Goldman Sachs Gr Unusual Options Activity

Goldman Sachs Gr Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Goldman Sachs Gr.

有大量资金的鲸鱼已经采取了明显的看好高盛集团的立场。

Looking at options history for Goldman Sachs Gr (NYSE:GS) we detected 16 trades.

在查看高盛(NYSE:GS)期权历史时,我们检测到16笔交易。

If we consider the specifics of each trade, it is accurate to state that 56% of the investors opened trades with bullish expectations and 37% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,56%的投资者持看好预期开立交易,37%持看淡预期。

From the overall spotted trades, 5 are puts, for a total amount of $331,520 and 11, calls, for a total amount of $560,010.

从总体交易中,有5个看跌期权,总金额为331,520美元;11个看涨期权,总金额为560,010美元。

Expected Price Movements

预期价格波动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $310.0 to $480.0 for Goldman Sachs Gr over the recent three months.

根据交易活动情况,近三个月内重要的投资者似乎瞄准高盛(GS)股票价格区间在310.0美元到480.0美元之间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

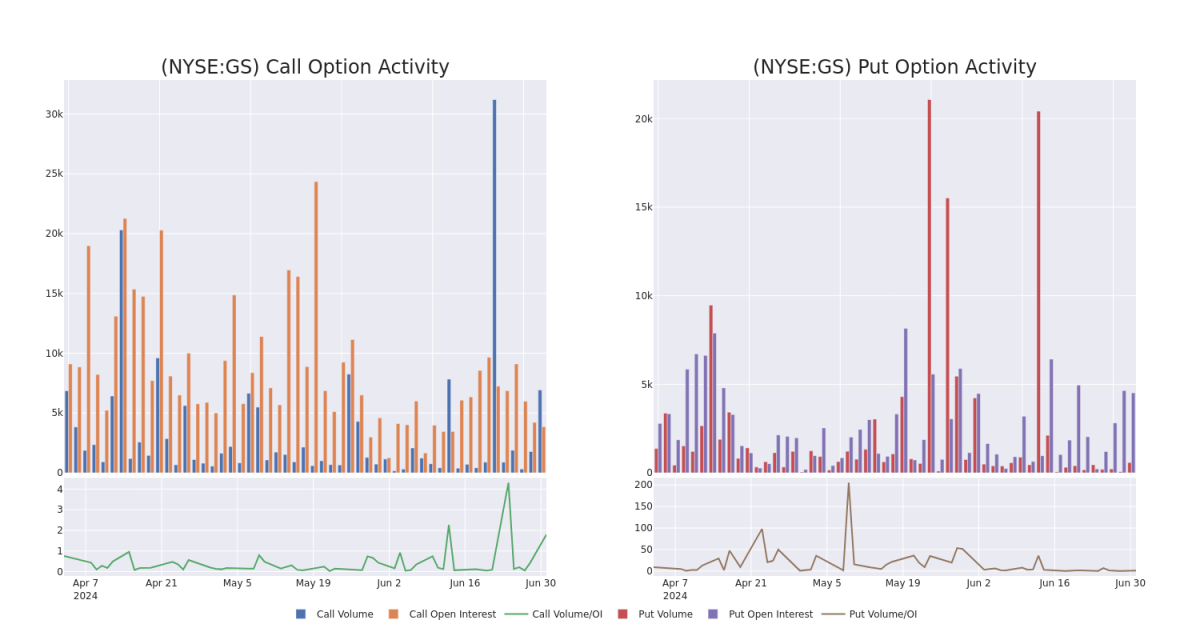

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Goldman Sachs Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Goldman Sachs Gr's substantial trades, within a strike price spectrum from $310.0 to $480.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易的战略步骤。这些指标揭示了特定行权价下,高盛(GS)期权的流动性和投资者的兴趣。下面的数据可视化地呈现了过去30天内,高盛(GS)重大交易的看涨和看跌期权的成交量和未平仓合约的波动情况,行权价位于310.0美元到480.0美元之间。

