MMG Limited (HKG:1208) shares have had a horrible month, losing 30% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 30% in the last year.

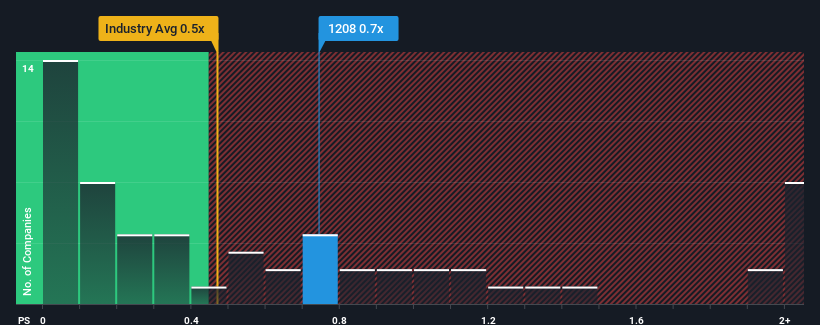

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about MMG's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in Hong Kong is also close to 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does MMG's Recent Performance Look Like?

MMG certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on MMG will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like MMG's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 34% gain to the company's top line. The latest three year period has also seen an excellent 43% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 11% per year during the coming three years according to the seven analysts following the company. That's shaping up to be materially higher than the 4.7% per year growth forecast for the broader industry.

In light of this, it's curious that MMG's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From MMG's P/S?

Following MMG's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, MMG's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for MMG (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If you're unsure about the strength of MMG's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com