Market Whales and Their Recent Bets on ABT Options

Market Whales and Their Recent Bets on ABT Options

Financial giants have made a conspicuous bullish move on Abbott Laboratories. Our analysis of options history for Abbott Laboratories (NYSE:ABT) revealed 8 unusual trades.

金融巨頭們對雅培公司進行了明顯的看好操作。我們對雅培公司的期權歷史進行分析(NYSE:ABT),發現有8次飛凡交易。

Delving into the details, we found 50% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $93,318, and 5 were calls, valued at $681,133.

具體來看,我們發現50%的交易者看漲,而37%顯示出看淡的傾向。我們發現所有被發現的交易中有3次看跌,價值爲$93,318,5次看漲,價值爲$681,133。

What's The Price Target?

價格目標是什麼?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $115.0 for Abbott Laboratories over the recent three months.

從交易活動來看,重要的投資者似乎瞄準了過去三個月雅培公司的價格區間,從$100.0到$115.0。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

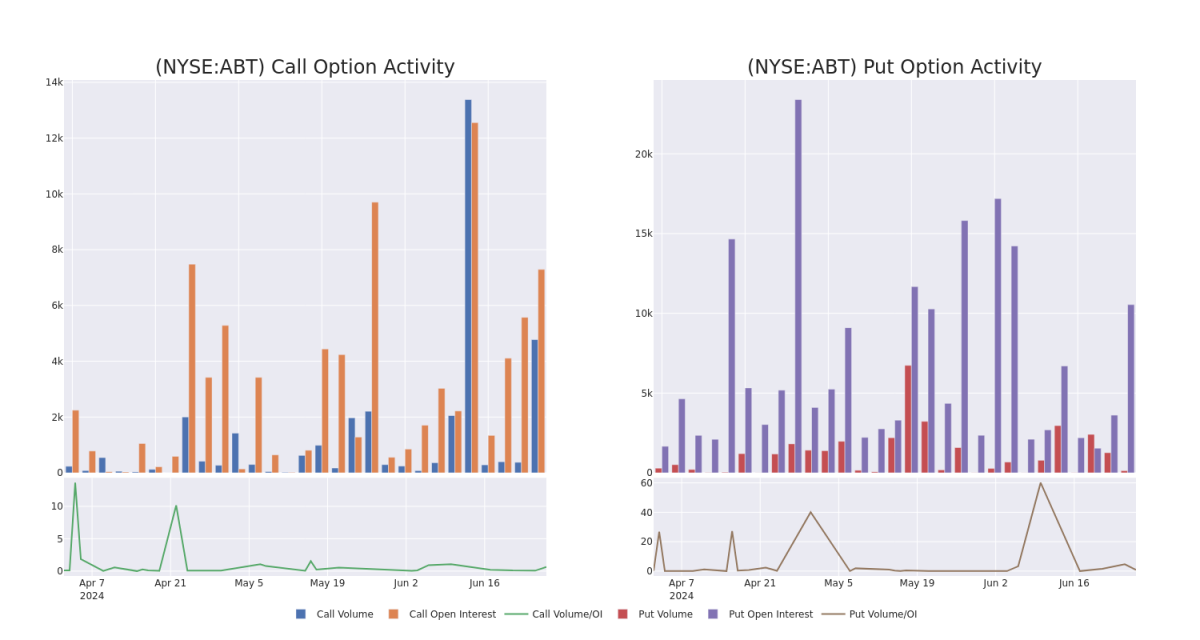

In terms of liquidity and interest, the mean open interest for Abbott Laboratories options trades today is 2972.17 with a total volume of 4,909.00.

就流動性和興趣而言,雅培公司期權交易今天的平均未平倉合約量爲2972.17,總成交量爲4,909.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Abbott Laboratories's big money trades within a strike price range of $100.0 to $115.0 over the last 30 days.

