Jilin Liyuan Precision Manufacturing Co., Ltd. (SZSE:002501) shares have had a horrible month, losing 26% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 28% in that time.

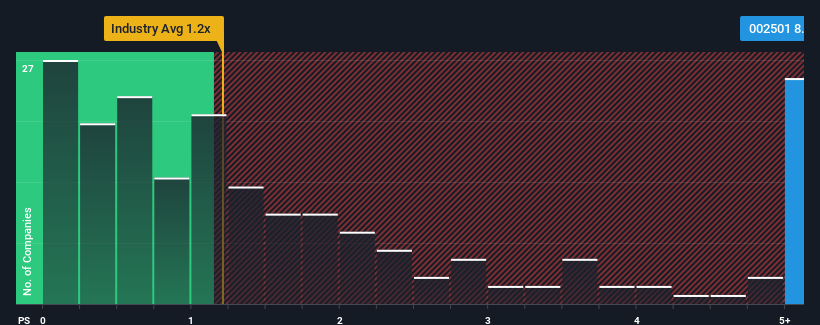

Even after such a large drop in price, when almost half of the companies in China's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.2x, you may still consider Jilin Liyuan Precision Manufacturing as a stock not worth researching with its 8.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has Jilin Liyuan Precision Manufacturing Performed Recently?

For instance, Jilin Liyuan Precision Manufacturing's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jilin Liyuan Precision Manufacturing will help you shine a light on its historical performance.How Is Jilin Liyuan Precision Manufacturing's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jilin Liyuan Precision Manufacturing's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jilin Liyuan Precision Manufacturing's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. Even so, admirably revenue has lifted 220% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 14% shows it's noticeably more attractive.

In light of this, it's understandable that Jilin Liyuan Precision Manufacturing's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

A significant share price dive has done very little to deflate Jilin Liyuan Precision Manufacturing's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Jilin Liyuan Precision Manufacturing revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It is also worth noting that we have found 2 warning signs for Jilin Liyuan Precision Manufacturing (1 shouldn't be ignored!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com