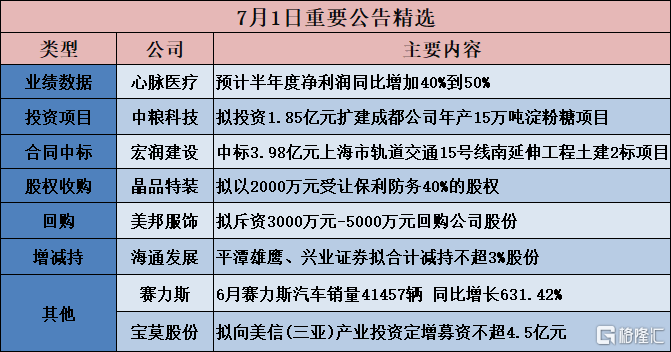

Investment project:

Cofco Biotechnology (000930.SZ): plans to invest 185 million yuan to expand Chengdu's annual production of 150,000 tons of starch and sugar projects.

Cofco Biotechnology (000930.SZ) announced that in order to improve the layout of the starch and sugar business, increase market share, and improve market competitiveness, the company plans to invest in expanding the 150,000 ton/year starch and sugar project of Cofco Biochemistry (Chengdu) Co., Ltd. The total investment is about 185.2613 million yuan (the final total investment of the project depends on the actual investment). The construction period is from the date of project approval to the successful trial run of material feeding, which takes 18 months.

Contracts awarded:

Contracts awarded:

Hongrun Construction Group (002062.SZ) won the bid for 398 million yuan for the civil engineering 2nd bid project of the south extension of Shanghai Metro Line 15.

Hongrun Construction (002062.SZ) announced that the company recently received the bid-winning notice for the civil engineering 2 section of Shanghai Rail Transit Line 15 South Extension Project from the Shanghai Construction Engineering Construction Tendering Co., Ltd. The bid-winning price of the project is 3979.32 million yuan.

China Zhonghua Geotechnical Engineering Group (002542.SZ): Beijing field road won the bid for the flight area runway expansion and ancillary works of the fourth phase expansion project of Xishuangbanna Airport, with a contract value of approximately 275 million yuan.

China Zhonghua Geotechnical Engineering Group (002542.SZ) announced that the bid results of the runway expansion and ancillary projects of the fourth phase expansion of Xishuangbanna Airport project, which Beijing Changdao Municipal Engineering Group Co., Ltd. (referred to as 'Beijing Changdao') participated in the bidding, were announced on July 1, 2024 in the civil aviation professional engineering construction project bidding and tendering management system (announcement), and Beijing Changdao was announced as the winning bidder. The bid amount was about 275 million yuan.

[Equity Acquisition]

Goldcard Smart Group (300349.SZ): plans to acquire the remaining 49% equity of Bailing Technology for 17.7515 million yuan.

Goldcard Smart Group (300349.SZ) announced that based on the overall strategic layout of Goldcard Smart Group Co., Ltd. and the company's confidence in the future development of Hangzhou Bailing Information Technology Co., Ltd. (hereinafter referred to as 'Bailing Technology'), the company plans to use about 17,751.5 million yuan of its own funds to acquire 29% of the equity held by Bailing Technology's minority shareholders Hangzhou Heming Enterprise Management Consulting Partnership Enterprise (Limited Partnership) (hereinafter referred to as 'Hangzhou Heming') and 20% held by Hangzhou Jinju Management Consulting Partnership Enterprise (Limited Partnership) (hereinafter referred to as 'Hangzhou Jinju'). After the transaction is completed, the company holds 100% of the equity of Bailing Technology, and Bailing Technology becomes a wholly-owned subsidiary of the company, which will not cause any changes to the company's consolidated financial statements. The company has signed the Equity Transfer Agreement with the transferor regarding Hangzhou Bailing Information Technology Co., Ltd.

Jingpin Special Decoration (688084.SH): plans to acquire 40% equity of Poly Defense for 20 million yuan

Jingpin Special Decoration (688084.SH) announced that on July 1, 2024, the company signed a share transfer agreement with Anhui Huojin and Poly Defense. The company plans to use its own funds of RMB 20 million to acquire 40% equity held by Anhui Huojin in Poly Defense Co., Ltd. with a registered capital of RMB 20 million (paid-up), which accounted for 40% of the Poly Defense's registered capital. After this investment, Poly Defense will not be included in the scope of the company's consolidation.

[Performance data]

Topband Co., Ltd. (002139.SZ): expected to increase net profit in the first half of the year by 40%-60%.

Topband Co., Ltd. (002139.SZ) announced its performance forecast for the first half of 2024. The net profit attributable to shareholders of the listed company is expected to be RMB 361.257 million to RMB 412.8651 million, an increase of 40%-60% year-on-year. The net profit after deducting non-recurring gains and losses is expected to be RMB 355.7454 million to RMB 406.5662 million, an increase of 40%-60% year-on-year. The basic earnings per share are expected to be 0.29 yuan/share to 0.33 yuan/share.

Shanghai MicroPort Endovascular Medtech (Group) Co., Ltd. (688016.SH): expected to increase net profit in the first half of the year by 40%-50%.

