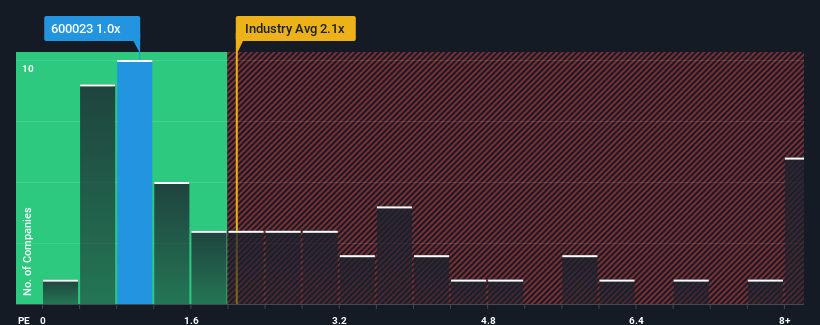

Zhejiang Zheneng Electric Power Co., Ltd.'s (SHSE:600023) price-to-sales (or "P/S") ratio of 1x might make it look like a buy right now compared to the Renewable Energy industry in China, where around half of the companies have P/S ratios above 2.1x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Zhejiang Zheneng Electric Power Has Been Performing

With revenue growth that's superior to most other companies of late, Zhejiang Zheneng Electric Power has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhejiang Zheneng Electric Power.Is There Any Revenue Growth Forecasted For Zhejiang Zheneng Electric Power?

In order to justify its P/S ratio, Zhejiang Zheneng Electric Power would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The strong recent performance means it was also able to grow revenue by 71% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 3.4% over the next year. That's not great when the rest of the industry is expected to grow by 11%.

In light of this, it's understandable that Zhejiang Zheneng Electric Power's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Zhejiang Zheneng Electric Power's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Zhejiang Zheneng Electric Power, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Zhejiang Zheneng Electric Power, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com