Market Whales and Their Recent Bets on AMD Options

Market Whales and Their Recent Bets on AMD Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Advanced Micro Devices.

拥有大量资金可支配的鲸鱼们对美国超微公司采取了明显看好的立场。

Looking at options history for Advanced Micro Devices (NASDAQ:AMD) we detected 8 trades.

从美国超微公司(纳斯达克:AMD)的期权历史来看,我们发现了8宗交易。

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 12% with bearish.

如果我们考虑每笔交易的特定情况,可以准确地说,62%的投资者对看涨有着期待,并且12%对看淡有着期待。

From the overall spotted trades, 2 are puts, for a total amount of $56,420 and 6, calls, for a total amount of $509,047.

从总的交易中可以看到,有2笔看跌交易,总金额为$56,420美元,有6笔看涨交易,总金额为$509,047美元。

Expected Price Movements

预期价格波动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $95.0 to $165.0 for Advanced Micro Devices over the recent three months.

基于交易活动,看起来重要的投资者正在瞄准美国超微公司在最近三个月内的价格区间,从$95.0到$165.0。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

In terms of liquidity and interest, the mean open interest for Advanced Micro Devices options trades today is 3498.57 with a total volume of 9,136.00.

从流动性和利益方面来看,美国超微公司期权交易的平均持仓量为3498.57,总成交量为9,136.00。

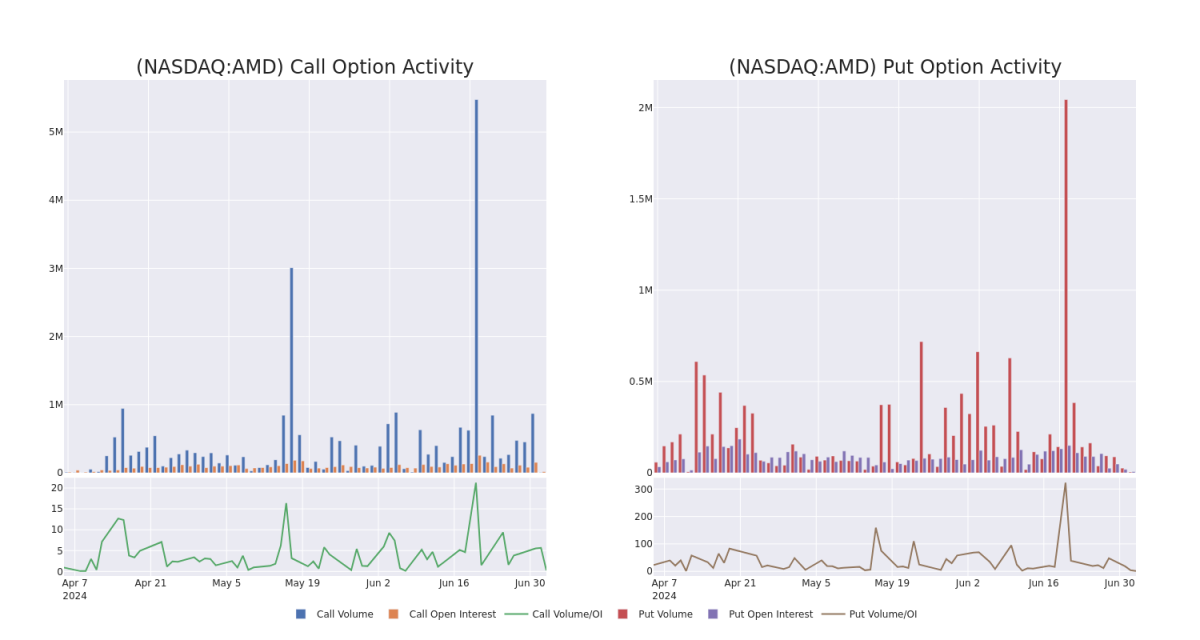

In the following chart, we are able to follow the development of volume and open interest of call and put options for Advanced Micro Devices's big money trades within a strike price range of $95.0 to $165.0 over the last 30 days.

