Unpacking the Latest Options Trading Trends in Qualcomm

Unpacking the Latest Options Trading Trends in Qualcomm

Investors with a lot of money to spend have taken a bullish stance on Qualcomm (NASDAQ:QCOM).

有足夠的資金的投資者對高通(納斯達克:QCOM)持有看好態度。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with QCOM, it often means somebody knows something is about to happen.

無論這些投資者是機構還是富人,我們不得而知。但是當這樣的大事發生在QCOM時,通常意味着有人知道即將發生的事情。

So how do we know what these investors just did?

那麼我們如何知道這些投資者剛剛做了什麼呢?

Today, Benzinga's options scanner spotted 22 uncommon options trades for Qualcomm.

今天,Benzinga的期權掃描器發現了22種不同尋常的高通交易期權。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 45% bullish and 31%, bearish.

這些大手交易者的情緒總體上分爲45%的看漲和31%的看跌。

Out of all of the special options we uncovered, 5 are puts, for a total amount of $311,412, and 17 are calls, for a total amount of $764,481.

在我們發現的所有特別期權中,有5種看跌期權,總價值爲311,412美元,有17種看漲期權,總價值爲764,481美元。

What's The Price Target?

價格目標是什麼?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $65.0 to $260.0 for Qualcomm over the recent three months.

根據交易活動,顯然顯著投資者正在瞄準高通近三個月的價格區間,範圍從65.0美元到260.0美元。

Volume & Open Interest Trends

成交量和未平倉量趨勢

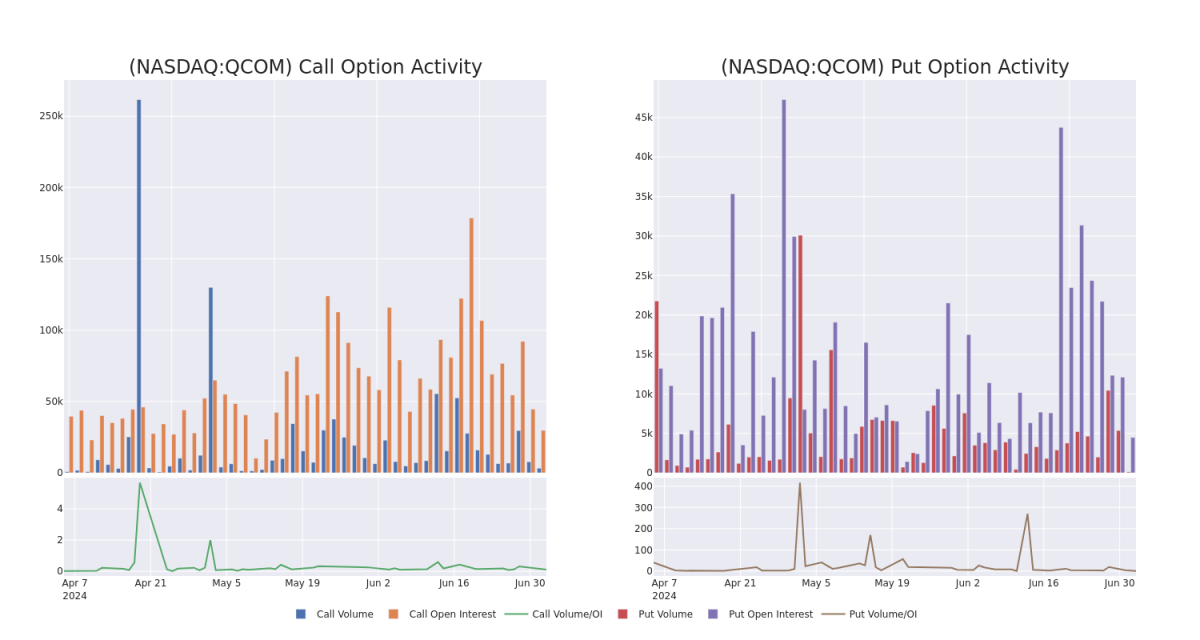

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Qualcomm's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Qualcomm's significant trades, within a strike price range of $65.0 to $260.0, over the past month.

