Macro Matters

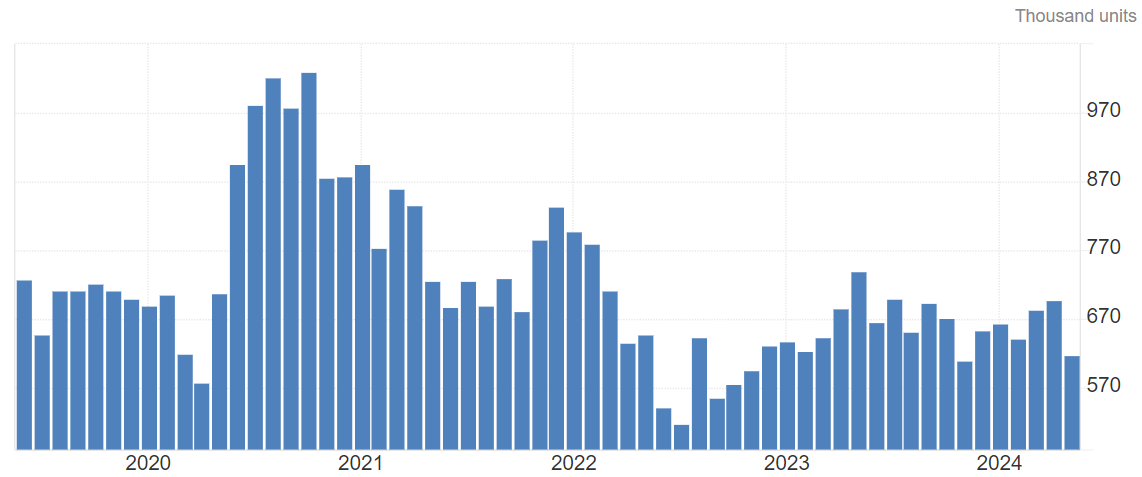

US New Home Sales Plunge, Inventory Reaches over 16-Year Peak

New home sales declined 11.3% to a seasonally adjusted annual rate of 619,000 units last month, the lowest level since November, the Commerce Department's Census Bureau said. The percentage-based drop was the biggest since September 2022.

Graph: US New Home Sales Number Trend

The median new house price fell 0.9% to $417,400 in May from a year ago. Nearly half of the new homes sold last month were priced under $399,000. The average rate on the popular 30-year fixed-rate mortgage reached a six-month high of 7.22% in early May before retreating to 7.03% by the end of the month, data from mortgage finance agency Freddie Mac showed.

At May's sales pace it would take 9.3 months to clear the supply of houses on the market. That was the most months since November 2022 and up from 8.1 months in April.

India's Gdp Growth Is Expected to Slow Modestly This Fiscal Year and Next

Forecasts for a mild slowdown in India's fast-growing economy held steady in the first Reuters poll of economists since the ruling Bharatiya Janata Party (BJP) lost its parliamentary majority in phased national elections that ended in early June.

Asia's third-largest economy grew 8.2% in the last fiscal year, the fastest among major economies. But growth is set to slow to 7.0% and then 6.7% in the current and next fiscal years, according to a June 19-27 Reuters poll of over 50 economists.

