Nasdaq technology ETF rose over 58% in the first half of the year.

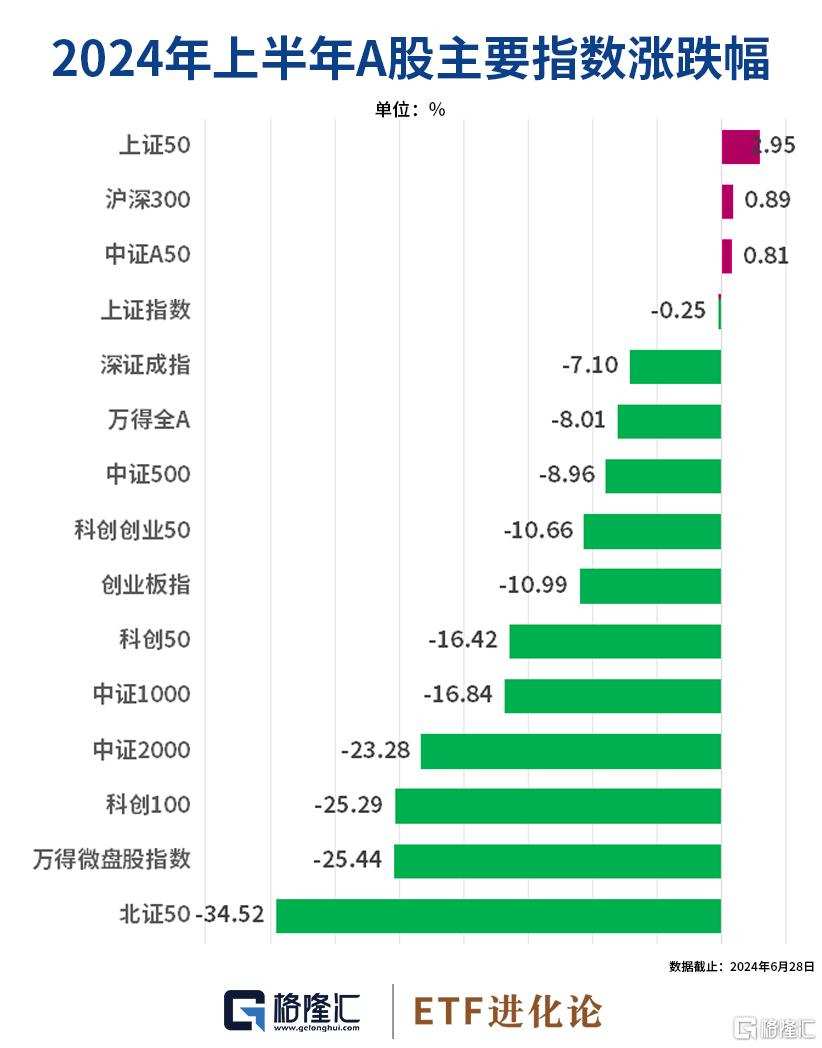

Today, the first half of 2024 market closed with the Shanghai Composite Index falling 0.25%, while SSE 50, CSI 300 Index, and CSI A50 Index all rose. Other major indexes fell to varying degrees, with the Shenzhen Component Index dropping more than 30% and ranking last.

The fund market has seen an increase in issuance compared to the same period last year. In the first half of 2024, a total of 565 fund products were issued with a total fundraising of up to 634.698 billion yuan. Bond funds have been favored by investors, with many of them ranking at the top of the TOP20 issuance in June and the first half of the year.

The fund market has seen an increase in issuance compared to the same period last year. In the first half of 2024, a total of 565 fund products were issued with a total fundraising of up to 634.698 billion yuan. Bond funds have been favored by investors, with many of them ranking at the top of the TOP20 issuance in June and the first half of the year.

In terms of ETF, the issuance scale in June increased compared to May, with a total fundraising of 4.459 billion yuan. A total of 79 ETF products were issued in the first half of the year, compared to only 60 in the same period last year.

The ETF performance remains polarized. The NASDAQ-related ETF continues to lead, with the NASDAQ Technology ETF rising 18.16% in June and more than 58% in the first half of the year. However, ETF products in fields like innovative drugs and photovoltaics are still in a slump, with the Photovoltaics 30 ETF dropping more than 115% in June and the Vaccine and Biotech ETF falling more than 30% in the first half of the year.

Turning our attention to the global market, most of the global investment masters with assets under management of more than 2 billion U.S. dollars achieved positive returns in the first half of 2024, with only three of them reporting losses. Howard Marks has been leading the way with a return rate of more than 30% in the past six months.

基金市场在发行方面较去年同期呈上升态势。

基金市场在发行方面较去年同期呈上升态势。