Nike experienced its largest intraday drop since 2001, with the company's fourth-quarter revenue falling short of expectations. Most semiconductor stocks rose, with Taiwan Semiconductor up about 1% and Nvidia slightly up. Most Chinese concept stocks fell, with Xpeng down more than 2% and JD.com, Li Auto Inc, and NIO Inc down more than 1%. The French CAC 40 index fell nearly 1%, and France's 10-year treasury note yield rose to its highest level since November last year. On the news front, the first round of voting for the National Assembly elections in France will take place on Sunday.

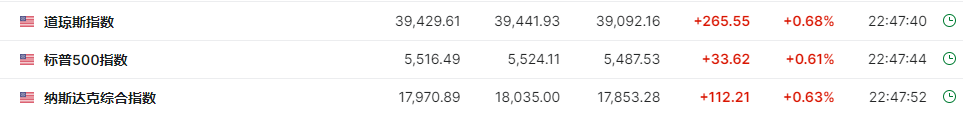

On Friday, June 28th, the three major US stock indexes opened higher, but gave up most of the gains in the first hour and a half.

The Nasdaq, mainly composed of technology stocks, once rose 176 points or nearly 1%; The Dow, which opened low, turned around and rose, rising more than 0.7%; The S&P 500 index strengthened, rising about 0.74%.

In addition, the Nasdaq 100 Index once rose about 1.1%, refreshing its intraday record high, and breaking through the 20,000-point mark for the first time.

The stock prices of popular tech companies fluctuated. Microsoft turned around and rose, rising steadily to 0.56% after a high opening before falling slightly; Apple's stock price was like a roller coaster, falling sharply at the beginning and then turning positive by more than 0.5%; Google A maintained a downward trend, and fell the deepest at the beginning of the session by 1.4%, then gradually narrowed the decline; Amazon rose steadily from a drop of nearly 1% to a rise of 0.5%, and is now erasing all gains and falling; Meta plunged more than 1.15% at the opening, then went directly to a rise of nearly 0.45%; Tesla maintained its upward trend and rose more than 2.8% at one point; Netflix turned from a decline of 0.78% to a rise of 0.39%, and is now falling.

Chip stocks rose across the board. The Philadelphia Semiconductor Index and the industry ETF SOXX both rose, rising nearly 3%; Nvidia once rose as much as 3%, and then gave up some of the gains; Nvidia's two to one long ETF once rose about 0.6%; TSMC's US stocks rose about 3%, Micron Technology rose about 2.4%, and Qualcomm rose about 4.5%.

On the news front, Morgan Stanley said on Friday that both the Fed and the ECB may cut interest rates in September, even if central banks are reluctant to take on the burden in advance. The EU's antitrust commissioner said on Friday that it will conduct further antitrust reviews of Microsoft's $13 billion investment in OpenAI and investigate the exclusive use of Microsoft's cloud technology by OpenAI.

AI concept stocks fluctuated, with most popular China concept stocks declining. Xpeng fell more than 4.5%, Nio fell more than 3.3%, and individual concept stocks rose slightly. Cryptocurrency concept stocks fell collectively.

In stocks with large fluctuations, Nike fell more than 19% because its fourth-quarter revenue fell short of expectations and its performance guidance was lowered.

The following is the update content before 21:50 Beijing time

On Friday, June 28th, as US inflation cooled, the three major US stock indexes rose collectively, with the Dow rising 0.39%, the Nasdaq rising 0.18%, and the S&P 500 index rising 0.29%.

Most semiconductor stocks rose, with TSMC up about 1% and Nvidia slightly up.

Nike fell by about 18%, marking its biggest intraday drop since 2001 due to its fourth-quarter revenue falling short of expectations.

Most major industry ETFs rose, with regional bank ETFs and semiconductor ETFs leading the way.

Most China concept stocks declined, with Xpeng falling more than 2%, and JD.com, Li Auto, and Nio falling more than 1%.

On the news front, data released by the US Commerce Department shows that the monthly growth rate of the May PCE price index fell from 0.3% in April to 0%, the lowest level since November 2023, in line with market expectations. The year-on-year growth rate also fell from 2.7% in the previous month to 2.6%, matching expectations.

More importantly, excluding volatile food and energy prices, the year-on-year growth rate of the core PCE price index in May hit its lowest level since March 2021, falling from 2.8% in April to 2.6%, also in line with expectations. At the same time, the month-on-month growth rate of the core PCE price index in May was 0.1%, the lowest level since December 2023.

European stocks were mixed, with French stocks and bonds falling.

The Euro Stoxx 50 Index fell 0.3%, the German DAX30 Index rose 0.05%, the UK's FTSE100 Index rose 0.24%, and France's CAC 40 Index fell 0.82%.

French bonds fell, with the yield on 10-year bonds rising 6 basis points at one point to 3.33%, breaking recent highs and hitting its highest level since November 2023. The yield gap between French and German 10-year bonds rose 4 basis points at one point to 86 basis points, its highest level since 2012. As the first round of parliamentary elections in France approached on Sunday, market turmoil reflected increasing uncertainty.