Can Mixed Fundamentals Have A Negative Impact on Shenzhen Ridge Engineering Consulting Co., Ltd. (SZSE:300977) Current Share Price Momentum?

Can Mixed Fundamentals Have A Negative Impact on Shenzhen Ridge Engineering Consulting Co., Ltd. (SZSE:300977) Current Share Price Momentum?

Shenzhen Ridge Engineering Consulting (SZSE:300977) has had a great run on the share market with its stock up by a significant 39% over the last week. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. In this article, we decided to focus on Shenzhen Ridge Engineering Consulting's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Shenzhen Ridge Engineering Consulting is:

2.7% = CN¥38m ÷ CN¥1.4b (Based on the trailing twelve months to March 2024).

The 'return' is the income the business earned over the last year. One way to conceptualize this is that for each CN¥1 of shareholders' capital it has, the company made CN¥0.03 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company's earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Shenzhen Ridge Engineering Consulting's Earnings Growth And 2.7% ROE

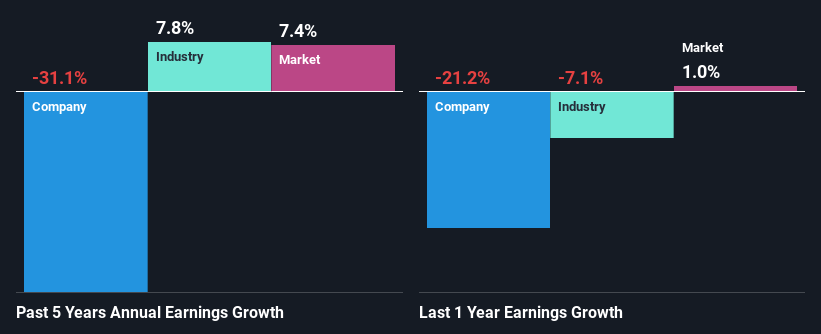

As you can see, Shenzhen Ridge Engineering Consulting's ROE looks pretty weak. Even when compared to the industry average of 7.3%, the ROE figure is pretty disappointing. Given the circumstances, the significant decline in net income by 31% seen by Shenzhen Ridge Engineering Consulting over the last five years is not surprising. However, there could also be other factors causing the earnings to decline. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

So, as a next step, we compared Shenzhen Ridge Engineering Consulting's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 7.8% over the last few years.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is 300977 fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Shenzhen Ridge Engineering Consulting Efficiently Re-investing Its Profits?

In spite of a normal three-year median payout ratio of 33% (that is, a retention ratio of 67%), the fact that Shenzhen Ridge Engineering Consulting's earnings have shrunk is quite puzzling. It looks like there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Moreover, Shenzhen Ridge Engineering Consulting has been paying dividends for three years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer consistent dividends even though earnings have been shrinking.

Conclusion

On the whole, we feel that the performance shown by Shenzhen Ridge Engineering Consulting can be open to many interpretations. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com