定歸因於全球宏觀經濟分歧有限和美國經濟增長強勁。Trivedi指出:“我們將繼續生活在一個強勁的美元世界。”美元在2024年的強勢,由於更高的利率、黏性通脹和韌性經濟,導致其對幾乎所有主要貨幣升值。

How investors can benefit from the US dollar strength?

投資者如何從美元強勢中受益?

Long U.S. Dollar ETFs are investment vehicles designed to capitalize on the appreciation of the U.S. dollar (USD) relative to a diverse array of major developed-market currencies such as the Japanese yen, Canadian dollar (loonie), Australian dollar (aussie), British pound, Swiss franc, and the euro. These ETFs achieve their investment objective by holding a mix of futures contracts and swaps. Investors interested in the performance of these ETFs can access a wealth of information through detailed tabs that offer data on historical returns, dividends, fund holdings, expense ratios, and technical analysis.

Long U.S. Dollar ETFs是投資工具,旨在從美元相對於如日元、加元(加密)、澳元(奧幣)、英鎊、瑞士法郎和歐元等主要發達市場貨幣的升值中獲利。這些ETF通過持有一攬子期貨合約和掉期合約來實現其投資目標。對這些ETF的表現感興趣的投資者可以通過詳細的選項卡訪問大量信息,這些選項卡提供有關歷史回報、分紅派息、基金持有、費用比率和技術分析的數據。

$Powershares Exchange Traded Fd Tst Db Us Dollar Index Bullish Fund Etf (UUP.US)$ stands out as a prime beneficiary of a rising dollar, offering exposure to a basket of six world currencies by tracking the Deutsche Bank Long USD Currency Portfolio Index - Excess Return, along with interest income from U.S. Treasury securities. The fund allocates 57.6% to the euro and 25.5% collectively to the Japanese yen and British pound.

$美元ETF-PowerShares DB (UUP.US)$作爲受益於美元上漲的優質股票之一,這隻基金可通過跟蹤德意志銀行美元長期貨幣組合指數-超額回報,以及來自美國國債證券的利息收入來獲得六種世界貨幣的暴露。該基金將57.6%的資金分配給歐元,25.5%的資金分配給日元和英鎊。

$Wisdomtree Trust Bloomberg U S Dollar Bullish Fd (USDU.US)$ offers direct exposure to the U.S. dollar against a basket of foreign currencies by tracking the Bloomberg Dollar Total Return Index. Notably, it exhibits strong negative correlations with international equity and bond portfolios. The fund has amassed $280.8 million in assets under management (AUM) and trades an average daily volume of approximately 242,000 shares.

$WisdomTree彭博美元看漲基金 (USDU.US)$通過跟蹤Bloomberg Dollar Total Return指數,直接暴露於美元相對於一籃子外幣的升值,特別是在國際股票和債券組合方面表現出強烈的負相關性。該基金已累積2.808億美元的資產管理規模,並以每日約242,000股的平均交易量交易。

Source: Goldman Sachs, U.S. Bank Wealth Management, J.P.Morgan, Bloomberg, moomoo

資料來源:高盛、美國銀行财富管理、摩根大通、彭博、moomoo

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易應用程序,在美國,Moomoo Financial Inc 爲投資者提供投資產品和服務,爲 FINRA/SIPC 的成員。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

Moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易應用程序,在美國,Moomoo Financial Inc 爲投資者提供投資產品和服務,爲 FINRA/SIPC 的成員。