在下图中,我们可以跟踪关于美国超微公司的看涨期权和看跌期权的成交量和持仓量在一个执行价格区间从$95.0到$165.0内的大宗交易的发展,这是在过去30天内发生的。

Advanced Micro Devices Call and Put Volume: 30-Day Overview

美国超微公司看涨和看跌的成交量:30天概述

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD | CALL | SWEEP | BULLISH | 12/18/26 | $69.6 | $67.6 | $69.6 | $130.00 | $173.9K | 80 | 0 |

| AMD | CALL | TRADE | BULLISH | 07/12/24 | $68.4 | $68.0 | $68.24 | $95.00 | $102.3K | 1 | 0 |

| AMD | CALL | TRADE | NEUTRAL | 07/05/24 | $68.45 | $67.9 | $68.14 | $95.00 | $102.2K | 40 | 0 |

| AMD | CALL | SWEEP | BULLISH | 07/05/24 | $2.03 | $2.02 | $2.02 | $165.00 | $74.2K | 16.9K | 4.6K |

| AMD | CALL | SWEEP | NEUTRAL | 07/05/24 | $2.03 | $1.95 | $2.01 | $165.00 | $29.9K | 16.9K | 4.6K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD (纳斯达克:AMD) | 看涨 | SWEEP | 看好 | 12/18/26 | $69.6 | $67.6 | $69.6 | $130.00 | $173.9K | 80 | 0 |

| AMD (纳斯达克:AMD) | 看涨 | 交易 | 看好 | 07/12/24 | $68.4 | $68.0 | $68.24 | $ 95.00 | $ 102.3K | 1 | 0 |

| AMD (纳斯达克:AMD) | 看涨 | 交易 | 中立 | 07/05/24 | $68.45 | $67.9 | $68.14 | $ 95.00 | $102.2千 | 40 | 0 |

| AMD (纳斯达克:AMD) | 看涨 | SWEEP | 看好 | 07/05/24 | $2.03 | $2.02 | $2.02 | 165.00美元 | 74.2K | 16.9K | 4.6K |

| AMD (纳斯达克:AMD) | 看涨 | SWEEP | 中立 | 07/05/24 | $2.03 | $1.95 | $2.01 | 165.00美元 | $29.9千 | 16.9K | 4.6K |

About Advanced Micro Devices

关于Advanced Micro Devices

Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications, among others. AMD's traditional strength was in central processing units, CPUs, and graphics processing units, or GPUs, used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field-programmable gate array, or FPGA, leader Xilinx to diversify its business and augment its opportunities in key end markets such as the data center and automotive.

Advanced Micro Devices为诸如PC、游戏机、数据中心、工业、汽车应用等市场设计各种数字半导体。AMD的传统优势在于用于PC和数据中心中的中央处理器(CPU)和图形处理器(GPU)。此外,该公司还为一些著名游戏机,如Sony PlayStation和Microsoft Xbox供应芯片。2022年,该公司收购了FPGA领导者Xilinx,以实现业务多元化,并增加在数据中心和汽车等关键终端市场的机会。

In light of the recent options history for Advanced Micro Devices, it's now appropriate to focus on the company itself. We aim to explore its current performance.

根据美国超微公司最近的期权历史,现在适合关注公司本身。我们旨在探讨其当前的表现。

Present Market Standing of Advanced Micro Devices

美国超微公司的现有市场地位

- Currently trading with a volume of 1,489,383, the AMD's price is down by -0.21%, now at $163.97.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 27 days.

- 目前交易量为1,489,383,美国超微公司的股价下跌了-0.21%,现在为$163.97。

- RSI读数表明该股票目前处于中立状态,处于超买和超卖之间。

- 预期的盈利发布还有27天。

Professional Analyst Ratings for Advanced Micro Devices

美国超微公司的专业分析师评级

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $188.0.

在过去的一个月中,有2位行业分析师分享了他们对该股票的看法,提出了$188.0的平均目标价。

- In a cautious move, an analyst from Morgan Stanley downgraded its rating to Equal-Weight, setting a price target of $176.

- An analyst from Susquehanna has decided to maintain their Positive rating on Advanced Micro Devices, which currently sits at a price target of $200.

- 大摩资源lof的一位分析师采取谨慎的举动,将其评级下调至等权重,并设定了$176的目标价。

- Susquehanna的一位分析师决定维持对美国超微公司的正面评级,目前的目标价格为200美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Advanced Micro Devices options trades with real-time alerts from Benzinga Pro.

期权交易存在较高的风险和潜在回报。审慎的交易者通过不断学习、调整策略、监控多个因子以及密切关注市场动向来管理这些风险。通过Benzinga Pro的实时提醒,及时了解美国超微公司期权交易的最新信息。