Eaton Corp's Options: A Look at What the Big Money Is Thinking

Eaton Corp's Options: A Look at What the Big Money Is Thinking

Financial giants have made a conspicuous bullish move on Eaton Corp. Our analysis of options history for Eaton Corp (NYSE:ETN) revealed 15 unusual trades.

金融巨头在伊顿公司上采取了明显的看好态度。我们对伊顿公司(纽交所:ETN)期权历史进行分析,发现出现了15次飞凡交易。

Delving into the details, we found 53% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $1,375,862, and 3 were calls, valued at $296,725.

深入研究后,我们发现53%的交易者看涨,而33%的交易者看淡。在我们发现的所有交易中,有12个是看跌期权,价值为1,375,862美元,有3个是看涨期权,价值为296,725美元。

Expected Price Movements

预期价格波动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $195.0 and $380.0 for Eaton Corp, spanning the last three months.

在评估交易量和未平仓量后,明显的是主要市场参与者正在关注伊顿公司的股价区间,该区间为195.0美元至380.0美元,在过去三个月中。

Insights into Volume & Open Interest

成交量和持仓量分析

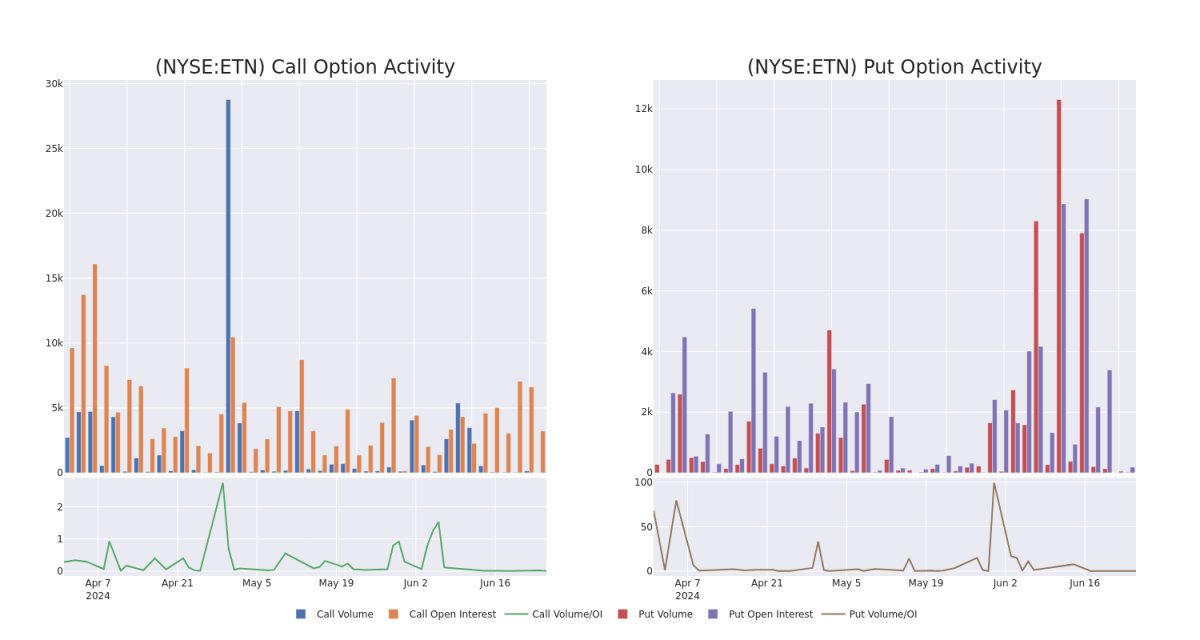

In today's trading context, the average open interest for options of Eaton Corp stands at 1256.33, with a total volume reaching 3,341.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Eaton Corp, situated within the strike price corridor from $195.0 to $380.0, throughout the last 30 days.

