Macro Matters

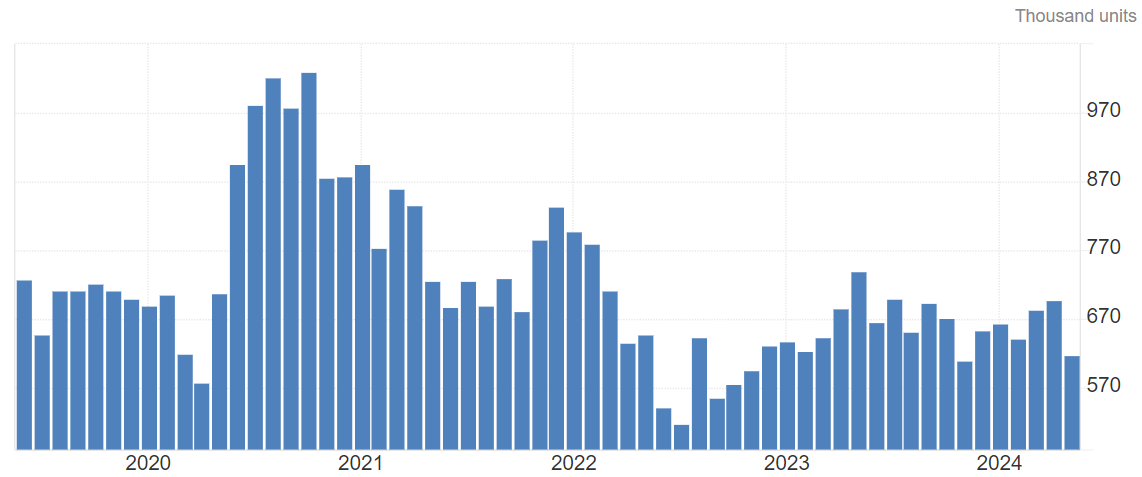

US New Home Sales Plunge, Inventory Reaches over 16-Year Peak

New home sales declined 11.3% to a seasonally adjusted annual rate of 619,000 units last month, the lowest level since November, the Commerce Department's Census Bureau said. The percentage-based drop was the biggest since September 2022.

Graph: US New Home Sales Number Trend

The median new house price fell 0.9% to $417,400 in May from a year ago. Nearly half of the new homes sold last month were priced under $399,000. The average rate on the popular 30-year fixed-rate mortgage reached a six-month high of 7.22% in early May before retreating to 7.03% by the end of the month, data from mortgage finance agency Freddie Mac showed.

The median new house price fell 0.9% to $417,400 in May from a year ago. Nearly half of the new homes sold last month were priced under $399,000. The average rate on the popular 30-year fixed-rate mortgage reached a six-month high of 7.22% in early May before retreating to 7.03% by the end of the month, data from mortgage finance agency Freddie Mac showed.

At May's sales pace it would take 9.3 months to clear the supply of houses on the market. That was the most months since November 2022 and up from 8.1 months in April.

India's Gdp Growth Is Expected to Slow Modestly This Fiscal Year and Next

Forecasts for a mild slowdown in India's fast-growing economy held steady in the first Reuters poll of economists since the ruling Bharatiya Janata Party (BJP) lost its parliamentary majority in phased national elections that ended in early June.

Asia's third-largest economy grew 8.2% in the last fiscal year, the fastest among major economies. But growth is set to slow to 7.0% and then 6.7% in the current and next fiscal years, according to a June 19-27 Reuters poll of over 50 economists.