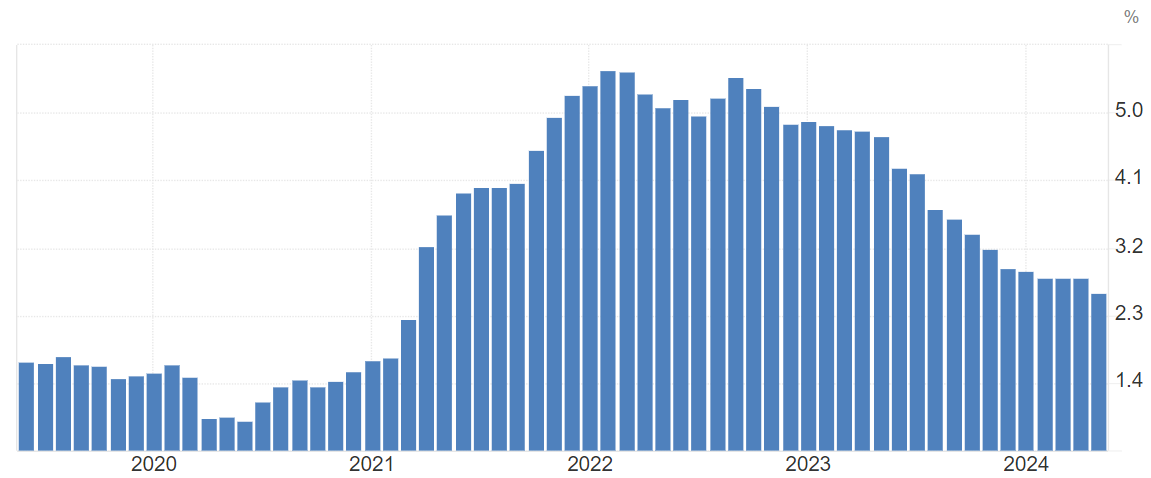

US May Core Pce Increased by 2.6% as Expected

The annual PCE inflation rate in the US decreased to 2.6% in May 2024 from 2.7% in each of the previous two months, in line with market forecasts. The core PCE inflation gauge for the US economy also fell to 2.6% in May 2024, the lowest since March 2021, down from 2.8% in April and matching market forecasts.

