REIT Watch - Healthcare S-Reits Stay Defensive With Robust Fundamentals

REIT Watch - Healthcare S-Reits Stay Defensive With Robust Fundamentals

The healthcare sector is often viewed as defensive with growth opportunities, supported by long-term demographic and socio-economic trends. JLL's latest Healthcare Real Estate Outlook report also identified that healthcare-related assets remain one of the most resilient commercial real estate sectors.

在长期人口和社会经济趋势的支持下,医疗保健行业通常被视为具有增长机会的防御性行业。仲量联行最新消息 医疗保健房地产展望 报告还指出,医疗保健相关资产仍然是最具弹性的商业房地产行业之一。

Healthcare real estate investment trusts (Reits) provide access to healthcare-related properties at a more affordable quantum (think a board lot size of 100 units) and without the hassle of being a landlord (Reits have managers to manage assets, tenants and set the growth strategy).

医疗保健房地产投资信托基金(Reit)以更实惠的数量(比如100个单位的董事会地块)提供对医疗保健相关物业的准入,而无需成为房东的麻烦(房地产投资信托基金有经理来管理资产、租户和制定增长战略)。

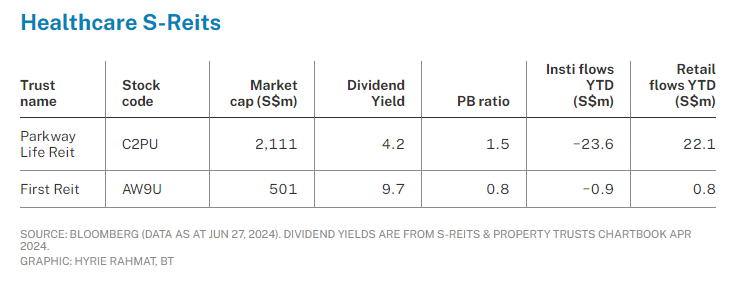

Notably, Parkway Life Reit (PLife) and First Reit are two listed healthcare Singapore Reits (S-Reits) that invest in income-producing, healthcare-related commercial properties in both Singapore and overseas markets such as Japan, Indonesia and Malaysia.

值得注意的是,百汇人寿房地产投资信托基金(liFe)和第一房地产投资信托基金是两家上市的新加坡医疗保健房地产投资信托基金(S-Reit),它们投资于新加坡和日本、印度尼西亚和马来西亚等海外市场的创收性医疗保健相关商业地产。

Parkway Life Reit

百汇人寿房地产投资信托基金

PLife is among the largest listed healthcare Reits in Asia, with 63 properties in Singapore, Japan and Malaysia and a combined portfolio size of S$2.23 billion. Its distribution per unit (DPU) grew 4 per cent year on year (yoy) to 3.79 Singapore cents in the first quarter of this year, and will form part of H1 2024's distribution when the Reit announces its half-year results.

Life是亚洲最大的上市医疗房地产投资信托基金之一,在新加坡、日本和马来西亚拥有63处房产,投资组合总规模为22.3亿新元。今年第一季度,其单位分配(DPU)同比增长4%,达到3.79新加坡分,并将成为房地产投资信托基金公布半年业绩时2024年上半年分配的一部分。

PLife's DPU has recorded a steady growth rate of 133.7 per cent since its listing in 2007. This could be partly attributed to the defensive nature of its portfolio as all its Singapore and Japan properties are fully occupied.

自2007年上市以来,Life的每股收益率一直稳步增长133.7%。这可能部分归因于其投资组合的防御性质,因为其在新加坡和日本的所有房产均已全部占用。

In Q1 2024, the Reit recorded 2.7 per cent and 2.8 per cent lower gross revenue and net property income, respectively, on a yoy basis. This was mainly due to the Japanese yen's depreciation, but it was offset by contributions from nursing homes acquired in October 2023.

2024年第一季度,房地产投资信托基金的总收入和净房地产收入同比分别下降2.7%和2.8%。这主要是由于日元贬值,但被2023年10月收购的疗养院的捐款所抵消。

In Singapore, PLife's portfolio includes three private hospitals worth S$1.51 billion – Gleneagles Hospital, Parkway East Hospital, and Mount Elizabeth Hospital. The Reit's master lease with Parkway Hospitals Singapore was recently renewed in 2021, with income certainty up to 2042 and an option to renew for another 10 years.

