Investment project:

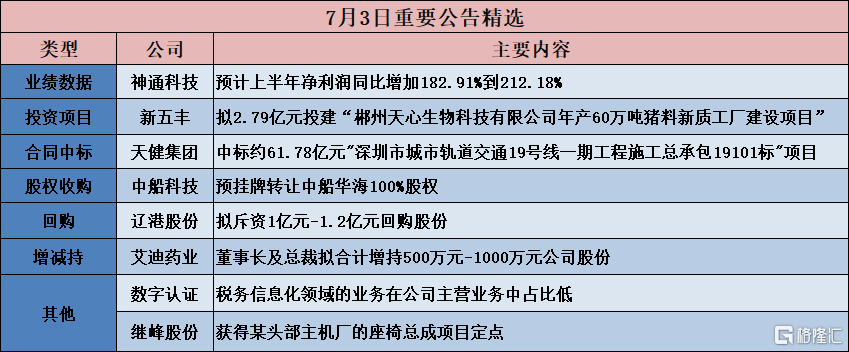

Hunan New Wellful (600975.SH): plans to invest 279 million yuan to build the 'Chenzhou Tianxin Biological Technology Co., Ltd. annual production of 600,000 tons of new quality pig feed factory construction project'.

Hunan New Wellful (600975.SH) announced that in order to further improve the pig industry chain, ensure the supply of supporting feed for the company's breeding farms, reduce feed production and logistics transportation costs, the wholly-owned subsidiary Tianxin Seed Industry set up by the company is planning to invest in the construction of Chenzhou Tianxin Biological Technology Co., Ltd., an annual production of 0.6 million tons of new quality pig feed factory construction project. The total construction land area of the project is about 90.57 mu. The total investment of the project is RMB 278.9753 million, of which the construction investment is RMB 224.5012 million, the construction period interest is RMB 0.3992 million, and the bottom-lying working capital is RMB 54.0749 million.

Contracts awarded:

Huatong Group (603176.SH): The consortium is expected to win the bid for the franchise operation of the Hebei section of the Beijing-Harbin Expressway Jiumenkou double-track project.

Huitong Group (603176.SH) announced that the Public Resources Trading Platform of Hebei Province released the list of bid candidates for the "Beijing-Harbin Expressway Jiumenkou Duplex Hebei Section Project Concessionaire" on July 3, 2024. Huitong Construction Group Co., Ltd. and Hebei Transportation Investment Group Co., Ltd., Taihang Urban and Rural Construction Group Co., Ltd., Hebei Transportation Construction and Development Co., Ltd., Hebei Jiaotou Intelligent Technology Co., Ltd., Hebei Jiaotou Resource Development and Utilization Co., Ltd., Gansu Road and Bridge Construction Group Co., Ltd., and Chengdu Huachuan Highway Construction Group Co., Ltd. jointly bid for the above-mentioned tender project as the successful bid candidate. The amount of the bid is RMB 2,721,236,400.00 for the total investment in the project.

Shenzhen Tagen Group (000090.SZ): Won the bid for about RMB 6.178 billion for the "Shenzhen Urban Rail Transit Line 19 Phase I Construction General Contract Package 19101" project.

Tianjin Tagen Group (000090.SZ) announced that on July 2, 2024, its wholly-owned subsidiary, Shenzhen Municipal Group Co., Ltd. (hereinafter referred to as "the municipal group"), received the "Winning Notice" from Shenzhen Building Materials Trading Group Co., Ltd., confirming that the municipal group, together with Shenzhen Special Zone Construction Engineering Co., Ltd. (hereinafter referred to as "Special Zone Construction Engineering"), Shenzhen Construction (Group) Co., Ltd. (hereinafter referred to as "Jianan Group"), Shenzhen Luqiao Construction Group Co., Ltd. (hereinafter referred to as "Luqiao Group"), Shenzhen Construction (Group) Co., Ltd. (hereinafter referred to as "Construction Group"), Shanghai Tunnel Engineering Co., Ltd. (hereinafter referred to as "Shanghai Tunnel") formed a bidding consortium as the successful unit of the "Shenzhen Urban Rail Transit Line 19 Phase I Construction General Contract Package 19101". The bid amount is RMB 6,178.4255293 million, of which the bid amount of the municipal group is about RMB 2,235.354356 million (the actual contract amount is subject to subsequent contracts).

Huakang Medical (301235.SZ) has won the bid for the medical special equipment and material procurement and installation project of the Traditional Chinese Medicine Inheritance and Innovation Engineering of Jiangxi Traditional Chinese Medicine University Affiliated Hospital, with a total of 73,999,600 yuan.

Huakang Medical (301235.SZ) announced that on July 2, 2024, the company received the "Winning Notice" from Jiangxi Chinese Medicine University Affiliated Hospital, confirming that the company is the winning supplier of the "Jiangxi Chinese Medicine University Affiliated Hospital Chinese Medicine Inheritance and Innovation Project Medical Special Equipment Material Procurement and Installation Project", with a bid price of RMB 73.9996 million.

