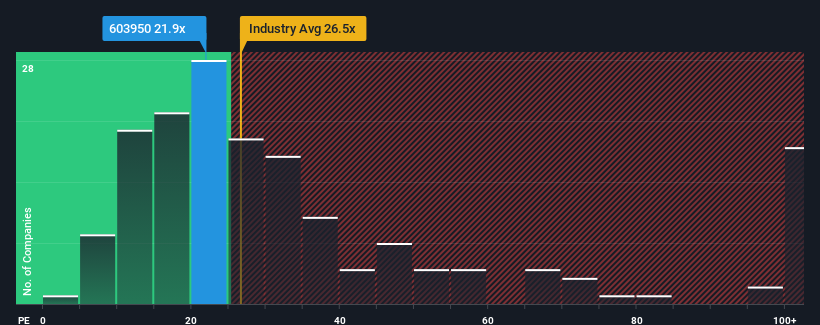

Xiangyang Changyuandonggu Industry Co., Ltd.'s (SHSE:603950) price-to-earnings (or "P/E") ratio of 21.9x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 29x and even P/E's above 54x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been quite advantageous for Xiangyang Changyuandonggu Industry as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

How Is Xiangyang Changyuandonggu Industry's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Xiangyang Changyuandonggu Industry's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 78% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 49% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 36% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Xiangyang Changyuandonggu Industry's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Xiangyang Changyuandonggu Industry's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Xiangyang Changyuandonggu Industry maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Xiangyang Changyuandonggu Industry (2 are significant!) that you should be aware of before investing here.

If you're unsure about the strength of Xiangyang Changyuandonggu Industry's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com