Whales with a lot of money to spend have taken a noticeably bullish stance on United Parcel Service.

Looking at options history for United Parcel Service (NYSE:UPS) we detected 15 trades.

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 10 are puts, for a total amount of $692,499 and 5, calls, for a total amount of $166,067.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $115.0 to $150.0 for United Parcel Service over the last 3 months.

Analyzing Volume & Open Interest

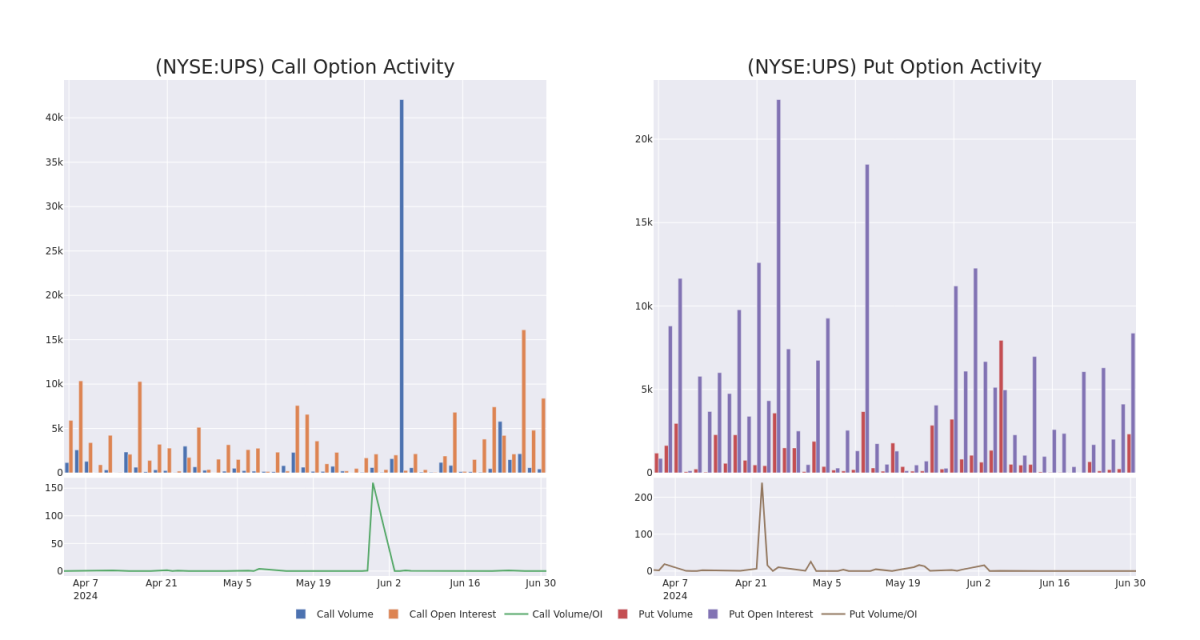

In today's trading context, the average open interest for options of United Parcel Service stands at 2096.25, with a total volume reaching 2,758.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in United Parcel Service, situated within the strike price corridor from $115.0 to $150.0, throughout the last 30 days.

United Parcel Service Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | PUT | SWEEP | BULLISH | 01/16/26 | $13.75 | $13.5 | $13.5 | $130.00 | $135.0K | 1.3K | 0 |

| UPS | PUT | SWEEP | BEARISH | 01/16/26 | $13.35 | $13.3 | $13.35 | $130.00 | $134.1K | 1.3K | 100 |

| UPS | PUT | SWEEP | BEARISH | 01/17/25 | $2.93 | $2.85 | $2.91 | $115.00 | $120.8K | 5.2K | 3 |

| UPS | CALL | SWEEP | BULLISH | 08/16/24 | $3.7 | $3.6 | $3.65 | $140.00 | $54.0K | 2.4K | 305 |

| UPS | PUT | SWEEP | BEARISH | 01/17/25 | $2.93 | $2.85 | $2.89 | $115.00 | $52.3K | 5.2K | 3 |

About United Parcel Service

As the world's largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS' domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder. UPS is currently pursuing "strategic alternatives" for its truck brokerage unit, Coyote, which it acquired in 2015.

Having examined the options trading patterns of United Parcel Service, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

United Parcel Service's Current Market Status

- With a trading volume of 1,774,863, the price of UPS is down by -0.81%, reaching $135.74.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 22 days from now.

Professional Analyst Ratings for United Parcel Service

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $150.5.

- An analyst from Evercore ISI Group has decided to maintain their In-Line rating on United Parcel Service, which currently sits at a price target of $145.

- Reflecting concerns, an analyst from Wells Fargo lowers its rating to Overweight with a new price target of $156.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest United Parcel Service options trades with real-time alerts from Benzinga Pro.