[Equity Acquisition]

CSSC Science & Technology (600072.SH): pre-listing transfer of 100% equity of CSSC Huahai.

CSSC Science & Technology (600072.SH) announced that in order to further optimize the company's equity structure, focus on core business, and continue to enhance professional development, the company plans to pre-list the transfer of 100% equity of CSSC Huahai on the property rights exchange. As of the date of this announcement, the evaluation work is still in progress, and the company will perform the corresponding approval procedures based on the actual evaluation of the equity.

[Performance data]

Olympic Circuit Technology (603920.SH): The net income in the first half of the year is expected to increase by 40.34% to 60.75%.

Olympic Circuit Technology (603920.SH) announced the 2024 half-year performance forecast. The company expects to achieve a net profit attributable to shareholders of listed companies of RMB 275 million to RMB 315 million in the first half of 2024, an increase of RMB 79.0425 million to RMB 119.0425 million from the same period last year, a year-on-year increase of 40.34% to 60.75%. The company expects to achieve a net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses of RMB 270 million to RMB 310 million in the first half of 2024, an increase of RMB 77.5523 million to RMB 117.5523 million from the same period last year, a year-on-year increase of 40.30% to 61.08%.

Sansure Biotech Inc. (688289.SH): The net income in the first half of the year is expected to increase by 64% to 80% compared with the same period last year.

Sansure Biotech Inc. (688289.SH) announced that according to the preliminary calculation of the financial department, the company is expected to achieve a revenue of RMB 710 million in the first half of 2024, an increase of RMB 282.3042 million from the same period last year, a year-on-year increase of 66%. It is expected that the net profit attributable to the owners of the parent company in the first half of 2024 will be RMB 150 million to RMB 165 million, an increase of RMB 58.3239 million to RMB 73.3239 million from the same period last year, a year-on-year increase of 64% to 80%. It is expected that the net profit attributable to the owners of the parent company after deducting non-recurring gains and losses will be RMB 120 million to RMB 130 million in the first half of 2024, an increase of RMB 88.8194 million to RMB 98.8194 million from the same period last year, a year-on-year increase of 285% to 317%.

Zhejiang Songyuan Automotive Safety Systems (300893.SZ): Net profit in the first half of the year is expected to increase by 90.00%-110.00%.

Zhejiang Songyuan Automotive Safety Systems (300893.SZ) announced the performance forecast for the first half of 2024, with a net profit attributable to shareholders of listed companies of RMB 119.7532 million to RMB 132.3588 million, an increase of 90.00% to 110.00% compared with the same period last year; after deducting non-recurring gains and losses, the net profit attributable to shareholders of listed companies was RMB 114.7532 million to RMB 127.3588 million, an increase of 103.91% to 126.31% compared with the same period last year.

Shentong Technology (605228.SH): net income is expected to increase by 182.91% to 212.18% in the first half of the year.

Shentong Technology (605228.SH) announced that, based on preliminary calculations by the finance department, it is expected to achieve a net profit attributable to the owner of the parent company of RMB 29 million to 32 million in the first half of 2024, an increase of RMB 18.7495 million to 21.7495 million compared with the same period last year, a year-on-year increase of 182.91% to 212.18%. It is expected to achieve a net profit attributable to the owner of the parent company after deducting non-recurring gains and losses of RMB 27 million to 30 million in the first half of 2024, an increase of RMB 19.6453 million to 22.6453 million compared with the same period last year, a year-on-year increase of 267.11% to 307.90%.

Zhejiang Dibay Electric (603320.SH): It is expected that the net income in the first half of the year will increase by 151.24% to 177.15% year-on-year.

Zhejiang Dibay Electric (603320.SH) announced that, based on preliminary calculations by the finance department, it is expected to achieve a net profit attributable to the owner of the parent company of RMB 36.7048 million to 40.4888 million in the first half of 2024, an increase of RMB 22.0956 million to 25.8796 million compared with the same period last year, a year-on-year increase of 151.24% to 177.15%. It is expected to achieve a net profit attributable to the owner of the parent company after deducting non-recurring gains and losses of RMB 35.5973 million to 39.3813 million in the first half of 2024, an increase of RMB 21.8527 million to 25.6367 million compared with the same period last year, a year-on-year increase of 158.99% to 186.52%.

[Repurchase]

Kangxin New Materials (600076.SH): Plan to repurchase shares of RMB 10 million to 20 million

Kangxin New Materials (600076.SH) announced that it plans to repurchase shares with an amount not less than RMB 10 million and no more than RMB 20 million, and the repurchase price shall not exceed RMB 2.36 per share.

Liaoning Port (601880.SH) plans to spend 100-120 million yuan to repurchase shares.

