Morgan Stanley believes that as the possibility of Trump winning the US presidential election increases, the steepening yield curve becomes an attractive bet, as the economy may slow down and inflation may accelerate in this scenario.

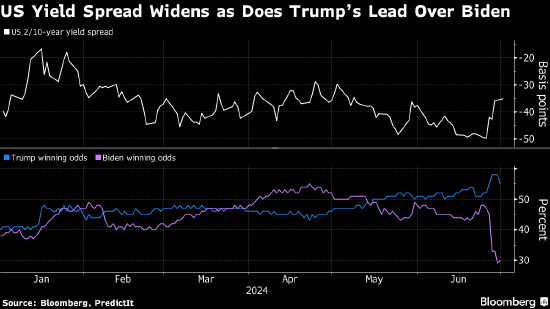

The bank's strategists wrote in a report on June 29 that the first debate of the US presidential election increased the possibility of Trump's re-election, which would attract more attention to his immigration and tariff policy. Bond traders are also preparing for this, with the spread between the 2-year and 10-year Treasury yields widening to the highest level since January last week.

Matthew Hornbach, Guneet Dhingra, and other Morgan Stanley strategists wrote in the report that since the first debate, there has been a significant relative change in the probability of Trump winning the election. The sharp change in the probability of Trump's victory may be a unique catalyst that makes steepening curve trades attractive.

Adjustments to bets may make the market outlook more complicated. US Treasury bonds have just experienced two consecutive months of gains. Traders are pricing in the risks of a slowdown in economic growth and an acceleration in inflation as Trump vows to expel undocumented immigrants.

Adjustments to bets may make the market outlook more complicated. US Treasury bonds have just experienced two consecutive months of gains. Traders are pricing in the risks of a slowdown in economic growth and an acceleration in inflation as Trump vows to expel undocumented immigrants.

These strategists wrote that against the backdrop of a cooling economy, the possibility of policy changes has increased, which is more likely to lead to an increase in investors' expectations of a rate cut in the United States. "As the deficit issue is increasingly scrutinized, the possibility of a Republican victory increases, which may bring upward pressure on long-term premiums."

The strategists suggest betting on the widening spread between the 2-year and 10-year Treasury yields.

The results of the first debate prompted analysts to give a series of recommendations on how to prepare for a Trump victory. Barclays recommended that investors buy inflation hedging products in the US bond market.

Naokazu Koshimizu of Nomura Securities expects that if Trump comes to power, he will favor fiscal expansion and a weak US dollar. Coupled with a preference for dovish Fed chair, this will cause the US bond yield curve to steepen.

押注的调整可能会使市场前景变得更加复杂,美债此前刚刚实现了连续两个月的上涨行情。由于特朗普誓言驱逐无证移民,交易员正在对经济增长放缓和通胀加快的风险进行定价。

押注的调整可能会使市场前景变得更加复杂,美债此前刚刚实现了连续两个月的上涨行情。由于特朗普誓言驱逐无证移民,交易员正在对经济增长放缓和通胀加快的风险进行定价。