Top 3 Energy Stocks That May Rocket Higher In July

Top 3 Energy Stocks That May Rocket Higher In July

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

能源板块中最过度卖出的股票为买入低估公司提供机会。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指标是一种动量指标,它比较了股票在价格上涨时的强度与在价格下跌时的强度。与股票的价格走势进行比较,可以给交易者更好的了解股票短期内表现的良好程度。当RSI低于30时,资产通常被认为是超卖的,根据Benzinga Pro的数据。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行业板块最近的主要超卖股票列表,RSI接近或低于30。

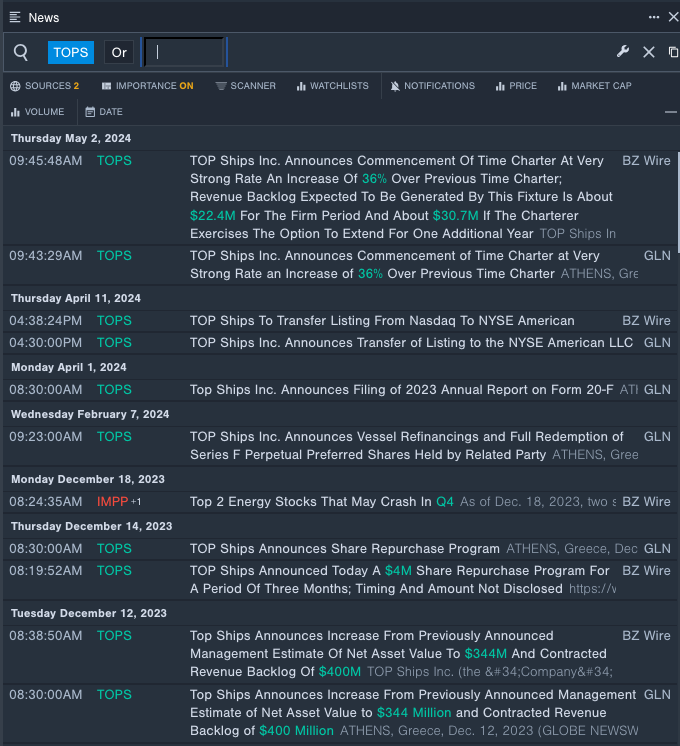

TOP SHIPS Inc (NYSE:TOPS)

纽交所的top ships股份有限公司 (NYSE:TOPS)

- On May 2, TOP Ships announced commencement of time charter at very strong rate an increase of 36% over previous time charter. The company's stock fell around 17% over the past month and has a 52-week low of $5.51.

- RSI Value: 25.60

- TOPS Price Action: Shares of TOP SHIPS fell 0.9% to close at $11.04 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest TOPS news.

- 5月2日,top ships宣布成为时间租赁商,租金非常高,比之前的时间租赁提高了36%。公司股票在过去一个月下跌了约17%,52周内低点是5.51美元。

- RSI值:25.60

- top ships股份有限公司的股票价格走势:周二,股价下跌0.9%,收于11.04美元。

- Benzinga Pro的实时新闻提醒了最新的TOPS股票资讯。

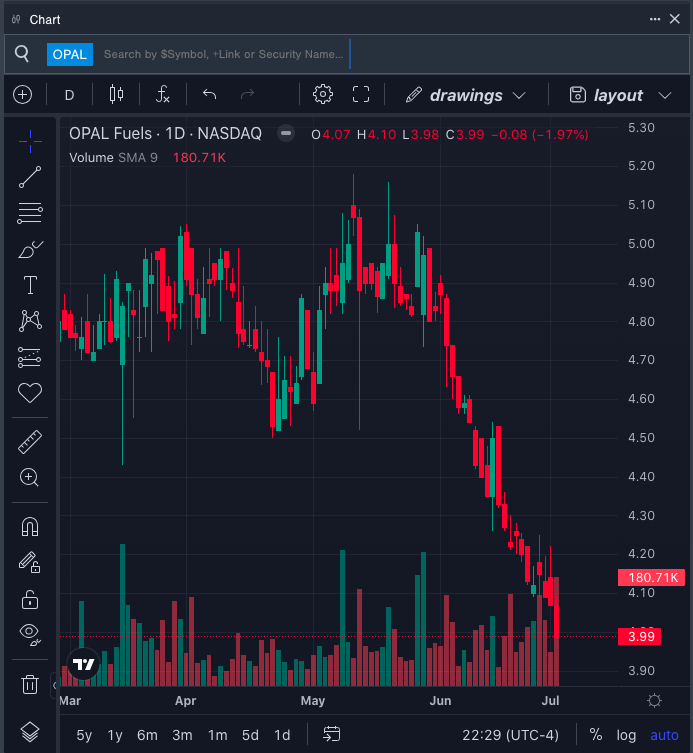

Opal Fuels Inc (NASDAQ:OPAL)

纳斯达克的Opal Fuels股份有限公司 (NASDAQ:OPAL)

- On June 7, B. Riley Securities analyst Ryan Pfingst maintained OPAL Fuels with a Buy and maintained a price target of $10. The company's stock fell around 18% over the past month. It has a 52-week low of $3.98.