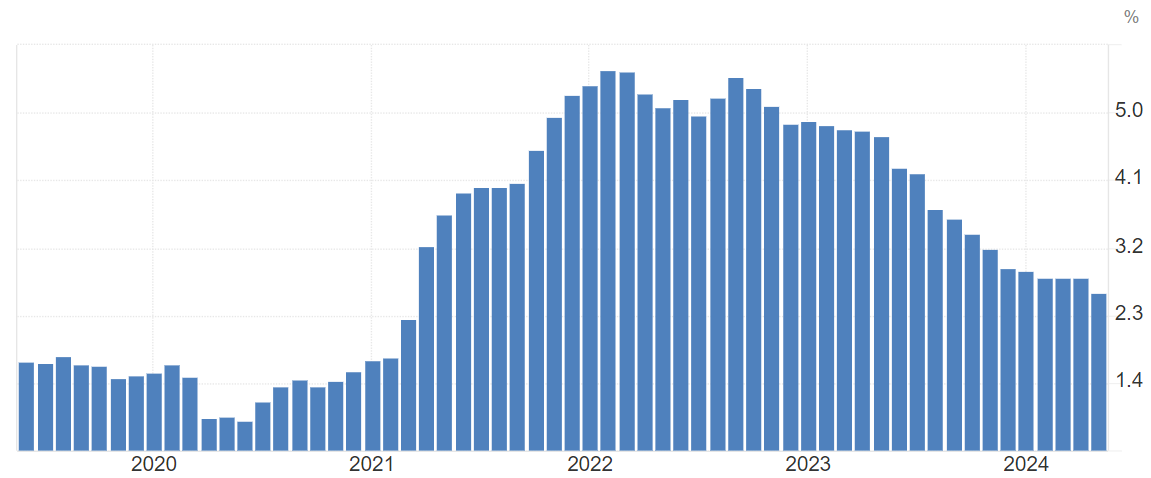

US May Core Pce Increased by 2.6% as Expected

The annual PCE inflation rate in the US decreased to 2.6% in May 2024 from 2.7% in each of the previous two months, in line with market forecasts. The core PCE inflation gauge for the US economy also fell to 2.6% in May 2024, the lowest since March 2021, down from 2.8% in April and matching market forecasts.

