Elutia Inc. (NASDAQ:ELUT) Surges 31% Yet Its Low P/S Is No Reason For Excitement

Elutia Inc. (NASDAQ:ELUT) Surges 31% Yet Its Low P/S Is No Reason For Excitement

Despite an already strong run, Elutia Inc. (NASDAQ:ELUT) shares have been powering on, with a gain of 31% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 92% in the last year.

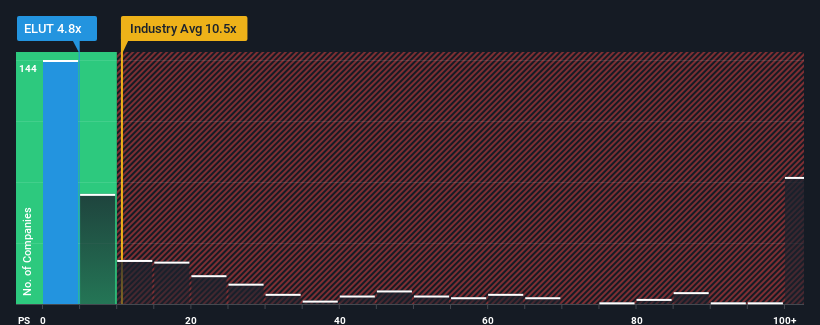

Even after such a large jump in price, Elutia's price-to-sales (or "P/S") ratio of 4.8x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 10.5x and even P/S above 63x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How Elutia Has Been Performing

Elutia could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Elutia's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Elutia?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Elutia's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. Still, revenue has fallen 45% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 21% during the coming year according to the two analysts following the company. That's shaping up to be materially lower than the 327% growth forecast for the broader industry.

With this in consideration, its clear as to why Elutia's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Elutia's P/S

Shares in Elutia have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Elutia's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 4 warning signs for Elutia (2 are concerning!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com