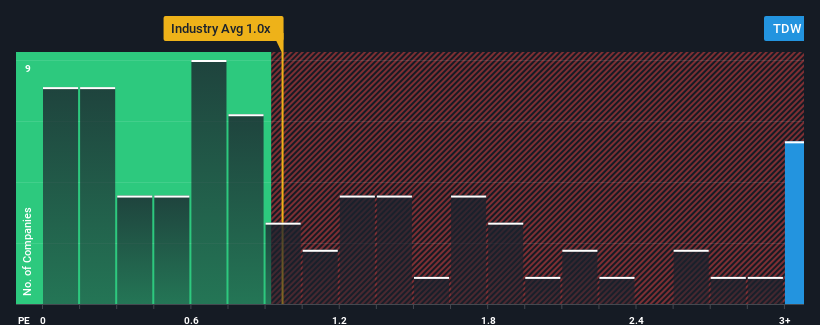

When you see that almost half of the companies in the Energy Services industry in the United States have price-to-sales ratios (or "P/S") below 1x, Tidewater Inc. (NYSE:TDW) looks to be giving off strong sell signals with its 4.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Tidewater's P/S Mean For Shareholders?

Recent times have been advantageous for Tidewater as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Tidewater will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Tidewater?

The only time you'd be truly comfortable seeing a P/S as steep as Tidewater's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 55% gain to the company's top line. Pleasingly, revenue has also lifted 213% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 29% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 11%, which is noticeably less attractive.

With this information, we can see why Tidewater is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Tidewater's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Tidewater shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Tidewater that you should be aware of.

If you're unsure about the strength of Tidewater's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com