Graph: US Core PCE Inflation Data

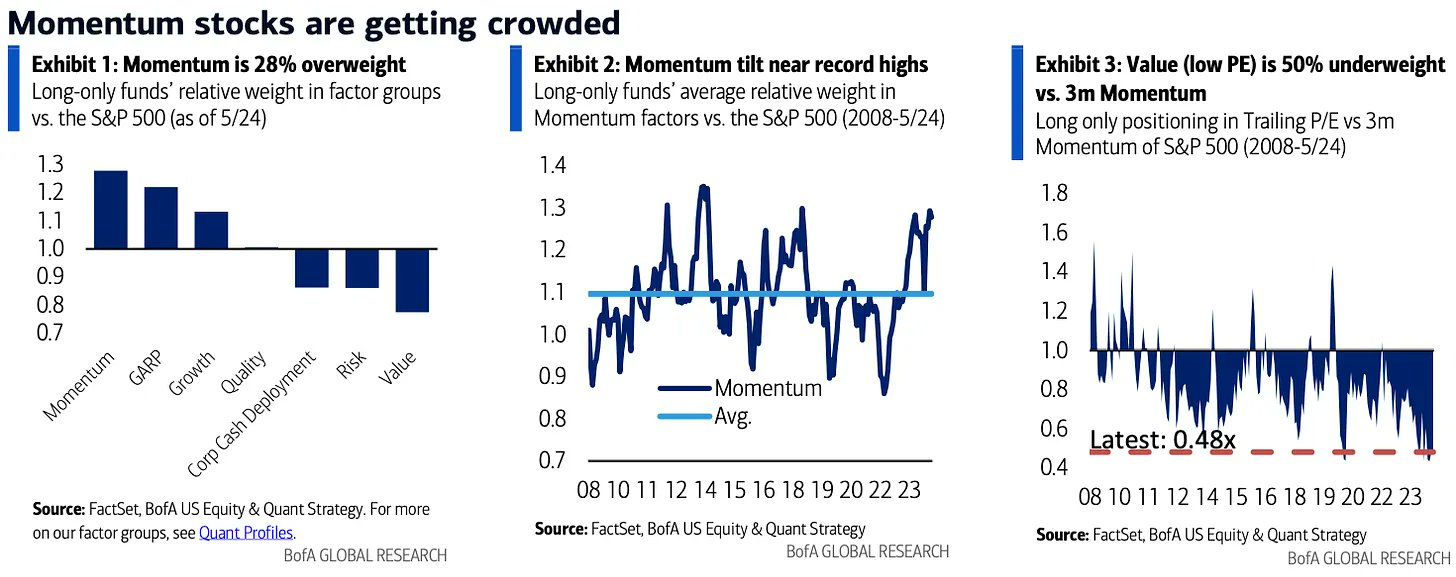

Smart Money Flow

Momentum is now the most crowded factor group, where funds have shifted from a record low 14% underweight in 2022 to nearly 30% overweight today. Meanwhile, Value remains the most underweight group.

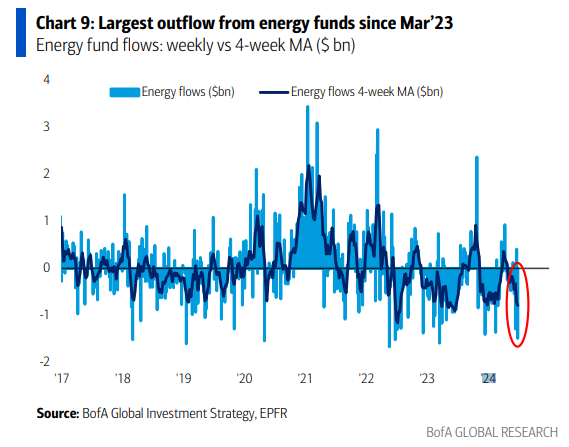

Largest weekly outflow from energy funds since Mar’23.

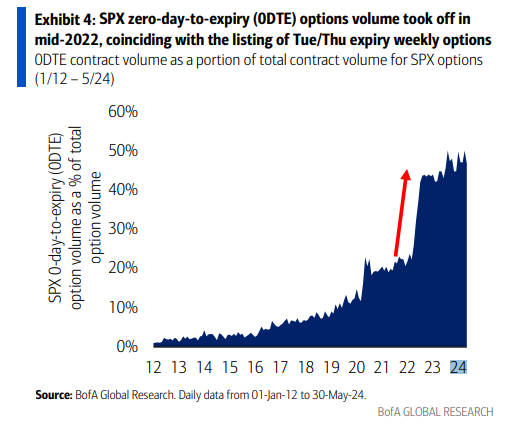

SPX 0DTE options have grown from ~10% of total SPX options volume pre-Covid, to~20% in 2021, to 45-50% so far in 2024.

Top Corporate News

Apple's iPhone Shipments in China Surge 40% in May Amid Aggressive Discounting

Apple's, opens new tab smartphone shipments in China rose nearly 40% in May from a year earlier, extending a rebound seen in April, data from a research firm affiliated with the Chinese government showed on Friday.

Shipments of foreign-branded phones in China increased by 1.425 million in May to 5.028 million units from 3.603 million a year earlier, calculations based on the data from the China Academy of Information and Communications Technology (CAICT) showed.

Nike Tumbles on Sales Warning as Rival Adidas Pushes Ahead

Nike Inc.'s shares plummeted, as the company projected a mid-single-digit revenue drop for the current fiscal year, defying analysts' forecasts of a 2% increase. This outlook, falling short of market expectations, has fueled concerns about diminishing demand and rising competition from brands like On, Hoka, and Adidas AG. In response, shares tumbled by 16% in premarket trading, erasing over $22 billion in market value. Should this downward trend persist, Nike is on track for its most significant decline since March 2020, exacerbating the 17% decrease experienced over the previous year.