Graph: US Core PCE Inflation Data

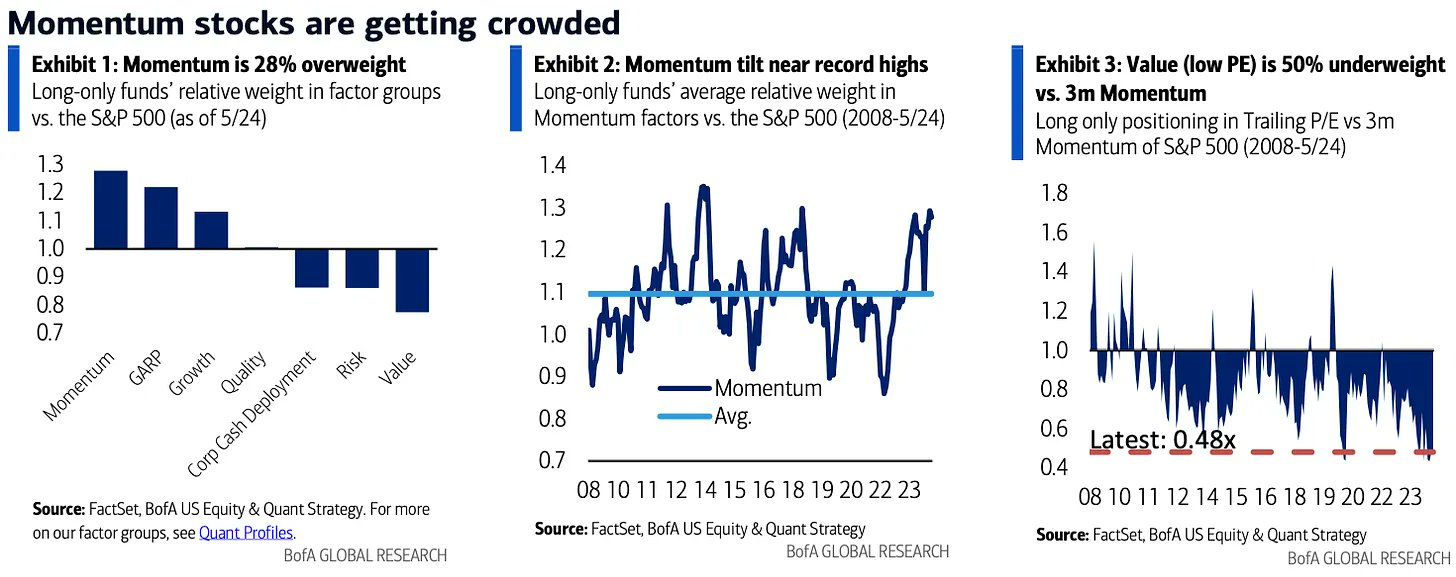

Smart Money Flow

Momentum is now the most crowded factor group, where funds have shifted from a record low 14% underweight in 2022 to nearly 30% overweight today. Meanwhile, Value remains the most underweight group.

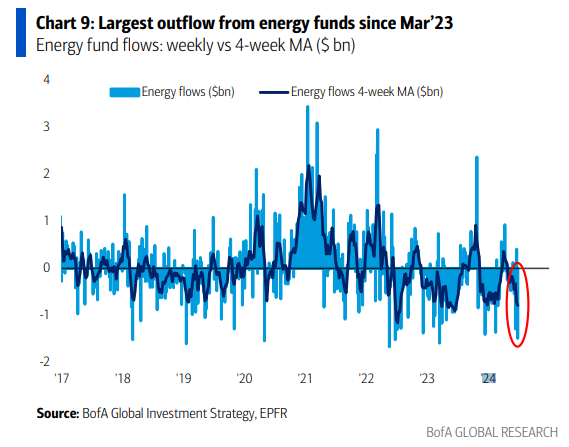

Largest weekly outflow from energy funds since Mar’23.

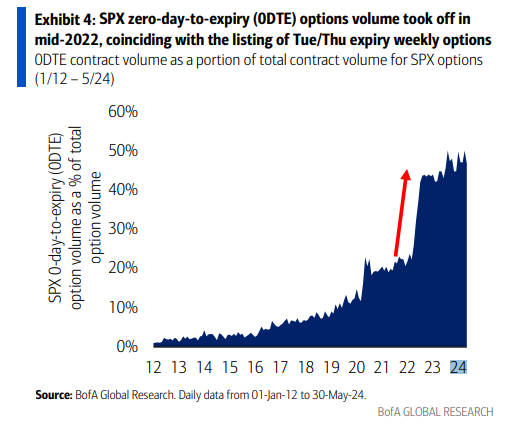

SPX 0DTE options have grown from ~10% of total SPX options volume pre-Covid, to~20% in 2021, to 45-50% so far in 2024.

Top Corporate News

Apple's iPhone Shipments in China Surge 40% in May Amid Aggressive Discounting

Apple's, opens new tab smartphone shipments in China rose nearly 40% in May from a year earlier, extending a rebound seen in April, data from a research firm affiliated with the Chinese government showed on Friday.

Shipments of foreign-branded phones in China increased by 1.425 million in May to 5.028 million units from 3.603 million a year earlier, calculations based on the data from the China Academy of Information and Communications Technology (CAICT) showed.

Nike Tumbles on Sales Warning as Rival Adidas Pushes Ahead

Nike Inc.'s shares plummeted, as the company projected a mid-single-digit revenue drop for the current fiscal year, defying analysts' forecasts of a 2% increase. This outlook, falling short of market expectations, has fueled concerns about diminishing demand and rising competition from brands like On, Hoka, and Adidas AG. In response, shares tumbled by 16% in premarket trading, erasing over $22 billion in market value. Should this downward trend persist, Nike is on track for its most significant decline since March 2020, exacerbating the 17% decrease experienced over the previous year.