檢查成交量和未平倉合約提供了證券研究的關鍵見解。這些信息是衡量高通期權在某些行權價下的流動性和利率水平的關鍵因素。以下是我們介紹的關於過去一個月內高通在65.0美元至260.0美元行權價範圍內看漲和看跌期權成交量及未平倉合約趨勢的快照。

Qualcomm 30-Day Option Volume & Interest Snapshot

高通30天期權成交量和利息縱覽

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | PUT | SWEEP | BEARISH | 12/20/24 | $21.55 | $21.45 | $21.55 | $210.00 | $148.7K | 998 | 70 |

| QCOM | CALL | TRADE | BULLISH | 08/16/24 | $27.45 | $27.45 | $27.45 | $180.00 | $68.6K | 11.9K | 0 |

| QCOM | CALL | TRADE | BEARISH | 07/12/24 | $3.35 | $3.3 | $3.3 | $205.00 | $65.6K | 3.0K | 1.6K |

| QCOM | CALL | SWEEP | BULLISH | 01/17/25 | $13.05 | $12.9 | $13.01 | $230.00 | $65.0K | 2.4K | 6 |

| QCOM | CALL | SWEEP | BULLISH | 07/05/24 | $5.9 | $5.85 | $5.9 | $197.50 | $59.0K | 1.1K | 630 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | 看跌 | SWEEP | 看淡 | 12/20/24 | $21.55 | $21.45 | $21.55 | 目標股價爲$210.00。 | $148.7K | 998 | 70 |

| QCOM | 看漲 | 交易 | 看好 | 08/16/24 | $27.45 | $27.45 | $27.45 | 180.00美元 | $68.6K | 11.9K | 0 |

| QCOM | 看漲 | 交易 | 看淡 | 07/12/24 | $3.35 | $3.3 | $3.3 | $205.00 | $65.6K | 3.0K | 1.6K |

| QCOM | 看漲 | SWEEP | 看好 | 01/17/25 | $13.05 | $12.9 | $13.01 | $230.00 | $65.0K | 2.4K | 6 |

| QCOM | 看漲 | SWEEP | 看好 | 07/05/24 | $5.9 | $5.85 | $5.9 | $197.50 | 59.0千美元 | 1.1千 | 630 |

About Qualcomm

關於高通

Qualcomm develops and licenses wireless technology and designs chips for smartphones. The company's key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G, 4G, and 5G networks. Qualcomm's IP is licensed by virtually all wireless device makers. The firm is also the world's largest wireless chip vendor, supplying nearly every premier handset maker with leading-edge processors. Qualcomm also sells RF-front end modules into smartphones, as well as chips into automotive and Internet of Things markets.

高通開發和許可無線技術,併爲智能手機設計芯片。該公司的關鍵專利圍繞CDMA和OFDMA技術展開,這些是無線通信的標準,是所有3G、4G和5g網絡的基礎。高通的知識產權被幾乎所有無線設備製造商許可使用。該公司還是全球最大的無線芯片供應商,爲幾乎所有主要手機制造商提供領先的處理器。高通還向智能手機銷售射頻前端模塊,以及在汽車和物聯網市場銷售芯片。

Qualcomm's Current Market Status

高通的當前市場狀態

- With a volume of 4,931,830, the price of QCOM is up 1.76% at $203.69.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 28 days.

- 成交量爲4,931,830,QCOM的價格漲了1.76%,達到203.69美元。

- RSI指標暗示該標的股票目前處於超買和超賣的中立區間。

- 下一個季度收益預計在28天內公佈。

Professional Analyst Ratings for Qualcomm

高通的專業分析師評級

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $252.5.

過去30天,共有2位專業分析師對該股進行了評估,設置了平均目標價爲252.5美元。

- An analyst from TD Cowen has decided to maintain their Buy rating on Qualcomm, which currently sits at a price target of $235.

- Maintaining their stance, an analyst from Tigress Financial continues to hold a Buy rating for Qualcomm, targeting a price of $270.

- TD Cowen的分析師決定維持對高通的買入評級,目前的目標價爲235美元。

- 保持他們的立場,Tigress Financial的分析師繼續爲高通持有買入評級,目標價爲270美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with QCOM, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with QCOM, it often means somebody knows something is about to happen.