Micron Shares Slide After Revenue Forecast Fails to Top Estimates

Despite Micron reporting stronger-than-anticipated fiscal third-quarter results with an adjusted earnings per share of 62 cents over the expected 51 cents, and revenue of $6.81 billion surpassing the $6.67 billion forecast, shares declined by roughly 7% in extended trading on Wednesday. The drop was attributed to investors' reactions to the company's revenue guidance for the current quarter, which, at $7.6 billion, aligned with analysts' predictions, without exceeding them. Micron, a key player in computer memory and storage riding the wave of the artificial intelligence surge, anticipates adjusted earnings per share of $1.08, closely matching analysts' expectations of $1.05. Over the past year, Micron's shares have more than doubled, bolstered by the demand for its advanced memory crucial for AI GPUs, such as those developed by Nvidia, enabling the company to capitalize on the burgeoning need for AI technologies like OpenAI's ChatGPT.

Carnival Stock Breaks Out As 2025 Bookings Already Top Full Year 2024

Carnival Corporation reported a turnaround with an adjusted profit of 11 cents per share, beating the expected 1 cent loss and recording $5.78 billion in revenue, surpassing estimates. The company's bookings for 2025 are already outpacing 2024, with higher prices and occupancy. Carnival raised its 2024 income forecast to $1.55 billion, above analyst expectations, and projects a 35% increase in Q3 adjusted net income to $1.58 billion, just above forecasts.

FedEx Stock Soars on Better-Than-Expected Earnings Driven By Cost Cutting

FedEx reported a robust fiscal fourth quarter with revenue rising to $22.1 billion, exceeding analysts' expectations and contributing to a share price surge in extended trading. The company's net income for the quarter was $1.47 billion, or $5.94 per diluted share, a slight decrease from the previous year but still above projections. Adjusted earnings saw a near 10% increase to $5.41 per share. Over the full year, FedEx's revenue dipped to $87.7 billion, yet net income climbed to $4.33 billion, surpassing both the previous fiscal year's results and analyst forecasts.

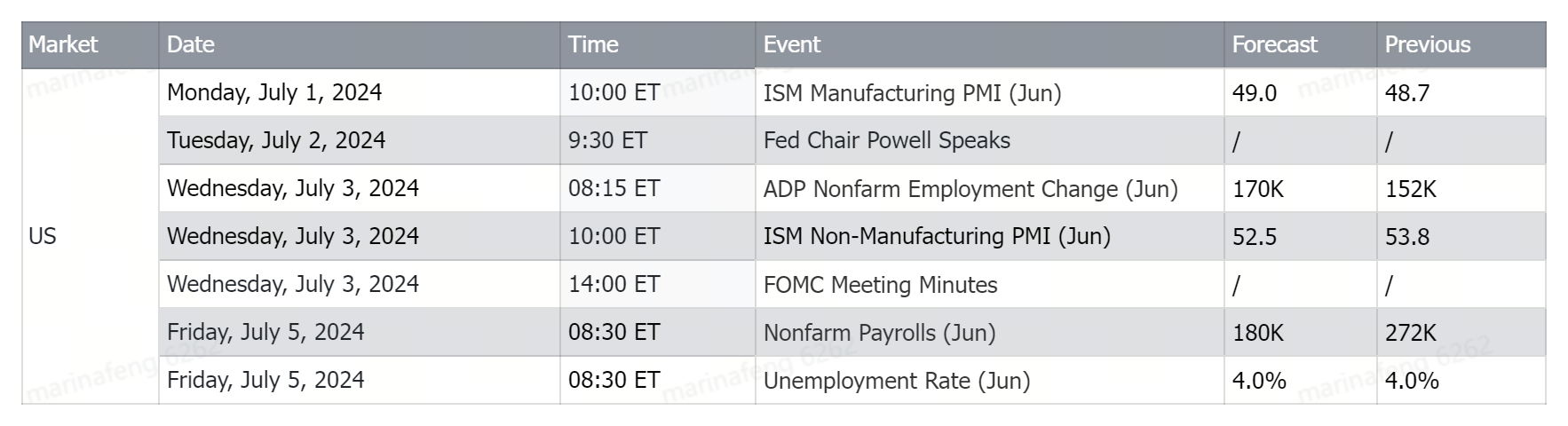

Upcoming Economic Data

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

マクロに関する問題

売り上げ急減、在庫は16年ぶりのピークに到達

新築住宅の販売は、先月に季節調整済み年率619,000ユニットに11.3%減少し、11月以来の最低水準に落ち込んだと、商務省国勢調査局は述べた。減少率は、2022年9月以来の最大のものでした。