Liaoning Port Co.Ltd. (601880.SH) announced that the company plans to repurchase its own shares through centralized bidding trading, and the repurchased shares will all be cancelled and reduce the company's registered capital. The total amount of this repurchase is not less than RMB 100 million (inclusive) and not more than RMB 120 million (inclusive), and the repurchase price does not exceed RMB 1.99 per share (inclusive).

【Increase and Decrease】

Aidea Pharmaceutical (688488.SH): The Chairman and CEO plan to increase their shareholding by a total of RMB 5 million to 10 million in the company.

Aidea Pharmaceutical (688488.SH) announced that Mr. Fu Heliang, one of the actual controllers and Chairman, and Mr. Zhang Jie, Director and CEO of the company plan to increase their shareholding in the company through the trading system allowed by the Shanghai Stock Exchange (including but not limited to centralized bidding and block trading) within 6 months from July 4, 2024. The total amount of shareholding increase of the two shall be not less than RMB 5 million and not more than RMB 10 million.

Shenzhen Fluence Technology Plc (300647.SZ): Zhang Kui plans to reduce his shareholding by no more than 1.31%.

Shenzhen Fluence Technology Plc (300647.SZ) announced that Mr. Zhang Kui, a shareholder holding more than 5% of the shares, directly holds 26,232,567 shares of the company's stock (accounting for 5.74% of the total share capital of the company). Mr. Zhang plans to reduce his shareholding in the company by no more than 6,000,000 shares (accounting for 1.31% of the total share capital of the company) through centralized bidding or block trading within 3 months after 15 trading days from the date of this announcement.

【Other】

Xiamen Hongxin Electronics Technology Group Inc. (300657.SZ) has signed a strategic cooperation agreement with a state-owned enterprise in Shenzhen on artificial intelligence computing power.

Xiamen Hongxin Electronics Technology Group Inc. (300657.SZ) announced that the company and Shenzhen X CO., LTD. (hereinafter referred to as "X CO.") signed a "Strategic Cooperation Agreement" on July 3, 2024 to jointly promote the development of artificial intelligence computing business with the goal of comprehensively grasping the great opportunities and severe challenges brought about by the fourth technological revolution centered on artificial intelligence, optimizing the company's strategic layout, building core competitiveness for the future, and in accordance with the principles of "innovative mechanism, efficient pragmatism, resource sharing, mutual benefit and win-win".

The strategic goal of the company's AI business is to become a provider of computing power hardware and overall solutions. The company has formed a complete commercial closed loop in this field, as well as rich key resources and software and hardware capabilities. It can provide customers with comprehensive services including computing chip procurement, server assembly and production, computing network, computing scheduling and operation management, maintenance, and computing disposal, significantly reducing the threshold for customers to participate in the computing industry. The development of artificial intelligence (AI) applications in the South China Greater Bay Area is very active, and it is in a leading position in the country. The demand for computing power is growing rapidly. The company focuses on the computing power markets in Beijing, Shanghai, Haixi, and the South China Greater Bay Area. The signing of this agreement is a breakthrough for the company's AI computing power business in the South China Greater Bay Area market; it has a very positive impact on the rapid landing of the company's computing power business, the development and branding of the company's computing power in the South China Greater Bay Area market, and is conducive to both parties fully leveraging their unique resource advantages in the service field and jointly strengthening the supply capacity of computing power infrastructure to promote the deep integration and extensive application of the digital economy in diverse fields.

Beijing certificate authority (300579.SZ): The business in the field of tax information technology accounts for a low proportion in the company's main business.

Beijing Certificate Authority Co Ltd (300579.SZ) disclosed an announcement about the abnormal volatility of its stock trading, the company's main business is in the cybersecurity sector, products and services based on password technology are applied in the fields of digital government, smart medical care, digital finance, enterprise digitization, and the business in the tax information technology sector accounts for a low proportion in the company's core business (less than 3%).

ST Yangguang Co Ltd (600220.SH): The company's stock will be delisted and removed from the market on July 10th.

ST Yangguang Co Ltd (600220.SH) announced that it received the self-regulatory supervision decision letter "Decision on the Delisting of the Shares of Jiangsu Yangguang Co., Ltd." (Self-regulatory Supervision Decision Letter of the Shanghai Stock Exchange [2024] No. 84) issued by the Shanghai Stock Exchange (hereinafter referred to as the "SSE") on July 3, 2024. The SSE decided to terminate the listing of the company's shares. The delisting and removal from the market will be on July 10, 2024.

Ningbo Jifeng Auto Parts (603997.SH): Received a seat assembly project from a certain leading automaker.

Ningbo Jifeng Auto Parts Co., Ltd. (603997.SH) announced that its holding subsidiary, Glamour (Harbin) Co., Ltd. has recently received a "Supplier Nomination Letter" from a customer. Glamour (Harbin) Co., Ltd. has won a designated seat for a seat assembly project of a head vehicle manufacturer, and will develop and produce front and rear seat assembly products for the customer. According to the customer's plan, the project is expected to start mass production from November 2025, with a project life cycle of 6 years and a total expected lifecycle amount of RMB 2.7 billion.