China Conch Venture Holdings Limited (HKG:586) shares have continued their recent momentum with a 32% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

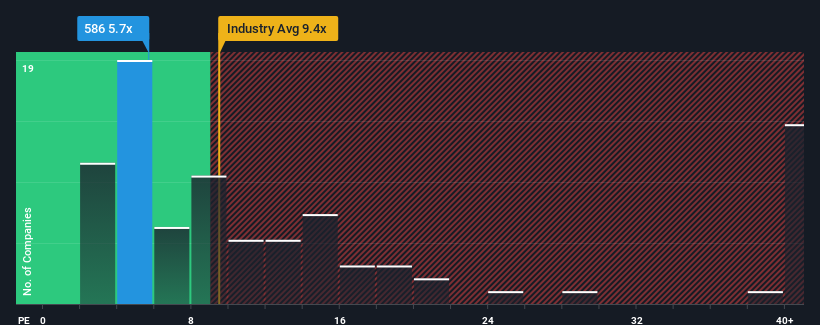

In spite of the firm bounce in price, China Conch Venture Holdings may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 5.7x, since almost half of all companies in Hong Kong have P/E ratios greater than 10x and even P/E's higher than 19x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

While the market has experienced earnings growth lately, China Conch Venture Holdings' earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

How Is China Conch Venture Holdings' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like China Conch Venture Holdings' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 36%. The last three years don't look nice either as the company has shrunk EPS by 65% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 5.3% per year during the coming three years according to the four analysts following the company. That's shaping up to be materially lower than the 16% per year growth forecast for the broader market.

With this information, we can see why China Conch Venture Holdings is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Despite China Conch Venture Holdings' shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of China Conch Venture Holdings' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - China Conch Venture Holdings has 2 warning signs (and 1 which is potentially serious) we think you should know about.

If you're unsure about the strength of China Conch Venture Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com