グラフ:米国の新築住宅の販売台数の傾向

新築住宅の中央価格は、1年前の5月に比べて0.9%減少し、417,400ドルになりました。先月売れた新築住宅の半数近くは39,900ドル未満の価格帯であった。人気のある30年固定金利抵当ローンの平均利率は、5月上旬に6か月ぶりの7.22%に達してから、月末には7.03%に下落した。モーゲージ金融機関フレディマックのデータによると。

新築住宅の中央価格は、1年前の5月に比べて0.9%減少し、417,400ドルになりました。先月売れた新築住宅の半数近くは39,900ドル未満の価格帯であった。人気のある30年固定金利抵当ローンの平均利率は、5月上旬に6か月ぶりの7.22%に達してから、月末には7.03%に下落した。モーゲージ金融機関フレディマックのデータによると。

5月の販売ペースでは、市場の住宅在庫を9.3ヶ月でクリアするのに必要な期間になりました。これは、2022年11月以来の最大数であり、4月の8.1ヶ月から増加したものです。

インドのGDP成長は、今の財政年度と次の財政年度にわたってわずかに減速する見通しです

成長が急速なインド経済の緩やかな減速の予測が、6月初めに終わった段階的な国民投票で統治党バラティヤ・ジャンタ党(BJP)が議会の過半数を失った後、初めての経済学者によるロイターの調査で変わっていない。

第3のアジア最大の経済国であるインドは、昨年度に8.2%の成長率を記録し、主要な経済国の中で最も高い成長率であった。しかし、50人以上のエコノミストの6月19-27日のロイターの調査によると、今後の今後の財政年度には7.0%、次の年度には6.7%の減速が予想されている。

米国5月のコアPCEは予想通り2.6%増加しました

米国の年間PCEインフレ率は、市場予想通り、2024年5月に前月と同じく2.7%から2.6%に低下しました。米国経済のコアPCEインフレゲージも、市場予想通りに、2024年5月に2.8%から2.6%に低下し、2021年3月以来の最低値になりました。

グラフ:米国のコアPCEインフレデータ

スマートマネーフロー

モメンタムが最も込み入った要因グループで、過去最低の14%アンダーウェイトから、現在ではほぼ30%オーバーウェイトに変わりました。一方、バリューは最もアンダーウェイトのグループのままです。

3月以来の最大のエネルギー投資信託からの週間流出。

SPX 0DTEオプションは、Covid前のSPXオプション総量の約10%から2021年には20%、2024年には45〜50%にまで増加しました。

トップ企業ニュース

アップル、中国でのiPhone出荷台数が40%増加

中国政府系研究機関のデータによると、アップルのスマートフォンの中国での出荷台数は、去年同月比で約40%増加し、4月の回復が続いています。

中国での外国ブランドの携帯電話の出荷台数は、CAICTのデータに基づく計算によると、去年同期の3,603万台から125万台増加して5,028万台になりました。

ライバルのアディダスが前進する中、ナイキが売上高の警告で暴落

ナイキの株式は急落し、会社が現在の財政年度に中位一桁の売上高低下を予測したため、2%の増加を予測したアナリストの予測に反した。市場予想に届かなかったこの見通しは、On、Hoka、Adidas AGのようなブランドからの需要の減少と競争の増加につながりました。これにより、プレマーケット取引で株価が16%下落し、市場価値が220億ドル以上削減されました。この下降トレンドが続く場合、ナイキは2020年3月以来最大の減少を記録し、前年の17%の減少を悪化させることになります。