- RSI Value: 26.98

- OPAL Price Action: Shares of Opal Fuels fell 2% to close at $3.99 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in Opal Fuels stock.

- 6月7日,B. Riley Securities的分析师Ryan Pfingst给予OPAL Fuels买入评级,维持目标价10美元。公司股票在过去一个月下跌了约18%,52周内低点为3.98美元。

- RSI值:26.98

- Opal Fuels的股票价格走势:周二,下跌2%,收于3.99美元。

- Benzinga Pro的图表工具帮助识别了Opal Fuels股票的趋势。

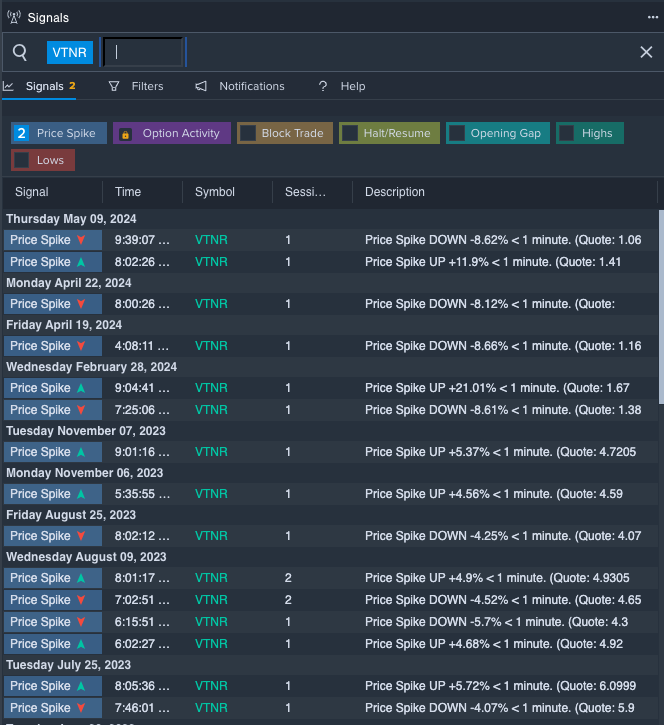

Vertex Energy Inc (NASDAQ:VTNR)

纳斯达克的顶点能源股份有限公司 (NASDAQ:VTNR)

- On May 9, Vertex Energy posted a wider-than-expected quarterly loss. Mr. Benjamin P. Cowart, Vertex's Chief Executive Officer, stated, "We had a strong operational and financial quarter, as we maintained our commitment to operating safely and reliably. We saw an improved crack spread environment, which drove our Adjusted EBITDA higher by over $50 million compared to the fourth quarter of 2023. Additionally, we saw conventional throughput above our guidance and managed direct operating costs and capital expenditures below our guidance." The company's stock fell around 42% over the past five days and has a 52-week low of $0.58.

- RSI Value: 24.75

- VTNR Price Action: Shares of Vertex Energy fell 21.8% to close at $0.61 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in Vertex Energy's shares.

- 5月9日,顶点能源发布了一个超过预期的季度亏损。顶点的首席执行官Benjamin P. Cowart先生说:“我们的运营和财务季度非常强劲,我们一直致力于安全可靠的运营。我们看到了改善的破裂价差环境,与2023年第四季度相比,带动我们的调整后EBITDA增长超过5000万美元。此外,我们看到常规吞吐量超过我们的指导,并将直接运营成本和资本支出控制在我们的指导之下。” 公司股票在过去五天下跌了约42%,52周内低点为0.58美元。

- RSI值:24.75

- 顶点能源的股票价格走势:周二下跌21.8%,收于0.61美元。

- Benzinga Pro的信号特色提醒顶点能源股票可能出现突破。

Read More: Top 3 Risk Off Stocks Which Could Rescue Your Portfolio This Quarter

阅读更多:走出风险的前三只股票,这个季度可以拯救您的投资组合