The GRIPM Advanced Materials Co., Ltd. (SHSE:688456) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 17% in that time.

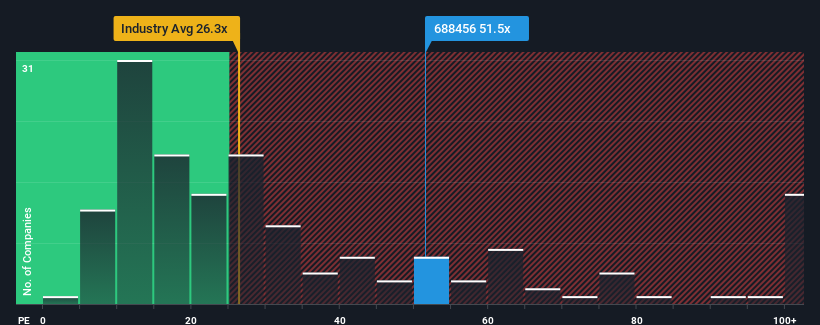

In spite of the heavy fall in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may still consider GRIPM Advanced Materials as a stock to avoid entirely with its 51.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

GRIPM Advanced Materials certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Is There Enough Growth For GRIPM Advanced Materials?

There's an inherent assumption that a company should far outperform the market for P/E ratios like GRIPM Advanced Materials' to be considered reasonable.

There's an inherent assumption that a company should far outperform the market for P/E ratios like GRIPM Advanced Materials' to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 8.1% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 70% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 31% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 25% per annum, which is noticeably less attractive.

In light of this, it's understandable that GRIPM Advanced Materials' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From GRIPM Advanced Materials' P/E?

GRIPM Advanced Materials' shares may have retreated, but its P/E is still flying high. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of GRIPM Advanced Materials' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for GRIPM Advanced Materials you should be aware of.

If you're unsure about the strength of GRIPM Advanced Materials' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com