Track the latest trends of north-south directional funds.

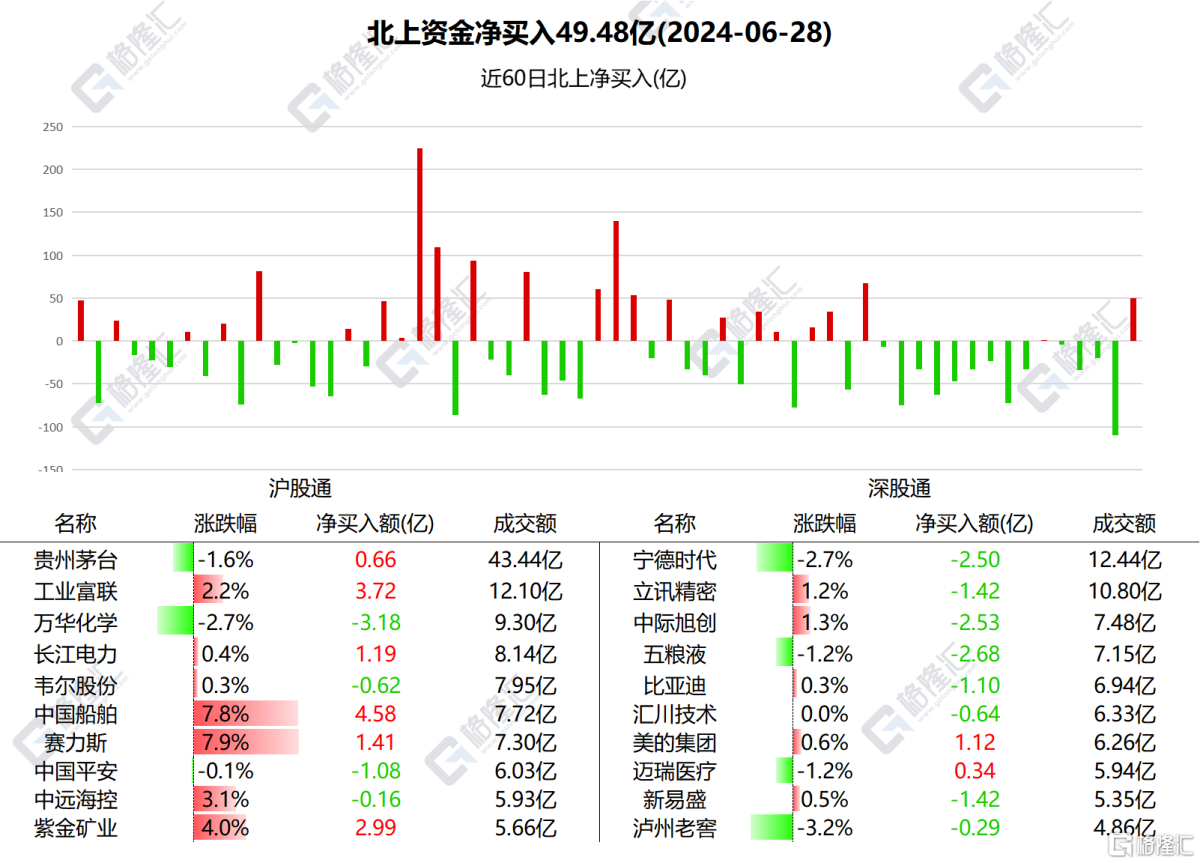

Northbound funds net bought A shares by RMB 4.948 billion today, ending the previous 4 days' net selling trend.

Among them, CSSC, Foxconn Industrial Internet and Zijin Mining Group received a net purchase of RMB 458 million, RMB 372 million and RMB 299 million respectively. Wanhua Chemical Group had the highest net selling amount, which was RMB 318 million.

