Analysts Just Published A Bright New Outlook For Precision Tsugami (China) Corporation Limited's (HKG:1651)

Analysts Just Published A Bright New Outlook For Precision Tsugami (China) Corporation Limited's (HKG:1651)

Celebrations may be in order for Precision Tsugami (China) Corporation Limited (HKG:1651) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. Investor sentiment seems to be improving too, with the share price up 7.5% to HK$10.60 over the past 7 days. Whether the upgrade is enough to drive the stock price higher is yet to be seen, however.

Precision Tsugami (China)股份有限公司(HKG:1651)股東應該感到慶幸,分析師對該公司的財務預測進行了重大升級。分析師大幅提高了其營業收入的預測,顯示其業務基本面出現了顯著改善。投資者情緒似乎也在改善,過去7天內股價上漲了7.5%,至10.60港元。然而,這次升級是否足以推動股價上漲還有待觀察。

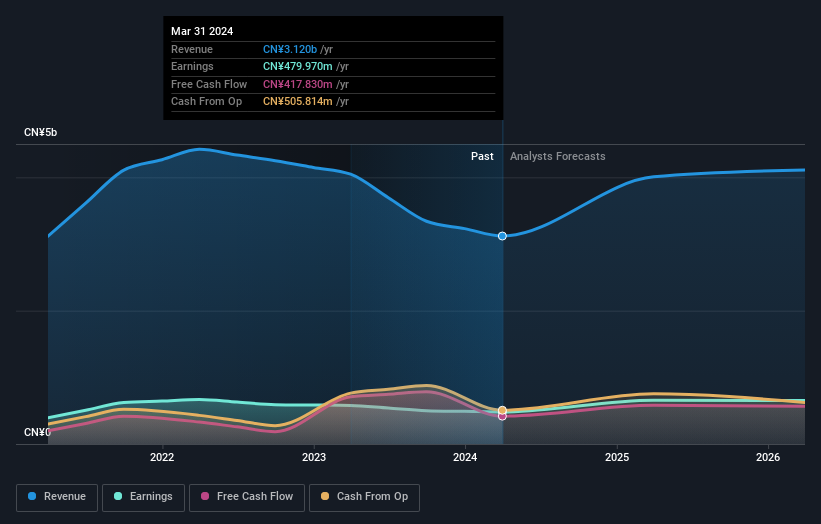

Following the upgrade, the latest consensus from Precision Tsugami (China)'s twin analysts is for revenues of CN¥4.0b in 2025, which would reflect a huge 28% improvement in sales compared to the last 12 months. Per-share earnings are expected to leap 37% to CN¥1.73. Previously, the analysts had been modelling revenues of CN¥3.6b and earnings per share (EPS) of CN¥1.38 in 2025. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

在這次升級之後,Precision Tsugami (China)的雙重分析師最新對2025年的營業收入預期爲400億人民幣,相較過去12個月銷售額大幅提高了28%。每股收益預計能夠飆升37%至1.73人民幣。此前,分析師們對2025年的營業收入和每股收益(EPS)進行了36億人民幣和1.38人民幣的預測。近期人們對此的感知肯定有所改觀,分析師大幅度提高了其關於收益和營業收入的預測。

With these upgrades, we're not surprised to see that the analysts have lifted their price target 7.5% to CN¥10.21 per share. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Precision Tsugami (China) analyst has a price target of CN¥12.01 per share, while the most pessimistic values it at CN¥8.40. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Precision Tsugami (China) shareholders.

有了這些升級,我們並不驚訝分析師將其價格目標調高了7.5%,至10.21人民幣/股。然而,只關注單一的價格目標可能是不明智的,因爲共識目標實際上是分析師價格目標的平均值。因此,一些投資者喜歡查看估計的範圍,以查看對公司估值是否有不同的看法。Precision Tsugami (China)的最樂觀分析師有每股12.01元人民幣的價值,而最悲觀的則將其價值定在8.40元人民幣。分析師對業務的看法確實存在差異,但在我們看來,估計的範圍不足以表明極端情況可能會發生在Precision Tsugami (China)股東身上。

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting Precision Tsugami (China)'s growth to accelerate, with the forecast 28% annualised growth to the end of 2025 ranking favourably alongside historical growth of 11% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 13% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Precision Tsugami (China) is expected to grow much faster than its industry.

現在看看更大的圖景,我們了解這些預測的其中一種方式是比較它們與過去的業績和行業增長預測。分析師確實預計Precision Tsugami (China)的增長將加速,預測2025年年化增長率爲28%,與過去5年的每年11%的歷史增長相比,排名靠前。與預計每年增長13%的同行業其他公司相比,這樣的預計加速營收增長,足以說明Precision Tsugami (China)預計的增長將遠高於其所處行業。

The Bottom Line

最重要的事情是分析師增加了它對下一年每股虧損的估計。令人欣慰的是,營收預測未發生重大變化,業務仍有望比整個行業增長更快。共識價格目標穩定在28.50美元,最新估計不足以對價格目標產生影響。

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Precision Tsugami (China) could be worth investigating further.

這次升級最重要的一點是,分析師對今年的每股收益預測進行了升級,預計業務狀況將會好轉。值得慶幸的是,分析師們還提高了他們的營收預測,我們的數據顯示,銷售業績有望表現優於市場整體水平。鑑於共識看起來幾乎普遍看漲,因此預計股份有限公司(HKG:1651)值得進一步調查。

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2026, which can be seen for free on our platform here.

話雖如此,公司收益的長期軌跡比明年重要得多。至少有一位分析師提供了2026年的預測,這可以免費在我們的平台上看到。

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

當然,看到公司高管將大量資金投入股票與分析師是否升級他們的估計同樣有用。因此,您可能還希望搜索此高內部持股的股票免費名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?關於內容有所顧慮?直接和我們聯繫。或者,發送電子郵件至editorial-team (at) simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有反饋?關於內容有所顧慮?直接和我們聯繫。或者發送電子郵件至editorial-team@simplywallst.com。

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting Precision Tsugami (China)'s growth to accelerate, with the forecast 28% annualised growth to the end of 2025 ranking favourably alongside historical growth of 11% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 13% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Precision Tsugami (China) is expected to grow much faster than its industry.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting Precision Tsugami (China)'s growth to accelerate, with the forecast 28% annualised growth to the end of 2025 ranking favourably alongside historical growth of 11% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 13% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Precision Tsugami (China) is expected to grow much faster than its industry.