No-one enjoys it when they lose money on a stock. But when the market is down, you're bound to have some losers. While the Shenzhen FRD Science & Technology Co., Ltd. (SZSE:300602) share price is down 20% in the last three years, the total return to shareholders (which includes dividends) was -20%. That's better than the market which declined 25% over the last three years. Unfortunately the share price momentum is still quite negative, with prices down 12% in thirty days. We do note, however, that the broader market is down 6.3% in that period, and this may have weighed on the share price.

The recent uptick of 5.5% could be a positive sign of things to come, so let's take a look at historical fundamentals.

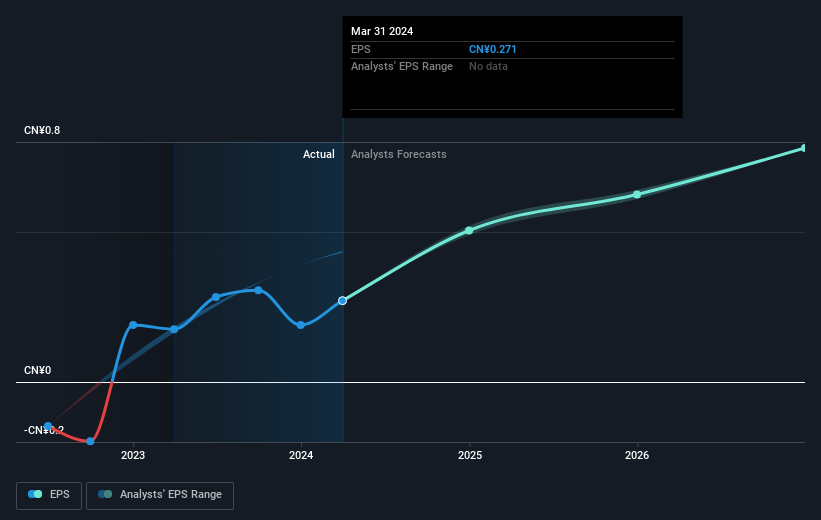

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Shenzhen FRD Science & Technology saw its EPS decline at a compound rate of 13% per year, over the last three years. In comparison the 7% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines. With a P/E ratio of 56.33, it's fair to say the market sees a brighter future for the business.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Shenzhen FRD Science & Technology has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

While it's never nice to take a loss, Shenzhen FRD Science & Technology shareholders can take comfort that , including dividends,their trailing twelve month loss of 2.4% wasn't as bad as the market loss of around 16%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 1.2% over the last half decade. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. Before forming an opinion on Shenzhen FRD Science & Technology you might want to consider these 3 valuation metrics.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com