Financial giants have made a conspicuous bullish move on CrowdStrike Holdings. Our analysis of options history for CrowdStrike Holdings (NASDAQ:CRWD) revealed 45 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $680,562, and 32 were calls, valued at $3,084,494.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $250.0 and $500.0 for CrowdStrike Holdings, spanning the last three months.

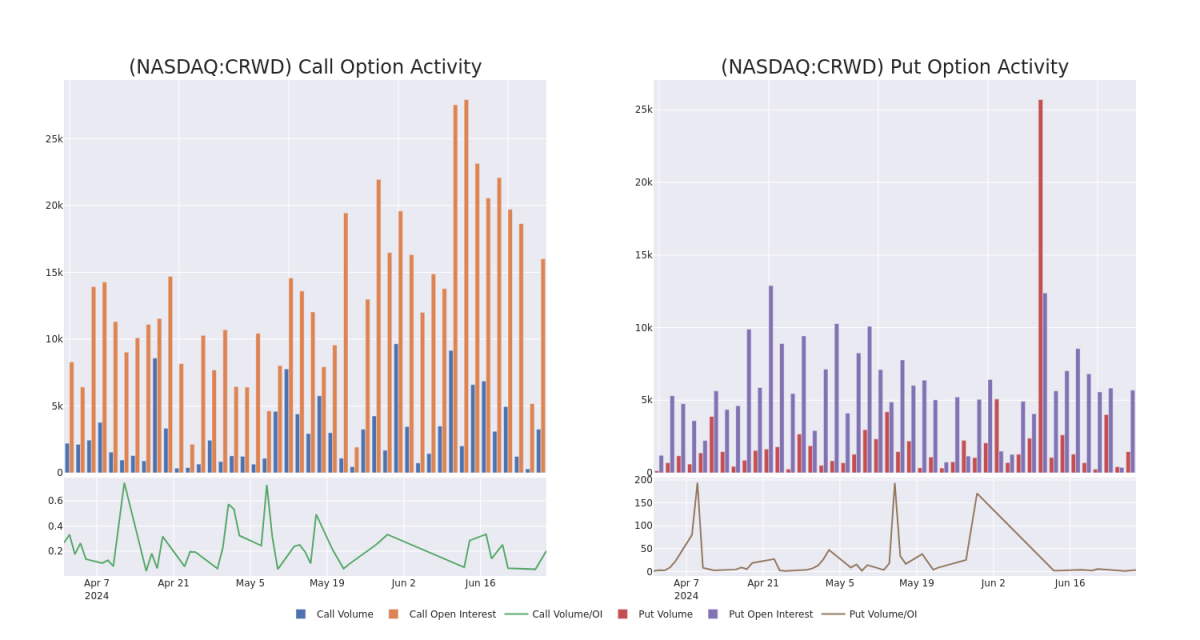

Volume & Open Interest Development

In today's trading context, the average open interest for options of CrowdStrike Holdings stands at 603.0, with a total volume reaching 4,605.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in CrowdStrike Holdings, situated within the strike price corridor from $250.0 to $500.0, throughout the last 30 days.

CrowdStrike Holdings 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | CALL | TRADE | BEARISH | 06/28/24 | $56.8 | $53.8 | $54.5 | $335.00 | $534.1K | 411 | 300 |

| CRWD | CALL | TRADE | NEUTRAL | 07/19/24 | $106.75 | $103.1 | $105.14 | $280.00 | $525.7K | 1.2K | 0 |

| CRWD | CALL | TRADE | BULLISH | 09/20/24 | $120.0 | $116.9 | $119.0 | $270.00 | $249.9K | 158 | 0 |

| CRWD | PUT | SWEEP | BEARISH | 06/20/25 | $60.3 | $58.6 | $60.3 | $390.00 | $168.8K | 1.0K | 0 |

| CRWD | CALL | TRADE | NEUTRAL | 08/16/24 | $28.45 | $26.85 | $27.68 | $380.00 | $166.0K | 604 | 0 |

About CrowdStrike Holdings

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike's primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

Following our analysis of the options activities associated with CrowdStrike Holdings, we pivot to a closer look at the company's own performance.

CrowdStrike Holdings's Current Market Status

- With a volume of 2,309,043, the price of CRWD is up 0.47% at $389.1.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 61 days.

What The Experts Say On CrowdStrike Holdings

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $399.0.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $400.

- An analyst from Mizuho persists with their Buy rating on CrowdStrike Holdings, maintaining a target price of $370.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $400.

- Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on CrowdStrike Holdings with a target price of $405.

- An analyst from Rosenblatt has decided to maintain their Buy rating on CrowdStrike Holdings, which currently sits at a price target of $420.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest CrowdStrike Holdings options trades with real-time alerts from Benzinga Pro.