Goldman Sachs Gr Call and Put Volume: 30-Day Overview

高盛公司看涨和看跌期权成交量:30天总览

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GS | PUT | SWEEP | BULLISH | 07/19/24 | $4.5 | $4.1 | $4.13 | $440.00 | $187.9K | 2.6K | 321 |

| GS | CALL | TRADE | BULLISH | 07/19/24 | $10.1 | $9.85 | $10.1 | $465.00 | $101.0K | 1.8K | 116 |

| GS | CALL | TRADE | BULLISH | 07/19/24 | $9.5 | $9.2 | $9.5 | $465.00 | $95.0K | 1.8K | 12 |

| GS | CALL | TRADE | BEARISH | 08/16/24 | $9.7 | $9.4 | $9.43 | $475.00 | $94.3K | 364 | 0 |

| GS | PUT | TRADE | BEARISH | 01/17/25 | $10.1 | $9.65 | $10.1 | $400.00 | $50.5K | 1.1K | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 高盛公司所有板块成交量 | 看跌 | SWEEP | 看好 | 07/19/24 | $4.5 | $4.1 | $4.13 | $440.00 | $187.9K | 2.6K | 321 |

| 高盛公司所有板块成交量 | 看涨 | 交易 | 看好 | 07/19/24 | $10.1 | $9.85 | $10.1 | $465.00 | $101.0K | 1.8K | 116 |

| 高盛公司所有板块成交量 | 看涨 | 交易 | 看好 | 07/19/24 | $9.5 | $9.2 | $9.5 | $465.00 | 95.0千美元 | 1.8K | 12 |

| 高盛公司所有板块成交量 | 看涨 | 交易 | 看淡 | 08/16/24 | 9.7 | 9.4美元 | $9.43 | $475.00 | $94.3K | 364 | 0 |

| 高盛公司所有板块成交量 | 看跌 | 交易 | 看淡 | 01/17/25 | $10.1 | $9.65 | $10.1 | $400.00 | $50.5K | 1.1千 | 0 |

About Goldman Sachs Gr

高盛集团简介

Goldman Sachs is a leading global investment banking and asset management firm. Approximately 20% of its revenue comes from investment banking, 45% from trading, 20% from asset management and 15% from wealth management and retail financial services. Around 60% of the company's net revenue is generated in the Americas, 15% in Asia, and 25% in Europe, the Middle East, and Africa.

高盛集团是全球领先的投资银行和资产管理公司。大约20%的营业收入来自投资银行业务,45%来自交易,20%来自资产管理,15%来自财富管理和零售金融服务。约60%的净收入来自美洲,15%来自亚洲,25%来自欧洲、中东和非洲。

In light of the recent options history for Goldman Sachs Gr, it's now appropriate to focus on the company itself. We aim to explore its current performance.

针对高盛集团近期期权历史,现在适合关注公司本身。我们旨在探究其当前业绩。

Goldman Sachs Gr's Current Market Status

高盛的当前市场状态

- With a volume of 299,643, the price of GS is up 1.49% at $459.06.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 14 days.

- 高盛(GS)的股价为459.06美元,成交量为299,643股,上涨了1.49%。

- RSI指标暗示该股票可能要超买了。

- 下一轮财报预计将在14天内发布。

What The Experts Say On Goldman Sachs Gr

关于高盛(GS)的专家意见

2 market experts have recently issued ratings for this stock, with a consensus target price of $497.5.

2位市场分析师最近对该股票发表了评级,一致看好的目标价位为497.5美元。

- An analyst from Morgan Stanley persists with their Overweight rating on Goldman Sachs Gr, maintaining a target price of $475.

- Consistent in their evaluation, an analyst from Keefe, Bruyette & Woods keeps a Outperform rating on Goldman Sachs Gr with a target price of $520.

- 大摩资源lof的一名分析师坚持给高盛(GS)股票打超配标签,并保持目标价475美元。

- 坚定地评估,Keefe,Bruyette & Woods的一名分析师仍然认为高盛(GS)股票表现优异,并给出了目标价为520美元的跑赢市场评级。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。