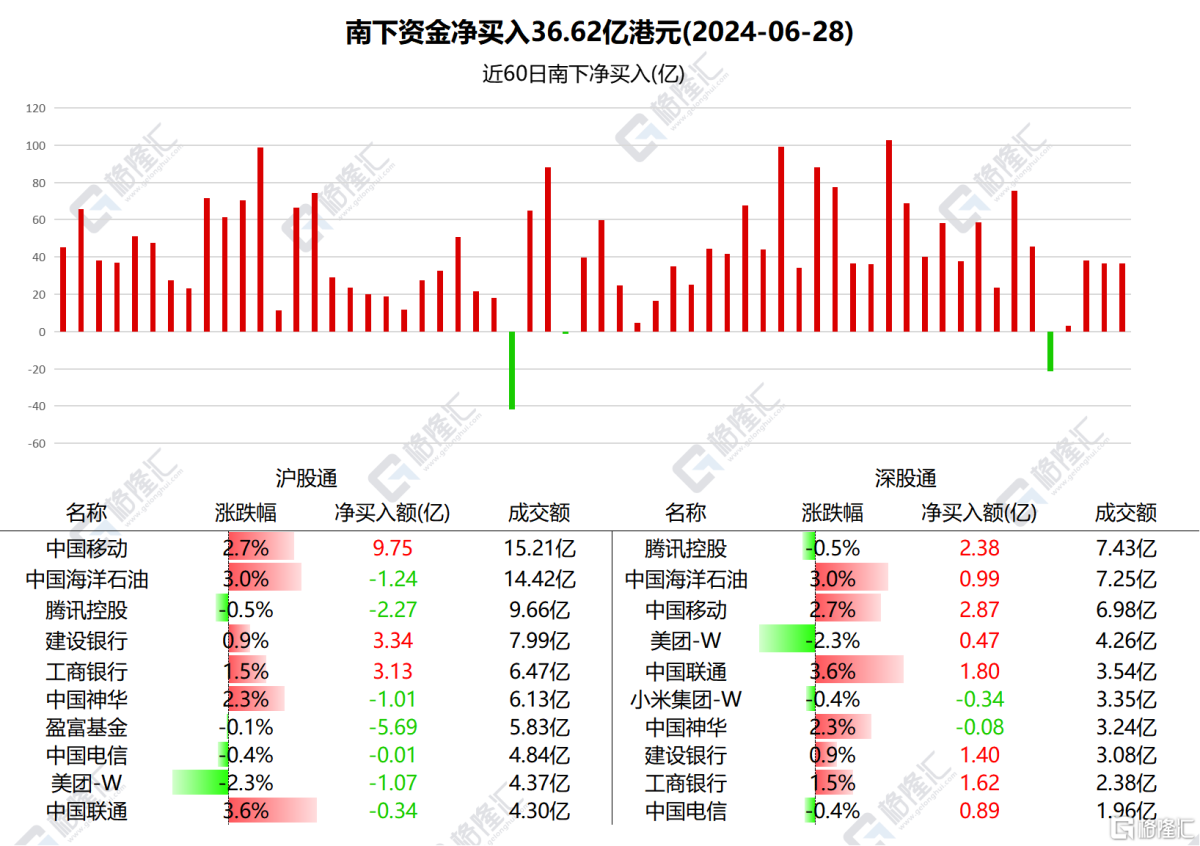

Southbound funds net bought Hong Kong stocks by HKD 3.662 billion today. The cumulative purchases in June amounted to HKD 87.646 billion.

Among them: China Mobile net bought HKD 1.262 billion, ICBC net bought HKD 475 million, China Construction Bank net bought HKD 473 million, China Unicom net bought HKD 145 million; Tracker Fund of Hong Kong net sold HKD 569 million, China Shenhua Energy net sold HKD 108 million.

According to statistics, southbound funds have been net buying China Construction Bank for 10 consecutive days, with a total of HKD 3.67461 billion; net buying ICBC for 9 consecutive days, with a total of HKD 3.36216 billion, and net selling CNOOC for 5 consecutive days, with a total of HKD 1.15451 billion.

Individual Stocks Concerned: China Mobile: On the news front, Goldman Sachs issued a research report stating that the company's management maintained its expectations for stable growth in revenue and profit in 2024. Due to increased R&D and marketing expenses for enterprise business (cloud, artificial intelligence, industrial internet, etc.), EBITDA profit margin continued to show a downward trend, but the slowdown in depreciation costs helped support the trend of stable net profit margin. The management believes that the dividend payout ratio can be increased from 71% to the target of 75% in 2026. Goldman Sachs believes that stable business growth and steady capital expenditures should help China Mobile gradually increase its dividends. Chinahongqiao:

China CSSC Holdings Ltd.China State Shipbuilding Corporation's stock rose by 7.84% today. The latest financial report showed that in the first quarter of this year, the company achieved a revenue of RMB 15.27 billion, a year-on-year increase of 68.84%, a net profit of RMB 401 million, a year-on-year increase of 821.12%, and an EPS of 0.09 yuan.

Foxconn Industrial InternetFoxconn Industrial Internet's stock rose by 2.2% today. At the 2023 annual shareholders meeting, Chairman Zheng Hongmeng said that as the "dual leader" of cloud computing and mobile phone components, the company's two major businesses are expected to develop simultaneously, and the company will also benefit from the double benefits of AI computing power and AI phones. The meeting also approved a cash dividend plan of approximately RMB 11.521 billion.

Zijin Mining GroupZijin Mining Group's stock rose by 3.96% today. On the news side, on June 24th, Zijin Changsha New Energy New Material Experiment Base Project, a subsidiary of Zijin Mining Group, started construction in Yue Lu High-Tech Industrial Development Zone in Xiangjiang New Area, Hunan Province, with an investment of RMB 500 million. It is positioned as an application-oriented scientific research institution with industrialization as its goal, and mainly carries out international cutting-edge technology research such as lithium-ion batteries, solid-state batteries, hydrogen production by electrolysis of water, and rubidium cesium molybdenum materials application research.

Materials of the companies of North Water

China MobileChina Mobile's stock rose by 2.67% today. On the same day, Apple Vision Pro was officially launched in the Chinese market, and Migu, a subsidiary of China Mobile, officially launched Migu Video-Vision as one of the first platforms to provide streaming media services on Apple Vision Pro.

Industrial and Commercial Bank of ChinaIt rose by 1.53%.China Construction Bank CorporationIt rose by 0.87%. Morgan Stanley is more optimistic about Chinese bank stocks, believing that global investors are too pessimistic about the impact of the sluggish Chinese real estate market and economic weakness on bank profits.