収益予想を上回れなかったマイクロン株が下落

マイクロンは調整後1株当たり62セントと予想を上回るアナリスト予想を51セントに切り上げた業績を発表し、売上高68.1億ドルは予想の66.7億ドルを上回ったにも関わらず、水曜日の拡張取引で株式は約7%減少しました。減少の理由は、現在の四半期の売上高ガイダンスが76億ドルであり、アナリストの予想に合致しているが超過していないことに投資家が反応したためです。人工知能の急増に乗ったコンピュータメモリとストレージの主要プレーヤーであるマイクロンは、1.08ドルの調整後1株当たり純利益を予測しており、アナリストの予想に近い1.05ドルにほぼ一致しています。過去1年間、マイクロンの株価は2倍以上に上昇し、Nvidiaが開発したAI GPUなどのために必要な高度なメモリに対する需要を背景に成長しています。この伸びに加えて、OpenAIのChatGPTなどのAI技術の需要を資本化することができます。

カーニバル・ストックが大幅に上昇し、2025年予約が2014年のフルブックをすでに超えています。

カーニバル社は調整後1株当たり純利益11セントで回復を報告し、予想の1セントの損失を上回り、57.8億ドルの売上高を記録し、予想を上回りました。2025年の予約は、価格と稼働率が高く、2024年を上回っています。カーニバル社は、2024年の収益予測を1.55億ドルに引き上げ、アナリストの予想を上回り、第3四半期の調整後当期純利益は1.58億ドル、わずかに予想を上回ります。

コスト削減による収益上昇により、FedExストックが急騰しました。

FedExは、売上高がアナリストの予想を超え、拡大取引で株価が急騰し、堅調な第4四半期決算を発表しました。同社の当期純利益は14.7億ドル、希薄化後1株当たり5.94ドルで前年からわずかに減少しましたが、予想を上回りました。調整後の利益は株当たり5.41ドルで、ほぼ10%増加しました。1年間の売上高はFedExの収益は87.7億ドルに減少しましたが、当期純利益は前年の結果とアナリストの予測を上回り、43.3億ドルに達しました。

次回の経済指標

免責事項:このプレゼンテーションは情報提供及び教育目的のみであり、特定の投資又は投資戦略の推奨又は支持を意図したものではありません。このコンテンツに提供されている投資情報は一般的な性質であり、純粋に説明目的であり、全ての投資家に適切であるとは限りません。投資家の金融的知識、金融状況、投資目的、投資期間、リスク許容度に関係なく提供されます。投資決定を行う前に、自身の状況に相応しいかどうかを吟味する必要があります。過去の投資成績は将来の成功又は収益を保証するものではなく、利回りは異なり、全ての投資には元本の損失等のリスクがあります。

MoomooはMoomoo Technologies Inc.が提供する金融情報および取引アプリです。米国では、Moomooの投資商品やサービスはMoomoo Financial Inc.が提供します。メンバーFINRA/SIPC。

新築住宅の中央価格は、1年前の5月に比べて0.9%減少し、417,400ドルになりました。先月売れた新築住宅の半数近くは39,900ドル未満の価格帯であった。人気のある30年固定金利抵当ローンの平均利率は、5月上旬に6か月ぶりの7.22%に達してから、月末には7.03%に下落した。モーゲージ金融機関フレディマックのデータによると。

新築住宅の中央価格は、1年前の5月に比べて0.9%減少し、417,400ドルになりました。先月売れた新築住宅の半数近くは39,900ドル未満の価格帯であった。人気のある30年固定金利抵当ローンの平均利率は、5月上旬に6か月ぶりの7.22%に達してから、月末には7.03%に下落した。モーゲージ金融機関フレディマックのデータによると。

The median new house price fell 0.9% to $417,400 in May from a year ago. Nearly half of the new homes sold last month were priced under $399,000. The average rate on the popular 30-year fixed-rate mortgage reached a six-month high of 7.22% in early May before retreating to 7.03% by the end of the month, data from mortgage finance agency Freddie Mac showed.

The median new house price fell 0.9% to $417,400 in May from a year ago. Nearly half of the new homes sold last month were priced under $399,000. The average rate on the popular 30-year fixed-rate mortgage reached a six-month high of 7.22% in early May before retreating to 7.03% by the end of the month, data from mortgage finance agency Freddie Mac showed.