Shanghai MicroPort Endovascular Medtech (Group) Co., Ltd. (688016.SH) announced that after preliminary calculation by the company's financial department, it is expected to achieve operating income of RMB 777.0281 million to RMB 808.1092 million in the first half of 2024, an increase of RMB 155.4056 million to RMB 186.4867 million compared with the same period last year (legally disclosed data), a year-on-year increase of 25%-30%. It is expected that the net profit attributable to the owners of the parent company in the first half of 2024 will be between RMB 3913.368 million and RMB 4192.894 million, which is an increase of RMB 1118.105 million to RMB 1397.631 million compared with the same period last year (legally disclosed data), a year-on-year increase of 40%-50%.

Shanghai Yanpu Metal Products (605128.SH): Net income in the first half of 2024 is expected to increase by about 92.29% year-on-year.

Shanghai Yanpu Metal Products (605128.SH) announced its performance forecast for the first half of 2024. The net profit attributable to shareholders of the listed company is expected to be about RMB 61.0022 million, an increase of about RMB 29.2776 million compared with the same period last year, an increase of about 92.29% year-on-year. The net profit after deducting non-recurring gains and losses that belongs to shareholders of listed companies is expected to be about RMB 56.4091 million, an increase of about RMB 27.4391 million compared with the same period last year, an increase of about 94.72% year-on-year.

[Repurchase]

Shanghai Metersbonwe Fashion & Accessories (002269.SZ): plans to spend RMB 30 million-RMB 50 million to buy back company's shares.

Metersbonwe Fashion & Accessories (002269.SZ) announced that the company plans to repurchase company shares through centralized competitive trading, which will be used for employee stock ownership plans or stock-based incentives. The total amount of the repurchase funds is no less than RMB 30 million and no more than RMB 50 million. The repurchase price of the shares will not exceed RMB 1.75 per share. The repurchase period is within 6 months from the date of approval of the repurchase plan by the shareholders' meeting.

【Increase and Decrease】

Dian Diagnostics Group (300244.SZ): Vice President and Secretary Tao Jun plans to increase his holding of the company's shares by no less than RMB 1 million.

Dian Diagnostics Group (300244.SZ) announced that Ms. Tao Jun, Vice President and Secretary of the Board of Directors, plans to increase her holding of the company's shares through centralized competitive trading on the Shenzhen Stock Exchange system within three months from July 2, 2024, with a proposed increase of no less than RMB 1 million.

Haitong Development (603162.SH): Pingtan Xiongying and Industrial Securities plan to jointly reduce their holdings by no more than 3% of the shares.

Haitong Development (603162.SH) announced that Pingtan Xiongying plans to reduce its holdings of the company's shares by no more than 6,821,970 shares through centralized competitive trading, accounting for no more than 0.75% of the company's total share capital. The company also plans to reduce its holdings of the company's shares by no more than 18,191,930 shares through bulk trading, accounting for no more than 2% of the company's total share capital. The reduction price will be determined by the market price. The plan will be implemented within three months after 15 trading days from the date of this announcement. The reduction period is from July 24, 2024 to October 23, 2024.

Industrial Securities plans to reduce its holdings of the company's shares by no more than 2,250,855 shares through centralized competitive trading, accounting for no more than 0.25% of the company's total share capital. The reduction price will be determined by the market price. The plan will be implemented within three months after 15 trading days from the date of this announcement. The reduction period is from July 24, 2024 to October 23, 2024.

【Other】

Chongqing Sokon Industry Group stock (601127.SH): In June, Sokon autos sold 41,457 units, a year-on-year increase of 631.42%.

Chongqing Sokon Industry Group Stock (601127.SH) announced its June production and sales report. In June, the sales volume of new energy autos was 44,126, among which the sales volume of Sokon autos was 41,457, a year-on-year increase of 631.42%. The cumulative sales volume of new energy autos this year was 200,949, a year-on-year increase of 348.55%.

BYD Company Limited (002594.SZ): The sales volume of new energy autos in June reached 341,700.

BYD Company Limited (002594.SZ) released its production and sales report for June 2024. The sales volume of new energy autos this month reached 341,658, a year-on-year increase of 35.02%. The cumulative sales volume of new energy autos this year reached 1,612,983, a year-on-year increase of 28.46%. In addition, the company sold a total of 26,995 new energy passenger vehicles overseas in June 2024; the total installation of new energy auto power batteries and energy storage batteries in June 2024 was approximately 16.101 GWh, and the cumulative installation total for 2024 was approximately 72.555 GWh.

Shandong Polymer Biochemicals (002476.SZ): Intends to raise no more than RMB 450 million through a private placement to Sanya Meixin Industry Investment.

Shandong Polymer Biochemicals (002476.SZ) announced its plan to issue shares to specific objects in 2024. The company plans to issue no more than 153,583,617 shares to specific objects, which does not exceed 30% of the company's total share capital before this issuance. The issue price of the shares is RMB 2.93 per share. The subscriber for this issuance of shares is Meixin (Sanya) Industrial Investment Co., Ltd., which will subscribe for the shares with cash. The total amount of funds raised by the company in this issuance of shares is no more than RMB 450 million (including the number of shares issued), and it will be used to supplement the company's working capital according to the regulatory approval of the China Securities Regulatory Commission.