Why Is Bitcoin Down To $60K Today?

Why Is Bitcoin Down To $60K Today?

Bitcoin (CRYPTO: BTC) has experienced a sharp decline in early Asian trading hours, dropping from $62,000 to $59,544, marking an over 4% decrease.

比特币(CRYPTO:BTC)在亚洲交易早期经历了急剧下跌,从62,000美元跌至59,544美元,标志着超过4%的下降。

What Happened: This downturn coincided with the first net outflow from Bitcoin spot ETFs in nearly a week, according to data by cryptocurrency analytics firm SoSo Value.

发生了什么:根据加密货币分析公司SoSo Value的数据,这次下跌与比特币现货ETF近一个星期以来的首次净流出同时发生。

On July 2, Bitcoin ETFs recorded a total net outflow of $13.6167 million, breaking a five-day streak of consecutive inflows.

7月2日,比特币ETF总净流出达到13.6167万美元,打破了连续五天流入的纪录。

The Grayscale Bitcoin Trust (OTC:GBTC) led the exodus with a substantial single-day outflow of $32.3779 million.

灰度比特币信托基金(OTC:GBTC)以巨额单日流出32.3779万美元带领了资金外流。

However, this was partially offset by inflows into other ETFs, with BlackRock's iShares Bitcoin Trust (NASDAQ:IBIT) and Fidelity's Wise Origin Bitcoin Fund (BATS:FBTC) attracting $14.1154 million and $5.4189 million, respectively.

然而,由于黑Rock旗下的iShares比特币信托基金(NASDAQ:IBIT)和Fidelity的Wise Origin比特币基金(BATS:FBTC)分别吸引了1,411.54万美元和541.89万美元的流入资金,上述资金外流部分被抵消。

The bearish sentiment extended beyond Bitcoin, affecting other major cryptocurrencies.

看淡情绪影响了其他主要加密货币。

Ethereum (CRYPTO: ETH), Solana (CRYPTO: SOL) and Dogecoin (CRYPTO: DOGE) each experienced over 4% declines, mirroring Bitcoin's downward trajectory. At the time of writing, Bitcoin is trading around $60,200.

以太坊(CRYPTO:ETH)、Solana(CRYPTO:SOL)和狗狗币(CRYPTO:DOGE)分别经历了4%以上的跌幅,呼应了比特币的下降趋势。目前,比特币的交易价格约为60,200美元。

Market analysts attribute this downward pressure to multiple factors, with particular emphasis on the anticipated distribution of Bitcoin from the defunct Mt. Gox exchange, expected to commence this month.

市场分析师将这种下行压力归因于多个因素,特别强调已于本月开始分发来自破产Mt. Gox交易所的比特币。

This looming supply increase has created uncertainty among investors, potentially contributing to the current price volatility.

这种潜在供应增加已经为投资者带来了不确定性,可能有助于当前价格的波动。

Also Read: Bitcoin To Hit $100K By US Election: Standard Chartered

还阅读了:标准劳动党:比特币将在美国大选前达到100,000美元

Why It Matters: Despite the current downturn, some analysts maintain a cautiously optimistic outlook.

为尽管目前经历下行趋势,某些分析师仍持谨慎乐观的态度。

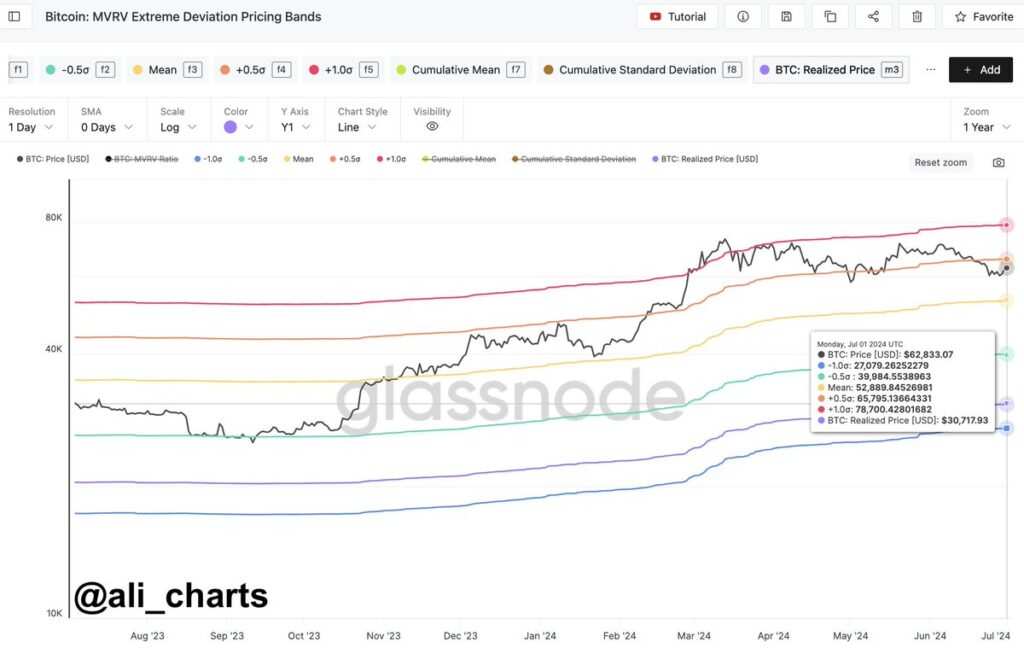

Crypto analyst Ali Martinez has identified key resistance levels for Bitcoin, stating, "One of the most crucial resistance areas for Bitcoin is $65,795. If BTC can break past this level, the next significant target is $78,700!"

加密货币分析师阿里·马丁内斯(Ali Martinez)已经确定了比特币的关键支撑位,称,“对于比特币来说,最关键的支撑区域之一是65,795美元。如果BTC能够突破这个水平,则下一个重要目标是78,700美元!”

As the market grapples with these immediate challenges, attention is also turning to future developments, particularly in the Ethereum ecosystem.

随着市场应对这些即时的挑战,关注的焦点也转向了未来的发展,特别是在以太坊生态系统中。

A K33 analyst highlighted the potential impact of the upcoming Ethereum ETF, describing it as "a solid catalyst for ETH's relative strength."

K33分析师强调了即将推出的以太坊ETF的潜在影响,称其为“ETH相对强势的一个稳定催化剂。”

The analyst predicts that while ETH might experience an initial dip post-launch, subsequent inflows could significantly boost its price.

该分析师预测,尽管上市后ETH可能会经历短暂下跌,但随后的资金流入可能会显着提高其价格。

Nate Geraci, president of The ETF Store, offered insights into the potential launch timeline for the Ethereum spot ETFs, suggesting a possible launch in the week of July 15.

ETF Store总裁Nate Geraci为以太坊现货ETF的潜在推出时间表提供了见解,并建议在7月15日左右可能会推出。

This development could introduce new dynamics to the cryptocurrency market.

此举可能会为加密货币市场引入新的动态。

What's Next: As these events unfold, industry stakeholders are looking forward to Benzinga's Future of Digital Assets event on Nov. 19.

下一步发展:随着这些事件的发展,行业利益相关者期待财经新闻机构Benzinga于11月19日举办的数字资产未来活动。

This gathering is expected to provide a platform for in-depth discussions on recent market trends, ETF flows, and their long-term implications for the digital asset landscape.

预计此次聚会将为最近市场趋势、ETF流动情况及其对数字资产格局的长期影响进行深入讨论。