Financial giants have made a conspicuous bullish move on PayPal Holdings. Our analysis of options history for PayPal Holdings (NASDAQ:PYPL) revealed 10 unusual trades.

Delving into the details, we found 80% of traders were bullish, while 20% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $207,389, and 8 were calls, valued at $414,144.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $37.5 and $80.0 for PayPal Holdings, spanning the last three months.

Analyzing Volume & Open Interest

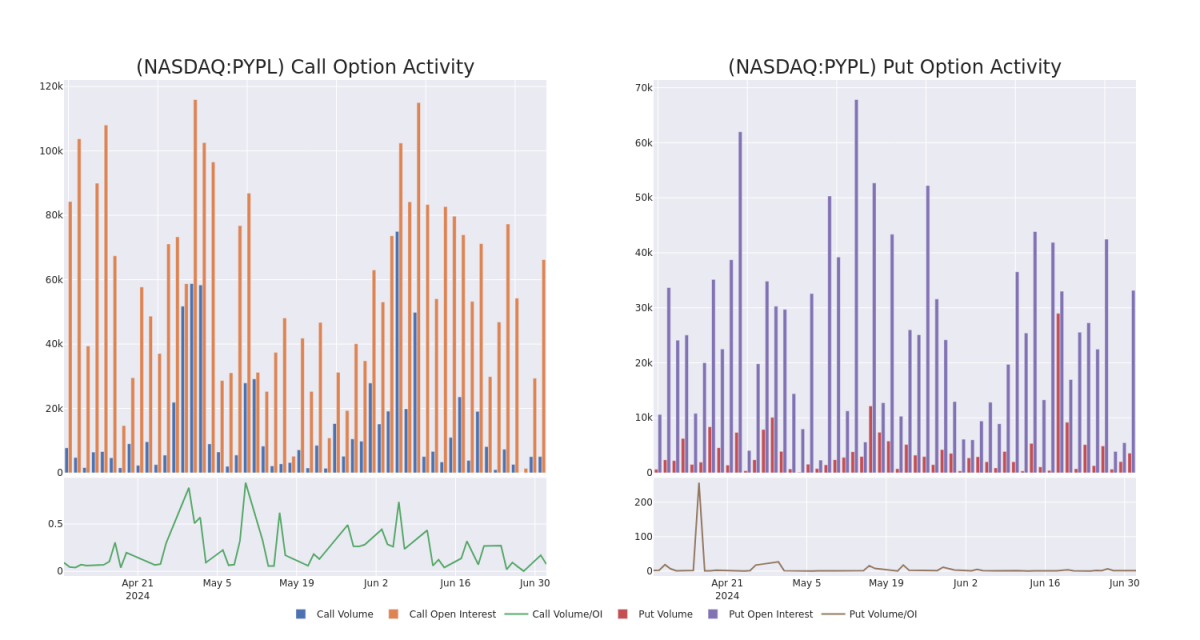

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for PayPal Holdings's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of PayPal Holdings's whale activity within a strike price range from $37.5 to $80.0 in the last 30 days.

PayPal Holdings 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | PUT | SWEEP | BULLISH | 01/16/26 | $5.0 | $4.95 | $4.95 | $50.00 | $178.7K | 3.1K | 42 |

| PYPL | CALL | SWEEP | BULLISH | 07/19/24 | $0.96 | $0.95 | $0.96 | $60.00 | $103.0K | 8.2K | 103 |

| PYPL | CALL | SWEEP | BEARISH | 08/16/24 | $1.5 | $1.48 | $1.48 | $65.00 | $59.6K | 8.5K | 242 |

| PYPL | CALL | TRADE | BEARISH | 12/18/26 | $30.4 | $28.25 | $28.26 | $37.50 | $56.5K | 60 | 0 |

| PYPL | CALL | TRADE | BULLISH | 12/18/26 | $10.8 | $9.15 | $10.25 | $80.00 | $51.2K | 587 | 0 |

About PayPal Holdings

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

After a thorough review of the options trading surrounding PayPal Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of PayPal Holdings

- With a trading volume of 3,357,655, the price of PYPL is up by 1.32%, reaching $59.75.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 28 days from now.

Expert Opinions on PayPal Holdings

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $73.8.

- An analyst from Susquehanna upgraded its action to Positive with a price target of $71.

- In a cautious move, an analyst from Goldman Sachs downgraded its rating to Neutral, setting a price target of $69.

- An analyst from Citigroup has decided to maintain their Buy rating on PayPal Holdings, which currently sits at a price target of $81.

- An analyst from Evercore ISI Group persists with their In-Line rating on PayPal Holdings, maintaining a target price of $70.

- Reflecting concerns, an analyst from Keefe, Bruyette & Woods lowers its rating to Outperform with a new price target of $78.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest PayPal Holdings options trades with real-time alerts from Benzinga Pro.