Whales with a lot of money to spend have taken a noticeably bullish stance on Merck & Co.

Looking at options history for Merck & Co (NYSE:MRK) we detected 23 trades.

If we consider the specifics of each trade, it is accurate to state that 56% of the investors opened trades with bullish expectations and 34% with bearish.

From the overall spotted trades, 12 are puts, for a total amount of $742,508 and 11, calls, for a total amount of $434,384.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $127.0 to $150.0 for Merck & Co over the recent three months.

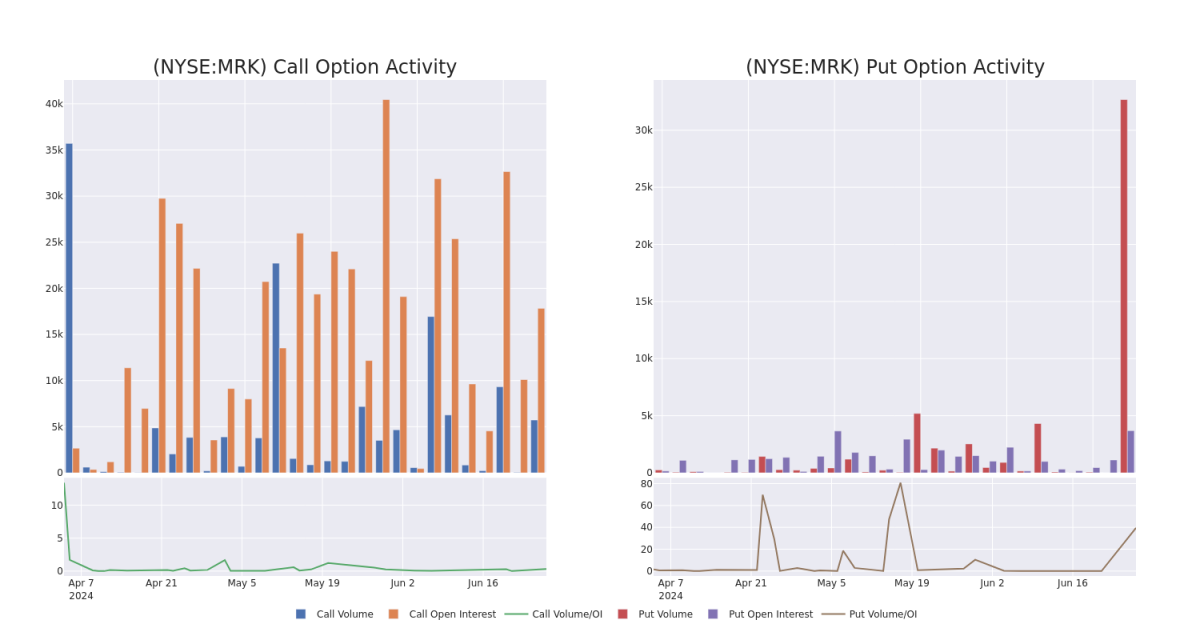

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Merck & Co's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Merck & Co's whale activity within a strike price range from $127.0 to $150.0 in the last 30 days.

Merck & Co Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRK | PUT | TRADE | BEARISH | 08/16/24 | $3.0 | $2.99 | $3.0 | $130.00 | $120.0K | 9810 | |

| MRK | PUT | TRADE | NEUTRAL | 06/28/24 | $2.95 | $2.69 | $2.8 | $130.00 | $97.9K | 8265.0K | |

| MRK | PUT | TRADE | BULLISH | 06/28/24 | $1.02 | $0.8 | $0.85 | $130.00 | $85.0K | 8261.6K | |

| MRK | PUT | TRADE | BULLISH | 06/28/24 | $1.73 | $1.58 | $1.57 | $130.00 | $78.5K | 8263.5K | |

| MRK | CALL | TRADE | BULLISH | 06/28/24 | $0.79 | $0.72 | $0.78 | $129.00 | $77.2K | 8281.0K |

About Merck & Co

Merck makes pharmaceutical products to treat several conditions in a number of therapeutic areas, including cardiometabolic disease, cancer, and infections. Within cancer, the firm's immuno-oncology platform is growing as a major contributor to overall sales. The company also has a substantial vaccine business, with treatments to prevent pediatric diseases as well as human papillomavirus, or HPV. Additionally, Merck sells animal health-related drugs. From a geographical perspective, just under half of the company's sales are generated in the United States.

After a thorough review of the options trading surrounding Merck & Co, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Merck & Co

- Currently trading with a volume of 7,206,232, the MRK's price is up by 0.38%, now at $132.0.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 33 days.

What Analysts Are Saying About Merck & Co

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $155.0.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $155.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $155.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $155.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Merck & Co with Benzinga Pro for real-time alerts.