在当今的交易环境中,伊顿公司期权的平均未平仓量为1256.33,总成交量为3,341.00。配图描述了过去30天中,针对伊顿公司中的高价值交易的看跌和看涨期权成交量和未平仓量的变化,位于195.0美元至380.0美元的行权价走廊内。

Eaton Corp 30-Day Option Volume & Interest Snapshot

Eaton Corp 30天期权成交量和未平仓合约快照

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETN | PUT | SWEEP | BULLISH | 07/19/24 | $7.7 | $6.9 | $6.98 | $320.00 | $538.2K | 2.3K | 626 |

| ETN | PUT | TRADE | BULLISH | 07/19/24 | $6.5 | $6.2 | $6.2 | $310.00 | $310.0K | 3.8K | 40 |

| ETN | CALL | TRADE | BULLISH | 01/17/25 | $9.0 | $8.6 | $9.0 | $380.00 | $165.6K | 96 | 0 |

| ETN | PUT | SWEEP | BULLISH | 06/20/25 | $23.5 | $21.0 | $21.0 | $290.00 | $151.2K | 3 | 0 |

| ETN | CALL | TRADE | BULLISH | 01/17/25 | $125.0 | $122.5 | $125.0 | $195.00 | $100.0K | 446 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 伊顿 | 看跌 | SWEEP | 看好 | 07/19/24 | $7.7 | $6.9 | $6.98 | $320.00 | $538.2K | 2.3K | 626 |

| 伊顿 | 看跌 | 交易 | 看好 | 07/19/24 | $6.5 | $6.2 | $6.2 | $ 310.00 | $310.0K | 3.8K | 40 |

| 伊顿 | 看涨 | 交易 | 看好 | 01/17/25 | 9.0美元 | $8.6美元 | 9.0美元 | $380.00 | $165.6K | 96 | 0 |

| 伊顿 | 看跌 | SWEEP | 看好 | 06/20/25 | $23.5 | $21.0 | $21.0 | $290.00 | $151.2K | 3 | 0 |

| 伊顿 | 看涨 | 交易 | 看好 | 01/17/25 | $125.0 | $122.5 | $125.0 | $195.00 | $100.0K | 446 | 0 |

About Eaton Corp

关于伊顿公司

Eaton is a diversified power management company operating for over 100 years. The company operates through various segments, including electrical Americas, electrical global, aerospace, vehicle, and eMobility. Eaton's portfolio can broadly be divided into two halves. One part of its portfolio is housed under its industrial sector umbrella, which serves a large variety of end markets like commercial vehicles, general aviation, and trucks. The other portion is Eaton's electrical sector portfolio, which serves data centers, utilities, and the residential end market, among others. While the company receives favorable tax treatment with its Ireland domicile, most of its operations are in the US.

伊顿是一家经营超过100年的多元化电力管理公司。该公司通过各种板块运营,包括美洲电力、全球电力、航空航天、车辆和eMobility。伊顿的投资组合可以大致分为两个部分。一个部分包含在其兴业证券伞下,为商用车辆、通用航空和卡车等各种最终市场服务。另一部分是伊顿的电力部门投资组合,为数据中心、公用事业和住宅最终市场等提供服务。尽管该公司以爱尔兰为其注册地享有有利的税收待遇,但其大部分业务在美国境内运营。

After a thorough review of the options trading surrounding Eaton Corp, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

经过对伊顿公司周边期权交易的全面审查之后,我们开始更详细地研究该公司。这包括对其当前市场状态和业绩的评估。

Present Market Standing of Eaton Corp

伊顿公司的现市场地位

- With a trading volume of 843,968, the price of ETN is down by -0.32%, reaching $312.95.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 32 days from now.

- 伊顿公司的成交量为843,968,价格下跌了-0.32%,达到312.95美元。

- 当前RSI值表明该股票可能即将超卖。

- 距离下一次盈利报告还有32天。

Professional Analyst Ratings for Eaton Corp

伊顿公司的专业分析师评级

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $375.0.

在过去30天内,共有1位专业分析师对该股票发表了看法,设定了平均目标价为375.0美元。

- Reflecting concerns, an analyst from Raymond James lowers its rating to Outperform with a new price target of $375.

- 出于担忧,Raymond James的一位分析师将其评级下调为跑赢大盘,并设立了一个新的目标价为375美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Eaton Corp options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。精明的交易者通过不断学习、调整策略、监控多个因子和密切关注市场变动来管理这些风险。通过Benzinga Pro的实时提示保持对最新的伊顿公司期权交易的了解。