It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Foxconn Industrial Internet (SHSE:601138), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Fast Is Foxconn Industrial Internet Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Foxconn Industrial Internet grew its EPS by 5.2% per year. This may not be setting the world alight, but it does show that EPS is on the upwards trend.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While Foxconn Industrial Internet may have maintained EBIT margins over the last year, revenue has fallen. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

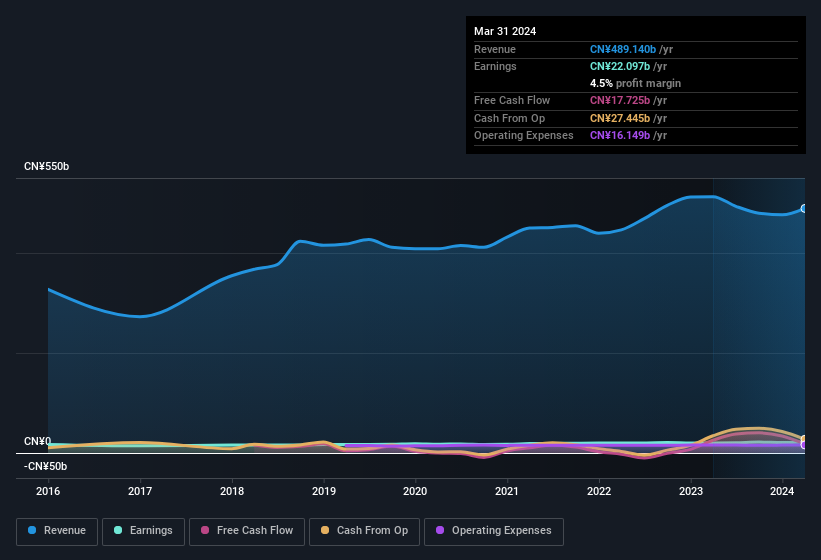

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Foxconn Industrial Internet's future profits.

Are Foxconn Industrial Internet Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a CN¥542b company like Foxconn Industrial Internet. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they hold CN¥114m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.02%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Is Foxconn Industrial Internet Worth Keeping An Eye On?

One important encouraging feature of Foxconn Industrial Internet is that it is growing profits. To add an extra spark to the fire, significant insider ownership in the company is another highlight. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. You should always think about risks though. Case in point, we've spotted 1 warning sign for Foxconn Industrial Internet you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com