Zhuzhou CRRC Times Electric Co., Ltd. (HKG:3898) is about to trade ex-dividend in the next four days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Therefore, if you purchase Zhuzhou CRRC Times Electric's shares on or after the 2nd of July, you won't be eligible to receive the dividend, when it is paid on the 8th of August.

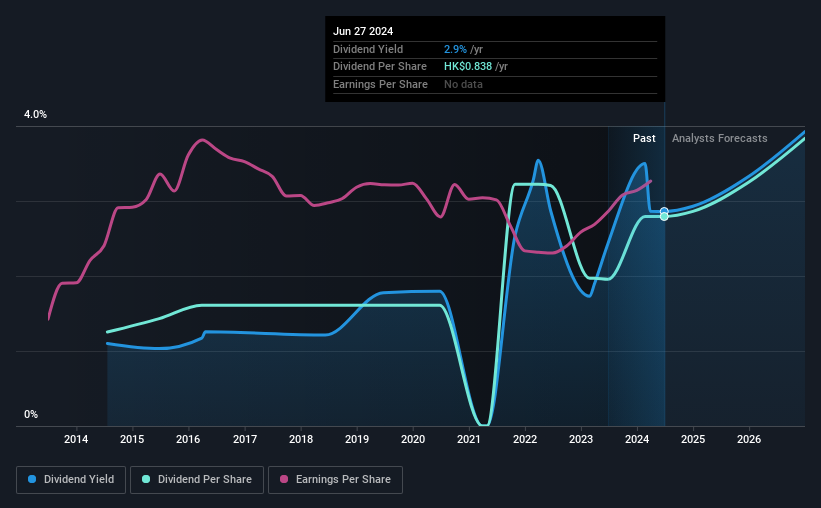

The company's upcoming dividend is CN¥0.78 a share, following on from the last 12 months, when the company distributed a total of CN¥0.78 per share to shareholders. Last year's total dividend payments show that Zhuzhou CRRC Times Electric has a trailing yield of 2.9% on the current share price of HK$29.30. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Fortunately Zhuzhou CRRC Times Electric's payout ratio is modest, at just 34% of profit. A useful secondary check can be to evaluate whether Zhuzhou CRRC Times Electric generated enough free cash flow to afford its dividend. Zhuzhou CRRC Times Electric paid out more free cash flow than it generated - 120%, to be precise - last year, which we think is concerningly high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

Zhuzhou CRRC Times Electric does have a large net cash position on the balance sheet, which could fund large dividends for a time, if the company so chose. Still, smart investors know that it is better to assess dividends relative to the cash and profit generated by the business. Paying dividends out of cash on the balance sheet is not long-term sustainable.

Zhuzhou CRRC Times Electric paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Were this to happen repeatedly, this would be a risk to Zhuzhou CRRC Times Electric's ability to maintain its dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're not enthused to see that Zhuzhou CRRC Times Electric's earnings per share have remained effectively flat over the past five years. We'd take that over an earnings decline any day, but in the long run, the best dividend stocks all grow their earnings per share. Earnings have been growing somewhat, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the past 10 years, Zhuzhou CRRC Times Electric has increased its dividend at approximately 8.3% a year on average.

Final Takeaway

Is Zhuzhou CRRC Times Electric worth buying for its dividend? Earnings per share have been effectively flat over this time, and Zhuzhou CRRC Times Electric's paying out less than half its profits and 120% of its cash flow. Only rarely do we find companies paying out a low percentage of their profits yet a high percentage of their cash flow, so we'd mark this as a concern. Overall, it's hard to get excited about Zhuzhou CRRC Times Electric from a dividend perspective.

Ever wonder what the future holds for Zhuzhou CRRC Times Electric? See what the 23 analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com