This Is What Whales Are Betting On Adobe

This Is What Whales Are Betting On Adobe

Financial giants have made a conspicuous bullish move on Adobe. Our analysis of options history for Adobe (NASDAQ:ADBE) revealed 27 unusual trades.

金融巨頭在Adobe上做出了明顯的看漲動作。我們對Adobe (NASDAQ:ADBE)期權歷史數據的分析表明有27次飛凡交易。

Delving into the details, we found 44% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $159,253, and 22 were calls, valued at $1,090,713.

深入研究後,我們發現44%的交易員看漲,而37%的交易員看跌。我們發現的所有交易中,有5筆看跌期權,價值159,253美元,22筆看漲期權,價值1,090,713美元。

Expected Price Movements

預期價格波動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $500.0 to $600.0 for Adobe over the last 3 months.

考慮到該合同的成交量和未平倉利息,看起來鯨魚已經針對最近3個月Adobe的價格區間爲$500.0至$600.0進行了目標定位。

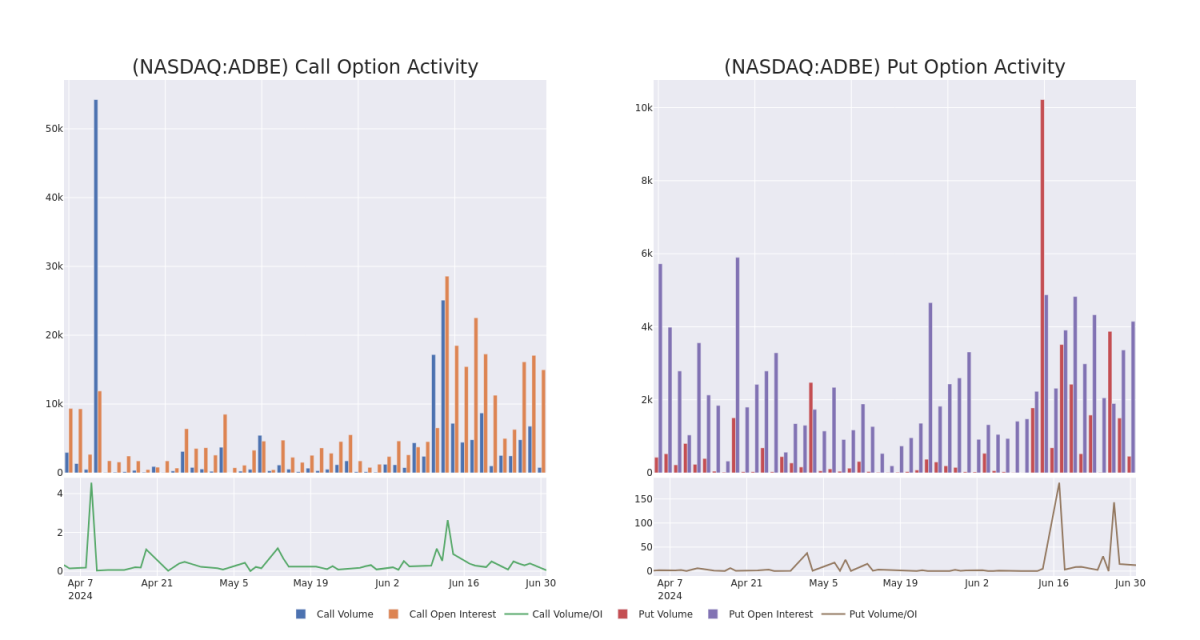

Volume & Open Interest Trends

成交量和未平倉量趨勢

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Adobe's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Adobe's significant trades, within a strike price range of $500.0 to $600.0, over the past month.

審查成交量和未平倉利息可以提供股票研究的關鍵見解。這些信息對於衡量Adobe的期權在特定行使價格的流動性和興趣水平非常重要。下面,我們提供了過去一個月內Adobe重要交易中的看漲和看跌期權在行使價格爲$500.0至$600.0的成交量和未平倉利息趨勢快照。

Adobe Call and Put Volume: 30-Day Overview

Adobe看漲期權和看跌期權成交量:30天概覽

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADBE | CALL | TRADE | BEARISH | 01/17/25 | $54.8 | $53.1 | $53.1 | $580.00 | $79.6K | 985 | 0 |

| ADBE | CALL | TRADE | BEARISH | 09/20/24 | $19.7 | $19.4 | $19.4 | $600.00 | $77.6K | 4.4K | 28 |

| ADBE | CALL | TRADE | BEARISH | 03/21/25 | $69.15 | $68.55 | $68.55 | $570.00 | $75.4K | 308 | 20 |

| ADBE | CALL | TRADE | BEARISH | 03/21/25 | $69.3 | $67.55 | $67.55 | $570.00 | $74.3K | 308 | 0 |

| ADBE | CALL | TRADE | BULLISH | 07/19/24 | $10.85 | $10.15 | $10.65 | $570.00 | $63.9K | 998 | 149 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| adobe | 看漲 | 交易 | 看淡 | 01/17/25 | $54.8 | $53.1 | $53.1 | $580.00 | $79.6K | 985 | 0 |

| adobe | 看漲 | 交易 | 看淡 | 09/20/24 | $19.7 | $19.4 | $19.4 | $600.00 | $77.6千美元 | 4.4K | 28 |

| adobe | 看漲 | 交易 | 看淡 | 03/21/25 | $69.15 | $68.55 | $68.55 | $570.00 | $75.4K | 308 | 20 |

| adobe | 看漲 | 交易 | 看淡 | 03/21/25 | $69.3 | $67.55 | $67.55 | $570.00 | $74.3K | 308 | 0 |

| adobe | 看漲 | 交易 | 看好 | 07/19/24 | $10.85 | $10.15 | $10.65 | $570.00 | $63.9K | 998 | 149 |

About Adobe

關於Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing,g and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Adobe提供內容創作、文檔管理和數字營銷和廣告軟件及服務,用於創建、管理、交付、度量、優化、吸引有吸引力的內容,適用於多種操作系統、設備和媒體。公司有三個業務部門:數字媒體內容創作,數字營銷解決方案體驗,出版傳統產品(營收不到5%)。

Where Is Adobe Standing Right Now?

Adobe現在處於什麼位置?

- With a volume of 819,340, the price of ADBE is up 1.19% at $566.66.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 72 days.

- ADBE的成交量爲819,340,目前價格爲566.66美元,上漲1.19%。

- RSI因子暗示底層股票可能被超買。

- 下一次收益預期將在72天內發佈。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Adobe options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。精明的交易者通過不斷地學習、調整策略、監控多個因子並密切關注市場動態來管理這些風險。從Benzinga Pro獲取實時的Adobe 期權交易警報信息,讓您時刻保持了解最新動態。