NVIDIA's skyrocketing stock price over the past two years theoretically could bring billions of unexpected windfall for charity, but the precondition is that the CEO, Jensen Huang, and his wife, Lori, actually donate the money. According to public tax filing documents, the Huangs have been donating some of their stocks to their charitable foundation, the Jen-Hsun & Lori Huang Foundation, every year for the past 20 years. By the end of 2022, the foundation holds a total of 69 million shares of NVIDIA stock. According to John Seitz, founder of FoundationMark, who tracks the foundation's investment performance, the total value of these stocks exceeds $8 billion, thanks to the sharp rise in the stock price.

According to publicly available tax filing documents, the Huangs have been donating some of their stocks to their charitable foundation, the Jen-Hsun & Lori Huang Foundation, every year for the past 20 years. By the end of 2022, the foundation holds a total of 69 million shares of NVIDIA stock. According to John Seitz, founder of FoundationMark, who tracks the foundation's investment performance, the total value of these stocks exceeds $8 billion, thanks to the sharp rise in the stock price.

Although $8 billion is a considerable amount, it may still underestimate the scale of the charitable assets that this couple currently has at their disposal. According to publicly available documents, a charitable fund operated by Charles Schwab holds NVIDIA stock worth $4.4 billion, at least some of which represents the Huangs and their foundation's holdings through a Donor-Advised-Fund (DAF) account. These funds far exceed the total amount of donations that the foundation has disclosed. From its establishment in 2007 to the end of 2022, the Huangs' charitable foundation donated or pledged to donate a total of about $65 million to external nonprofit organizations, mainly Stanford University and Oregon State University. The foundation also donated about $125 million to the GeForce Foundation, primarily in the form of NVIDIA stock donations. The GeForce Foundation is a DAF account that the Huangs set up in the Charles Schwab Charitable Fund.

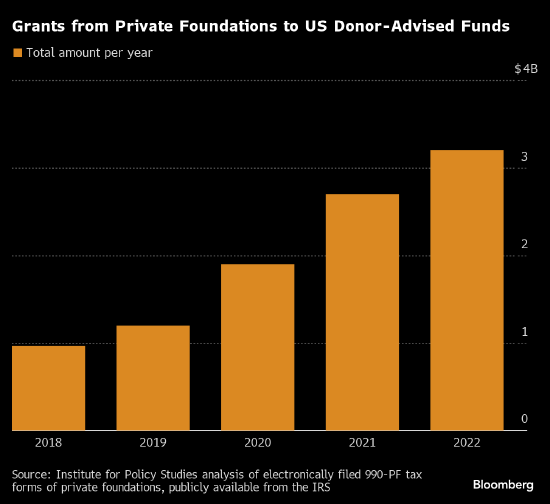

This practice of donating stocks to a foundation and holding them through the foundation has made the Huangs' charitable assets pool quite considerable and has placed them among the top 20 private foundations in the United States. However, there has been constant controversy in the charity sector because more and more billionaires are using this type of long-term investment charitable donation to receive immediate tax breaks, which has reduced the amount of actual money going to charitable institutions.

Jensen Huang.

Jensen Huang.

"Their operating costs are minuscule," said Seitz. "This suggests they are simply "kicking the can down the road" when it comes to their charitable work."

Dean Zerbe, a former Republican tax counsel on the Senate Finance Committee who now works at Alliantgroup, said, "Congress created rules around charitable donations that allow for very generous tax write-offs for these types of gifts, and if they are simply left sitting there and not used, that goes against the spirit and the intent of our charitable-giving laws."

A spokesperson for Huang declined to comment, issuing instead a statement about the foundation's work that said, "The Huang Foundation supports higher education, public health, STEM initiatives across the United States, and local community organizations in the San Francisco Bay Area."

A representative of the Charles Schwab Charitable Fund said its donors gave $6 billion to charitable organizations last year, a 31% increase from 2022.

A representative of Charles Schwab Charitable Fund said that its donors donated $6 billion to charitable organizations last year, an increase of 31% compared to 2022.

One hour of work per week.

Thanks to the market's huge demand for NVIDIA's artificial intelligence chips, the company's stock price has risen sharply. According to a requirement that private foundations allocate at least 5% of their assets annually, the Huangs must allocate more money to public charities. This might be a challenge because the foundation has been operating quite primitively.

The address of the Huang Foundation is the address of a Paloaalto accounting firm that helps them file taxes. The staff consists only of Lori and Jensen Huang, with Lori serving as president and Jensen as secretary and chief financial officer. According to tax filing documents, they work an average of one hour per week and the foundation has never incurred any compensation expenses.

"Their operating costs are minuscule," said Seitz. "This suggests they are just "kicking the can down the road" when it comes to their charitable work."

According to regulations from the US Internal Revenue Service (IRS), when people donate cash, securities, or other assets to a private foundation specifically set up to manage charitable endeavors, they are eligible for tax deductions. Conversely, the foundation is required to donate at least 5% of its assets to public charities each year.

Like many other billionaires, the Huangs mainly fulfill the aforementioned annual asset allocation requirements by donating to the Charles Schwab Charitable Fund account. Assets in this type of account have no deadline because DAFs are classified as public charities and are not subject to the annual asset allocation requirements for private foundations established under US IRS regulations.

As a public charity institution, Jiaxin Charitable Fund does not need to disclose details about customer investments and donations, which is another reason why DAF is so popular among the wealthy. But Jiaxin Charity is one of the few DAF companies that discloses client account stock information through quarterly reports required by fund companies such as hedge funds and private equity firms.