在下圖中,我們可以追蹤雅培公司大宗交易的看跌和看漲期權成交量和未平倉合約的發展情況,範圍在$100.0到$115.0之間,歷時30天。

Abbott Laboratories Option Volume And Open Interest Over Last 30 Days

雅培公司在過去30天內的期權成交量和未平倉合約

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABT | CALL | SWEEP | NEUTRAL | 07/12/24 | $1.36 | $1.05 | $1.18 | $106.00 | $420.9K | 86 | 403 |

| ABT | CALL | TRADE | BULLISH | 08/16/24 | $1.12 | $1.06 | $1.11 | $110.00 | $166.5K | 5.7K | 109 |

| ABT | PUT | SWEEP | BEARISH | 07/12/24 | $0.7 | $0.63 | $0.7 | $102.00 | $35.0K | 25 | 20 |

| ABT | CALL | SWEEP | BULLISH | 11/15/24 | $1.96 | $1.85 | $1.96 | $115.00 | $34.4K | 1.4K | 4 |

| ABT | CALL | SWEEP | BULLISH | 07/12/24 | $1.04 | $1.03 | $1.04 | $106.00 | $32.8K | 86 | 4.2K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABT | 看漲 | SWEEP | 中立 | 07/12/24 | $1.36 | $1.05 | $1.18 | $106.00 | $420.9K | 86 | 403 |

| ABT | 看漲 | 交易 | 看好 | 08/16/24 | $1.12 | 1.06美元 | $1.11 | $110.00 | $166.5K | 5.7千 | 109 |

| ABT | 看跌 | SWEEP | 看淡 | 07/12/24 | 0.7美元 | $0.63 | 0.7美元 | $102.00 | $35.0K | 25 | 20 |

| ABT | 看漲 | SWEEP | 看好 | 11/15/24 | 1.96美元 | $1.85 | 1.96美元 | $115.00 | 成交量: $34.4K | 1.4千 | 4 |

| ABT | 看漲 | SWEEP | 看好 | 07/12/24 | $1.04 | $1.03 | $1.04 | $106.00 | $32.8千美元 | 86 | 4.2千 |

About Abbott Laboratories

關於Abbott Laboratories

Abbott manufactures and markets cardiovascular and diabetes devices, adult and pediatric nutritional products, diagnostic equipment and testing kits, and branded generic drugs. Products include pacemakers, implantable cardioverter defibrillators, neuromodulation devices, coronary stents, catheters, infant formula, nutritional liquids for adults, continuous glucose monitors, and immunoassays and point-of-care diagnostic equipment. Abbott derives approximately 60% of sales outside the United States.

Abbott Laboratories生產和銷售心血管和糖尿病設備、成人和兒童營養產品、診斷設備和測試工具以及品牌通用藥品。其產品包括起搏器、可植入式心律轉復除顫器、神經調節器、冠狀動脈支架、導管、嬰兒配方奶粉、成人營養液、連續血糖監測儀、免疫測定和現場診斷設備。Abbott Laboratories約60%的銷售額來自美國以外的市場。

After a thorough review of the options trading surrounding Abbott Laboratories, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對雅培公司的期權交易進行徹底審核後,我們進一步檢查該公司的詳細情況,包括對其當前市場狀態和表現進行評估。

Where Is Abbott Laboratories Standing Right Now?

雅培公司目前處於什麼位置?

- With a volume of 1,979,841, the price of ABT is down -0.59% at $104.26.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 21 days.

- 雅培的成交量爲1,979,841,股票價格下跌了-0.59%,爲$104.26。

- RSI指標暗示該股票可能要超買了。

- 預計下次發佈收益報告距今21天。

What The Experts Say On Abbott Laboratories

專家對雅培公司的評論

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $123.0.

過去30天中,已有2位專業分析師對這隻股票發表了看漲的評論,設定了平均目標價爲$123.0。

- An analyst from Goldman Sachs has revised its rating downward to Buy, adjusting the price target to $121.

- In a cautious move, an analyst from RBC Capital downgraded its rating to Outperform, setting a price target of $125.

- 高盛的一位分析師已將其評級調降至買入,並將目標價調整爲121美元。

- 在一個謹慎的舉動中,RBC Capital將其評級降級爲強於市場表現,設定目標價爲125美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Abbott Laboratories options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在回報。精明的交易者通過不斷學習、調整策略、監控多個因子和緊密關注市場變化來管理這些風險。通過Benzinga Pro實時警報了解最新的雅培公司期權交易情況。