在新加坡,Life的投资组合包括三家价值15.1亿新元的私立医院——格伦伊格尔斯医院、百汇东方医院和伊丽莎白山医院。房地产投资信托基金与新加坡百汇医院的主租约最近于2021年续订,收入确定性最高可达2042年,并且可以选择再续订10年。

PLife also has a right of first refusal over its sponsor IHH Healthcare's Mount Elizabeth Novena Hospital for a period of 10 years. Given its renewal lease structure, rents are guaranteed to increase until FY2025, and a formula based on either adjusted hospital revenue or consumer price index (whichever is higher) will be applicable to rents from FY2026 onwards. Some analysts are sanguine that the Reit stands to benefit from an annual rental upside of more than 3 per cent.

Life还对赞助商IHH Healthcare的伊丽莎白山诺维娜医院拥有优先拒绝权,为期10年。鉴于其续订租赁结构,在 FY2025 之前,租金肯定会增加,并且基于调整后的医院收入或消费者物价指数(以较高者为准)的公式将适用于 FY2026 以后的租金。一些分析师乐观地认为,房地产投资信托基金将受益于超过3%的年租金上涨。

In Japan, PLife's 59 nursing home properties are well-diversified across 17 prefectures and 30 nursing home operators. This part of PLife's portfolio also has a long-term lease structure with a weighted average lease term to expiry of 11.67 years, and 95.8 per cent of its Japan revenue with downside protection.

在日本,Life的59处疗养院物业在17个县和30家疗养院运营商中实现了多元化。LiLife投资组合的这一部分还具有长期租赁结构,加权平均租赁期限为11.67年,其日本收入的95.8%带有下行保护。

As part of its growth strategy, PLife plans to build a third key market, strengthen existing markets, and foster strategic partnerships.

作为其增长战略的一部分,liLife计划建立第三个关键市场,加强现有市场并促进战略伙伴关系。

First Reit

第一房地产投资信托基金

First Reit has a vision to become Asia's premier healthcare trust, having grown its portfolio from just four assets in Indonesia to 32 properties across Indonesia, Japan and Singapore worth S$1.14 billion. The Reit aims to increase its portfolio in developed markets from 25.5 per cent to more than 50 per cent of its assets under management by FY2027.

First Reit的愿景是成为亚洲首屈一指的医疗信托基金,其投资组合已从印度尼西亚的四项资产增长到横跨印度尼西亚、日本和新加坡的32处房产,价值11.4亿新元。房地产投资信托基金的目标是通过 FY2027 将其在发达市场的投资组合从其管理的资产的25.5%增加到50%以上。

In its Q1 2024 business update, First Reit reported that rental and other income declined 2.7 per cent yoy, due to the impact of a stronger Singapore dollar on the Indonesian rupiah and Japanese yen. Apart from a stronger Singapore currency, rising interest rates also led to a higher cost of debt, which led to DPU dipping from 0.62 Singapore cents in Q1 2023 to 0.6 cents in Q1 2024.

First Reit在其2024年第一季度业务更新中报告称,由于新加坡元走强对印度尼西亚卢比和日元的影响,租金和其他收入同比下降2.7%。除了新加坡货币走强外,利率上升还导致债务成本上涨,这导致DPU从2023年第一季度的0.62新加坡美分下降至2024年第一季度的0.62美分。

As at Mar 31, First Reit's proportion of debt on fixed rates or hedged is over 87 per cent, and the Reit has no refinancing requirements until May 2026.

截至3月31日,第一房地产投资信托基金的固定利率或对冲债务比例超过87%,房地产投资信托基金在2026年5月之前没有再融资要求。

REIT Watch is a regular column on The Business Times, read the original version.

房地产投资信托基金观察是《商业时报》的定期专栏文章, 读 原始版本。

Enjoying this read?

喜欢这本书吗?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即订阅 新加坡交易所我的网关 时事通讯,汇编了最新的市场新闻、行业表现、新产品发布更新以及新加坡证券交易所上市公司的研究报告。

- 随时了解我们的最新动态 新加坡证券交易所投资 电报频道。