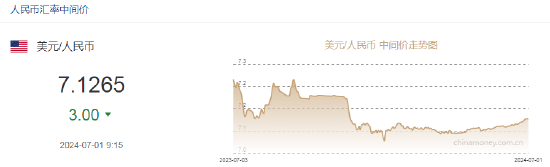

On July 1st, the central parity rate of RMB was reported at 7.1265, up 3 points from the previous trading day's central parity rate of 7.1268.

There are many highlights this week, as Federal Reserve Chairman Powell appears at the European Central Bank forum, and the UK and France elections may stir up the market.

There are many highlights this week, as the performance of the US non-farm report for June will be crucial for the future policy choices of the Fed. Important elections in France and the UK may cause price fluctuations in assets due to the escalation of situations in Israel and Lebanon. The June Consumer Price Index (CPI) of the Eurozone, FOMC minutes, and European Central Bank forum are also worth investors' attention.

In the coming week, several Fed officials will deliver regular speeches, and Fed Chairman Powell will attend the central bank forum held by the European Central Bank in Sintra, Portugal, and have a group discussion with Lagarde. In addition, the FOMC minutes will be released, and the discussion details within the committee behind the changes in the dot plot will be closely watched.

In terms of data, the June non-farm report will be the biggest focus, and the continued tightness of the labor market may be the main reason the Fed remains on hold. Institutions expect an increase of 180,000 new jobs for the month, lower than the 272,000 in the previous month, and the unemployment rate is expected to remain stable at 4.0%, while average hourly earnings are expected to fall from 0.4% in May to 0.3%.

Former top three officials of the Fed: The Fed will eventually cut interest rates, but it will be later than the market expects.

Bank of America Merrill Lynch released a research report summarizing the speech of former President and CEO of the Federal Reserve Bank of New York, Dudley, at the 2024 Boao Forum for Asia. At the meeting, Dudley analyzed key economic indicators such as US economic growth expectations, unemployment rates, and service industry inflation, and discussed the prospects for Fed interest rate cuts.

Overall, Dudley believes that the US economic growth will gradually slow down, the Fed will cut interest rates, but the timing and speed of the interest rate cut will be later than the market expected. It is expected that the 10-year US Treasury bond yield will be at 4.5%. The interest rates will remain high for a longer period of time, and the neutral interest rate level may rise.