Micron Shares Slide After Revenue Forecast Fails to Top Estimates

Despite Micron reporting stronger-than-anticipated fiscal third-quarter results with an adjusted earnings per share of 62 cents over the expected 51 cents, and revenue of $6.81 billion surpassing the $6.67 billion forecast, shares declined by roughly 7% in extended trading on Wednesday. The drop was attributed to investors' reactions to the company's revenue guidance for the current quarter, which, at $7.6 billion, aligned with analysts' predictions, without exceeding them. Micron, a key player in computer memory and storage riding the wave of the artificial intelligence surge, anticipates adjusted earnings per share of $1.08, closely matching analysts' expectations of $1.05. Over the past year, Micron's shares have more than doubled, bolstered by the demand for its advanced memory crucial for AI GPUs, such as those developed by Nvidia, enabling the company to capitalize on the burgeoning need for AI technologies like OpenAI's ChatGPT.

Carnival Stock Breaks Out As 2025 Bookings Already Top Full Year 2024

Carnival Corporation reported a turnaround with an adjusted profit of 11 cents per share, beating the expected 1 cent loss and recording $5.78 billion in revenue, surpassing estimates. The company's bookings for 2025 are already outpacing 2024, with higher prices and occupancy. Carnival raised its 2024 income forecast to $1.55 billion, above analyst expectations, and projects a 35% increase in Q3 adjusted net income to $1.58 billion, just above forecasts.

FedEx Stock Soars on Better-Than-Expected Earnings Driven By Cost Cutting

FedEx reported a robust fiscal fourth quarter with revenue rising to $22.1 billion, exceeding analysts' expectations and contributing to a share price surge in extended trading. The company's net income for the quarter was $1.47 billion, or $5.94 per diluted share, a slight decrease from the previous year but still above projections. Adjusted earnings saw a near 10% increase to $5.41 per share. Over the full year, FedEx's revenue dipped to $87.7 billion, yet net income climbed to $4.33 billion, surpassing both the previous fiscal year's results and analyst forecasts.

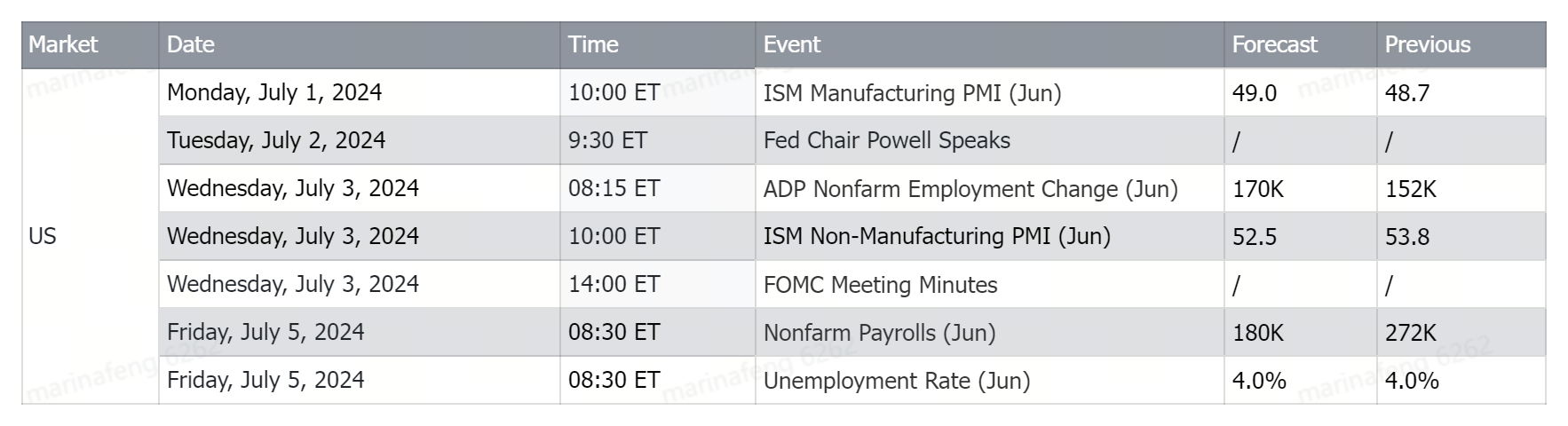

Upcoming Economic Data

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.